Roth IRAs and the Five-Year Rule

In addition to many other rules, the IRS places limitations on penalty-free withdrawals that occur within five years of contributions and/or withdrawals to the account. These are often confused but are two stand-alone conditions for making Roth withdrawals without facing a 10% penalty. It’s important to know the differences between each so you can avoid costly Roth IRA withdrawal errors.

The Five-Year Rule

I love Roth IRAs.

Having a bucket of savings that the IRS won’t ever touch again helps me sleep well at night.

By allowing investors to pay taxes first and enjoy tax-free growth, Roth IRAs provide a greater incentive for lower-income investors to save while also providing tax flexibility to retirees as they begin making withdrawals.

However, like any tax legislation, there are a variety of rules and regulations governing these accounts to ensure that a) they’re used for their intended purposes and b) Uncle Sam eventually gets his share.

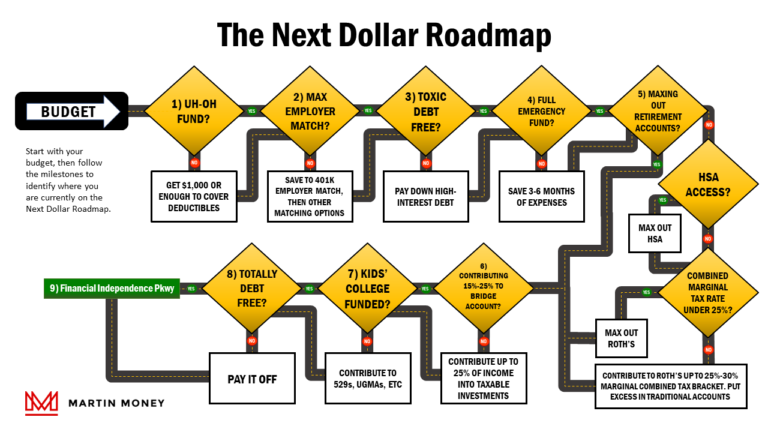

For more about Roth IRAs and the rules, see Milestone 5 about saving for retirement.

Among the many, many guidelines governing Roth IRAs there is one in particular that seems to regularly cause confusion.

It’s known as the five-year rule.

While the name may sound simple enough on the surface, there are really 3 five-year rules, all sharing the same name.

Basically, a five-year rule is a period of five years in which Roth IRA owners are not allowed to make penalty-free withdrawals from certain portions of their Roth IRA balances.

In summary, the Roth five-year rule(s) apply to:

- Withdrawal of earnings;

- Withdrawal of conversions;

- Inherited Roth IRA

We’ll unpack these various scenarios here and explain how each five-year rule works.

Starting the Clock

Before looking closely at each scenario, we should point out how the IRS begins counting your Roth IRA years on the clock.

Each applicable year is a tax year, meaning contributions made to an applicable tax year are viewed as if they were made on January 1st.

Since Roth IRA contributions can be made up to tax day in mid-April of the following calendar year, one could potentially start their clock retroactively, up to 15.5 months before they actually begin making contributions.

For example, let’s assume you make a 2021 Roth IRA contribution in April of 2022, just before you file your 2021 tax returns. In the eyes of the IRS, your 5-year contribution clock started on January 1, 2021.

This means you’ll be able to potentially make penalty-free withdrawals of your earnings beginning on January 1, 2026, as opposed to April 2027.

Withdrawal of Earnings

Let’s start by reminding everyone at home that the withdrawal of Roth contributions is always tax and penalty-free.

These funds were taxed before you deposited them into the account, so the IRS provides more freedom on how they’re used.

The same cannot be said for earnings (the returns on your contribution investment).

One key rule of Roth IRAs is that the withdrawal of earnings cannot occur without penalty before the age of 59.5 or 5 years after the Roth IRA was opened, whichever occurs later.

