8 401(k) Hacks!

401(k)s are an excellent way to save for retirement. They provide a tax-efficient space to save for decades meaning you’ll have more money in the long run if you use one.

Like anything the IRS writes into the Internal Revenue Code, the rules and regulations governing 401(k)s can be complex at times.

The good news is, they also leave wrinkles and exceptions in the system that can allow us to squeeze even more benefit from the plan.

So, in no particular order, here are my eight favorite 401(k) hacks to take these savings plans to the next level.

1) Employer Match

Admittedly, there may be some debate about whether taking advantage of an employer match qualifies as a “hack”.

What isn’t debatable is the value this boost of free money from your employer brings to your retirement portfolio.

In fact, if you have access to an employer match you should give it top financial priority after you have enough cash saved to cover basic emergencies.

It’s free money. Do I really need to say more? Go get it.

2) 401(k) Rollovers (in or out, in service or after)

Many 401(k) plans offer flexibility for moving the funds in or out of the plan, both before and after your employment ends.

You might want to roll an old 401(k) into your new one because the new one has better investment options, you want to take advantage of the Rule of 55 (see below), or you just want to keep things simple by holding them all in one account.

You might want to roll a Traditional IRA into your 401(k) to clear the way for Backdoor Roth IRA contributions that avoid the IRS’ pro-rata rule for conversions.

If your 401(k) plan allows you to make in-service distributions, you could use this option to move your retirement savings out of your 401(k) and into an IRA where there are more investment options available.

This could lead to a more strategic asset allocation and lower investment expenses.

In-service distributions also pave the way for Mega-Backdoor Roth Conversions which we’ll discuss in more detail below.

After you separate from your employer rolling your 401(k) into an IRA will normally make managing the accounts much easier while also giving you the benefits of flexibility we discussed previously.

There are also some handy tax-efficiency strategies you can employ from an IRA that aren’t possible from a 401(k) like Qualified Charitable Distributions or Roth IRA Conversions.

3) Mega Backdoor Roth

You probably know that anyone with enough earned income can contribute up to $7,000 ($8,000 if 50 or older) to an IRA in 2024.

Using the Mega Backdoor Roth strategy, you could potentially move up to $69,000 into a Roth IRA in a single year! And if you’re 50 or older, that amount increases to $76,500.

Here’s how it works.

Even though only the first $23,000 (plus employer contributions) to a 401(k) can receive special tax treatment, the total 401(k) contribution limit for combined employee and employer contributions is $69,000 in 2024 (again $76,500 if 50 or older).

So, one could potentially contribute $23,000 on a Roth basis to their 401(k), then another $46,000 ($69k – $23k = $46k) on an after-tax basis.

Once the funds are in the 401(k), you could make an in-service distribution to a Roth IRA if your plan allows, moving all of these contributions into an account where they can grow completely tax-free.

If your plan doesn’t allow for in-service distributions, you may be able to convert after-tax contributions to a Roth 401(k), effectively giving you the same tax treatment you would have if it were in a Roth IRA.

4) Use A Solo 401(k)

If you have income from a business you own, you could open a Solo 401(k).

A Solo 401(k) is an account you can open with an investment company much like you would an IRA.

The contribution limits for Solo 401(k)s are the same as regular 401(k)s, but as the business owner, you can make contributions both as an employee and the employer.

Employer contributions to a Solo 401(k) are limited to 25% of your business’s net self-employment income, so if you net $100,000 in your personal business you could contribute $25,000 to your Solo 401(k).

Keep in mind that the annual 401(k) employee deferral limits are cumulative meaning the employee contributions cannot exceed the annual contribution limits.

However, each plan gets its own employer contribution limit. So, you could potentially make employee deferrals to one or more 401(k) plans, then max out the remaining space with employer contributions.

One of the primary reasons you might want to set up a Solo 401(k) even if you already have access to one at work is for access to the Mega Backdoor Roth that we highlighted earlier.

Since you can choose your plan custodian for your Solo 401(k), you can pick one that offers the flexibility you want from your plan.

Also, if your spouse receives taxable income from the business, you can open one for them as well!

5) The Rule of 55

If you have a retirement account that isn’t a 457 plan, then you probably won’t be able to make withdrawals from the account without paying an early withdrawal penalty until you reach age 59.5.

This could be a real bummer if you want to retire earlier and don’t have other assets to fund your living expenses.

However, there is a way to tap your 401(k) plan as early as age 55 using a cleverly named strategy called the rule of 55.

The rule of 55 allows anyone to begin making penalty-free withdrawals from their 401(k) beginning at age 55 or later, assuming the money comes from a plan that was sponsored by an employer you severed service from at age 55 or later.

In other words, you can’t tap an old 401(k) from a previous employer, just the one you retired from.

Also, you can’t retire before age 55 and start making withdrawals when you turn 55. You can only start this if you retire at age 55 or later.

You can begin at any age after 55, leading up to 59.5, so if you decide to call it a day at 56, 57, or 58, you could still take advantage of the rule of 55.

