The Five-Year Rule For Roth 401(k)s

If you’re at all familiar with Roth IRAs, then you might know that there is a rule that prevents one from removing earnings from a Roth IRA before five years have elapsed since the first contribution was made into the account.

Run afoul of the five-year provision in the tax code and you’ll owe a 10% early withdrawal penalty for any earnings you remove prematurely.

You probably don’t want to do that, so let’s talk more about what is and isn’t allowed so you can navigate the five-year rule with the grace and expertise of a seasoned financial mastermind.

Five-Year Rule For Roth IRAs

To begin with, it rarely takes a full five years for the five-year rule to pass.

The five-year clock actually begins on January 1st of the tax year for which you made your first contribution to a Roth IRA. So, technically, if you made a contribution to a new Roth IRA in March of the year after the tax year for which you made your contribution, you are credited with opening the account 15 months earlier.

For example, let’s assume you open a Roth IRA in March of 2024. The IRS allows you to contribute to an IRA up until tax day of the following year, so you could still make 2023 IRA contributions up until tax day in April of 2024.

If you did that, the effective start date for the five-year clock would begin on January 1, 2023.

There is also a five-year clock that applies to each Roth IRA conversion made before age 59.5 (as in each conversion gets its own five-year clock), but that isn’t very relevant to this article unless you plan to roll your 401(k) to an IRA and then conduct Roth conversions.

Speaking of that, even though understanding how these rules apply to IRAs is helpful for understanding the five-year rule for all retirement accounts, we will now turn our attention to 401(k)s.

Five-Year Rule For Roth 401(k)s

The fact is there is also a five-year clock for Roth 401(k)s that works in a similar fashion to the five-year clock that applies to Roth IRAs, but there are a couple of important differences.

First, no matter how many Roth IRAs you open, your initial starting clock for the five-year rule will start with the very first one. This is true even if you close that first account.

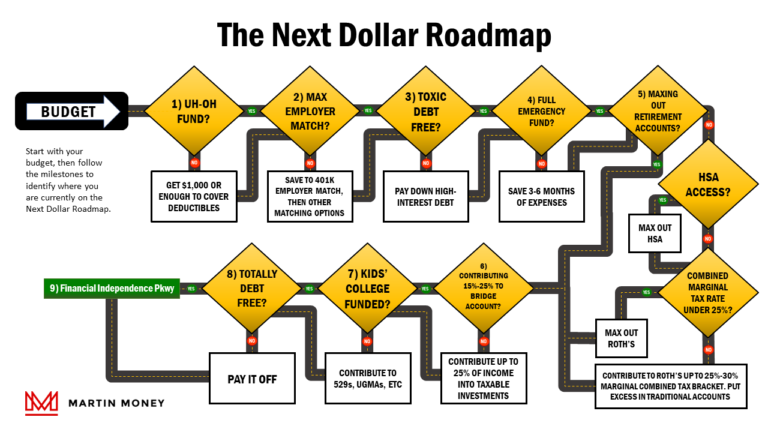

For this reason, many people who don’t need a Roth IRA open one anyway, put a dollar in it, and leave it just to start the clock and get this rule out of their way for good, no matter when or where they open other Roth IRAs down the road.

Unfortunately, 401(k) plans do not enjoy the same level of flexibility.

Each 401(k) account you possess will have its own five-year clock and it doesn’t matter if you open the account well before, around, or after you turn 59.5.

Also, unlike IRAs, you can only get credit for starting your clock on January 1st of the same year in which you make a contribution to your Roth 401(k).

So, if you make a contribution on December 31st, your clock will start on January 1st of the same year. If you wait until March, however, as in our IRA example above, You’ll only receive credit for starting the clock a couple of months earlier.

Workarounds

There are a couple of workarounds for the five-year rule for Roth 401(k)s that can provide some flexibility.

First off, if you roll an older Roth 401(k) into a newer one, the combined account’s five-year clock is deemed to have begun with the first contribution to the older account.

Another option is to roll your Roth 401(k) into your Roth IRA. If you do this, your 401(k) dollars will inherit the five-year starting point that exists for your Roth IRAs no matter when you started contributions to your Roth 401(k).

Wrap Up

There may not be a more confusing set of guidelines than those that govern the five-year rule for Roth accounts (and we didn’t even touch inherited Roth IRAs).

Hopefully, this explanation is helpful to you as you try to navigate the optimal path for making distributions from these accounts.