This means if you open a Roth in your 20s, you’ll have to wait until you turn 59.5 to make penalty-free withdrawals of any earnings.

It also means that if you open a Roth on your 59th birthday, you’ll have to wait until you’re 64 to withdraw any earnings without paying a 10% penalty.

The reason for this is the IRS wants to incentivize you to use the Roth IRA as a savings vehicle for retirement.

Allowing account owners to easily renege on their decision to save could defeat the purpose of establishing the account in the first place.

One noteworthy item to remember is that the five-year clock starts when the Roth is opened. So, after five years, no earnings are subject to penalty under the five-year rule (though they’d still apply before age 59.5).

This would be important information to recall if you wanted to withdraw earnings that were received from contributions made less than five years ago, but more than five years after the Roth was opened.

Also, the IRA sees all of your Roth IRAs as one account. So, if you have a small Roth that you started years ago, but open a new one later in life, the opening date of your first Roth IRA is the one that counts for starting your five-year clock.

Withdrawal of Conversions

A Roth IRA conversion occurs when you move money from a Traditional IRA to a Roth IRA, thus converting the tax status of the funds from tax-deferred to after-tax.

As a result of the conversion, you’ll trigger a taxable event because the dollars in your traditional IRA have never been taxed (after-tax contributions excepted).

The tax you pay will be based on whatever income tax bracket you are in during the tax year of the conversion.

For example, if you made a conversion of $10,000 in 2021 and were in the 12% tax bracket, then you would have a tax liability of $1,200 for the conversion.

One great feature of conversions is there are no limits on the amount you can convert. As long as the money is in your traditional IRA, you can convert any amount to a Roth.

Another bonus of these conversions is the fact that when tax is paid on the converted amount, that piece effectively is viewed as a contribution to your Roth IRA for tax purposes. As we’ve already discussed, contributions to Roth IRAs are always eligible for penalty-free withdrawals.

These Roth conversion features are helpful for tax planning, but also create a potential opportunity for abuse of the IRS’ intent for these retirement accounts. Let’s look at an example to see how.

Clever Casey and the Clunky Conversion

Assume Clever Casey is 45 and has a traditional IRA balance of $50,000 that she would like to get her hands on soon. Casey reads on the interwebs that traditional IRA conversions are treated like contributions after they are moved into a Roth.

Casey is in a low tax bracket but needs the money now. She contrives that she could convert her traditional IRA and get her hands on most of that money now while avoiding the 10% penalty.

She decides the tax hit is worth it and wants to move forward with converting the IRA so she can withdraw the balance from a Roth as if it was a contribution.

Not so fast, Casey.

IRS special agent Frank Forethought knew this loophole might entice people to tap their retirement early, so he put the kibosh on Casey’s plan before she could put it into action.

To account for this scenario the IRS gives each conversion its own five-year clock to ease the temptation to convert funds for the sake of early withdrawal.

If you make a withdrawal of converted funds before the five-year clock runs its course, the withdrawal will be subject to a 10% penalty.

This means Casey can still convert the traditional IRA, she’ll just have to wait five years to withdraw her converted funds as if they are contributions and pull them out penalty-free.

This is actually a common early retirement income strategy known as a Roth Conversion Ladder. You can read more about it in this post.

There is one important caveat to the five-year rule for conversions to Roth IRAs. Once you turn 59.5, the clock for conversions effectively disappears. This means if you convert at age 57, you’ll be able to begin withdrawing conversions penalty-free in the tax year in which you turn 59.5.

If you’re over 59.5, then you can withdraw as soon as you convert if you wish. Neither the part that is considered a contribution nor any earnings will be subject to penalty.

Inherited Roth IRAs

A third five-year rule scenario to keep an eye out for is inherited Roth IRAs.

Inherited Roth IRAs are an excellent way to inherit retirement accounts because they are completely tax-free for the recipient.