In addition to retiring, you can also use the rule of 55 to reach your 401(k) if you’re laid off at age 55 or later.

Finally, if you do have an old 401(k) out there from a previous job or an IRA you want to tap at 55, you could roll it into your current 401(k) before you retire and then you would be able to access the funds in those plans as well.

6) 72T Distributions or SEPP

If you want to start withdrawing from your 401(k) even earlier than age 55, you could use a 72t distribution or Series of Equal Periodic Payments (SEPP) to do so.

Like the rule of 55, 72t Distributions or SEPP allows you to withdraw money from your 401(k) or other retirement plan without early withdrawal penalties.

You can begin taking 72t distributions at any age, but you must continue making them annually for five years or until you reach age 59.5, whichever occurs later.

So, if you start at age 51, you’ll have to keep it up until age 59.5. If you begin at age 57, you’ll have to make distributions until 62.

There are three methods the IRS provides for calculating 72t distributions and you’ll have to choose one and keep using that method until you’ve met the term obligation we mentioned before.

The three calculation methods are known as the amortization method, the minimum distribution method, and the annuity factor method.

Handling 72t distributions can be complicated and may come with costly penalties, so we recommend contacting a tax professional to help you navigate the process.

7) Use Roth or Traditional Contributions

It wasn’t until 2006 that the tax code was amended to allow us to make contributions to our 401(k)s on a Roth basis.

Traditional 401(k) contributions are made on a tax-deferred basis, meaning you get an income tax deduction for the deposits you make, but pay taxes on all withdrawals in retirement.

Roth contributions do not receive an income tax deduction, but all earnings and withdrawals are completely tax-free.

Almost 90% of 401(k) plans now offer a Roth option, meaning most of us have the choice to pay taxes now or wait and pay them in retirement.

That means if you have a high income now and could benefit more from a tax deduction today, you could make tax-deferred contributions and reduce your taxable income now while taking advantage of lower income tax rates in retirement when you have a lower income.

On the other hand, if you anticipate having a higher income tax rate in retirement, then a Roth contribution will save you more money in the long run.

It’s important to note that neither method is advantageous over the other if your tax rate is the same when you make contributions and when you make withdrawals.

Generally, if your combined federal and state income tax rate is below 25%, you’ll be better off with Roth contributions. If your combined tax rate is over 30%, you’ll be better off taking a deduction now through tax-deferred contributions. If you’re in the 25% to 30% range you should consider contributing both ways so you’ll have some diversification down the road.

8) Choose Low-Expense Investments

When you choose investments to hold in your 401(k) plan, they will almost certainly have expenses associated with them that compensate the plan administrator and the fund management company for operating both your retirement plan and the investment options in the account.

This small cost is known as an expense ratio, and though it may appear insignificant it is a very important factor to consider.

Most funds within a 401(k) will carry expense ratios of anywhere from 0.25% to 1.5%, depending on a number of things.

Typically, funds with high equity turnover or extensive exposure to international markets will land on the higher end of this range, while those focused domestically or on tracking market indices will have lower expenses.

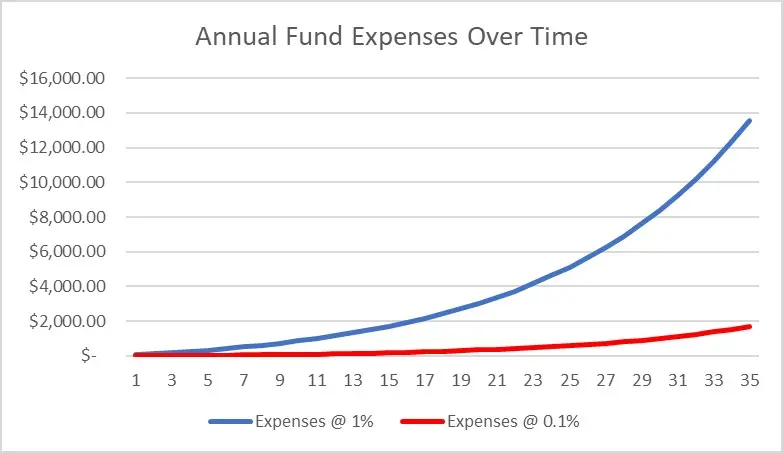

In a post we wrote recently, we showed how an expense ratio delta of just 0.90% in two investments that otherwise perform identically could amount to a difference of almost $120,000 in returns over the course of 35 years.

Here’s a pretty chart we made illustrating their cost over time:

Personally, I choose to hold broad market-based index funds in my 401(k) to take advantage of the diversification and low expenses they offer.

Ironically, actively managed funds typically underperform compared to index funds because of the fees required for active management (and taxes for frequent equity turnover).

Do yourself a favor and just go with the index funds.

Wrap Up

Even if you don’t use the hacks we’ve covered in this post, the tax advantages of using 401(k)s make them worth your while.

If you’re not contributing to a 401(k) plan and you have access to one, you should start. This is especially true if your employer offers any sort of matching contribution to the plan.

For more on 401(k)s check out the investing section of our website or visit our YouTube channel’s playlist about 401(k)s.