They are still subject to RMDs and the account must be completely exhausted within 10 years of the deceased’s death, but there isn’t a tax hit for those RMDs like there would be with an inherited traditional IRA.

The five-year rule comes into play if the inherited Roth includes money that was earned from contributions made to the account within five years of the deceased’s death.

For example, let’s assume Clever Casey has inherited a Roth IRA from her uncle, Saver Sam.

Uncle Saver Sam was great at saving. He was so good in fact, that he was contributing cash to his Roth IRA right up until his death in 2021.

Uncle Saver couldn’t stop taking advantage of the tax-free growth one receives with a Roth, even if he knew he didn’t need the money. He put the money in a Roth IRA because he knew this way, his favorite niece could still receive her inheritance free of any encumbrances that a tax liability would create for her.

As Clever Casey is settling her uncle’s estate, she learns that Uncle Saver made contributions to his Roth in 2021. From some reading she did on martinmoney.com, Casey learns that she’ll have to wait five years (1/1/2026 in this case) to withdraw the earnings portion from the Roth IRA.

If Casey failed to wait for the five-year window to close, she would have to pay a 10% early withdrawal penalty on those earnings.

Note the careful distinction between contributions and earnings. Contribution withdrawals are always penalty-free; earnings fall under the five-year rule.

Roth 401(k)s and the Clock

The same five-year rules apply to Roth 401(k)s as Roth IRAs. Earnings will have to sit for 5 years before making a penalty-free withdrawal

Also, the clock for a Roth 401(k) is separate from your Roth IRA clocks. So, if you began one well ahead of the other, they won’t satisfy the requirement for one another. Each account type has its own clock.

Furthermore, if you have multiple Roth 401(k)s, each employer plan will have its own clock. One Roth 401(k) clock does not start for other Roth 401(k) accounts.

A workaround for this is to roll one Roth 401(k) into another. In this case, the five-year clock for the comingled funds is deemed to have begun with the older of the two accounts.

If you roll a Roth 401(k) into a Roth IRA, then the applicable five-year clock is the one that started for the IRA. In other words, even if you had satisfied the five-year rule in your Roth 401(k), you drop that one for the clock that started for the IRA, even if the account is brand new.

Other Food for Thought…

Start your clock! – If you ever think you may need some flexibility with the five-year rules, go open a Roth IRA and put a dollar in it. All you have to do is open the account to start your clock. There is no minimum deposit required by the IRS (though there may be from your custodian).

This is especially important if you have a Roth 401(k) and ambitions to retire early. Starting the clock now will give you the flexibility to access those Roth 401(k) dollars when you decide to retire.

You still have to be 59.5 – In case you’re young and reading this, don’t forget about the 59.5 age requirement. You still must satisfy that rule, even if all your other five-year rules have been satisfied. Look back to the conversion ladder strategy for a noteworthy exception.

Exceptions – There are exceptions to the five-year rule. First, you can use up to $10,000 of Roth earnings for the purchase of your first home (though even this definition is flexible). You may also use earnings to pay for higher education costs for yourself, your spouse, your child, or a grandchild.

Finally, exceptions are made to cover health insurance while you are unemployed or if you experience a medical event in which the cost exceeds 10% of your adjusted gross income.

Post 50!

Woohoo! This is our 50th post!

We started this little journey only a few months ago and man am I happy to reach this milestone. We have been churning out posts as fast as we reasonably could in order to build enough content to have a legitimate site.

So, thank you for joining us on this journey. It’s been fun and we look forward to where the Lord will take us going forward.

With that said, I’m tapping the brakes a little bit. Lisa and I have both seen significant increases in our work responsibilities over the last couple of months.

By the time we punch the clock each day, we don’t have a lot of energy left for writing.

We’re going to drop our post rate to two per week for a while and see how that goes. Hopefully, it will allow us to keep dishing out good stuff and devote some time to maintenance on the site that has gone largely neglected for the last 6-8 weeks.

Thanks again for reading!