Milestone 7: Prefund Kids’ Education Expenses

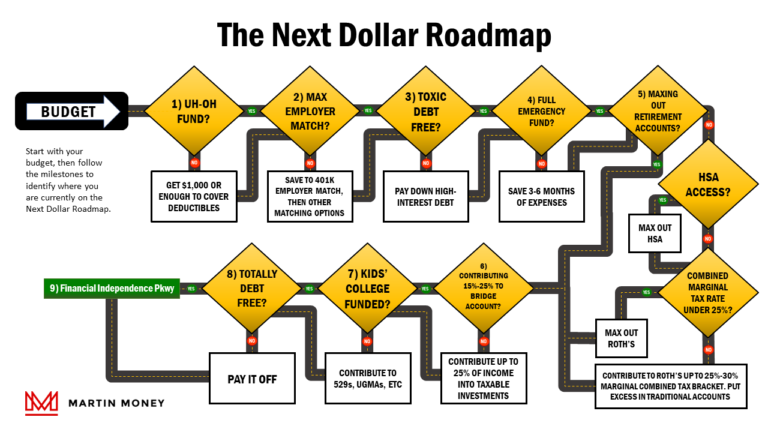

Congratulations on making it through the first six milestones on our Next Dollar Roadmap:

- Starting Point: Creating Your First Budget

- Milestone 1: The Uh-Oh Fund

- Milestone 2: Take Advantage of Your Employer Match

- Milestone 3: Pay Off Toxic Debt

- Milestone 4: Fully Funded Emergency Fund

- Milestone 5: Save 15%-25% of Your Income in Tax-Advantaged Retirement Accounts

- Milestone 6: Save for Flexibility in Bridge Accounts

- Milestone 7: Prefund Kids’ Expenses

- Milestone 8: Pay Off Remaining Debt

- Milestone 9: Total Financial Independence

Milestone seven is to use tax-advantaged accounts for setting aside money to fund your kid’s future expenses; mostly with a focus on education.

If you don’t have children yourself, don’t plan to fund their education, or don’t have anyone else you plan to help with education (like a grandchild or niece) then you can roll on over to Milestone 8.

You might ask, “Why is this coming after milestones 5 & 6? After all, my kids will probably be in college before I retire?”

There’s one simple reason: There are myriad alternate ways to fund college, but no one gives loans for retirement.

What’s worse? Your kids having to borrow money to go to college or you having to move in with them one day because you didn’t set enough aside for your own retirement when you had the chance?

It’s been said the greatest gift you can give your kids is to not move into their basement when you’re older. I can think of exceptions to this maxim, but the principle is correct.

What follows are several tax-advantaged options for saving for your kids’ education expenses and our thoughts on each savings vehicle.

Roth IRA’s

We covered Roth IRAs earlier in Milestone 5, so I’ll spare you most of the details in this post.

One point we did not cover, however, is Roth IRAs can be used to fund college tuition without the 10% early withdrawal penalty.

The recipient of the funds must be the Roth IRA owner, his or her spouse, child, or grandchild.

Additionally, distributions from a Roth are counted as income on your student’s Free Application for Federal Student Aid (FAFSA).

This means Roth withdrawals reduce eligibility for student aid, but the impact depends on several factors and should be examined further.

One downside of using your Roth IRA is you have to pay income tax on the earnings portion of the account when you make a withdrawal if you’re under 59.5.

That means in addition to having paid income tax on your contribution to a Roth IRA, you’re now also paying income tax on the earnings (assuming you use that portion for education expenses).

In so doing, you would receive no tax break on the funds you use from a Roth IRA to fund college.

Sheesh, even the capital gains in a taxable brokerage account are taxed at a lower rate than your income.

Additionally, perhaps the biggest downside of using your Roth to fund college is you’ve essentially redirected retirement dollars to pay for education. If you might need those funds for your own secure retirement, this isn’t a wise decision.

What’s that? You’re rolling in Roth dough and won’t need it anyway?

Then why not use all those extra bucks to fund the next option so you can get a state income tax break and leave even more in the Roth to your heirs?

529’s

The easiest way to describe a 529 is to think of it as a Roth for education.

Funds are placed into the investment account on an after-tax basis. The account is allowed to grow tax-free and distributions can be made tax-free as long as they are used to pay for a qualified education expense in the year the expense is incurred.

Formerly, 529’s were only available for use in paying for college expenses. In 2018, however, the IRS expanded its use to K-12 tuition expenses, trade schools or some training, and student loan repayment.

In addition to federal tax benefits for the growth portion, over 30 states offer tax deductions if you enroll in the state plan where you live. If your state doesn’t offer a 529 plan or a tax incentive, you can sign up for an account in another state.

Technically, there aren’t any federal contribution limits on 529 plans, but each state plan has varying aggregate contribution limits of anywhere from $235,000 to $550,000.

Contributions are subject to the annual IRS gift tax exclusion ($16,000 in 2022). This basically means excess contributions count against your lifetime estate tax exclusion.

The IRS does allow you to frontload up to 5 years of contributions without the gift tax exclusion reporting requirement.

As with Roth IRAs, having a 529 account does impact FAFSA eligibility so look into that if it is a factor for you.

There are some risks associated with using 529 plans. Perhaps the largest is what to do if your student decides not to go to college. What if they get a full scholarship and don’t need the money? What if, God forbid, your student dies or becomes disabled?

If you elect to make a withdrawal and do not use it to pay for a qualified expense, you’ll owe income tax on the earnings and a 10% penalty for a non-qualified withdrawal. Ouch.

However, if your student receives a scholarship, attends a military academy, dies, or becomes disabled, withdrawals can be made penalty-free; though you’ll still owe income tax on the earnings.

If you have money left over after your student has completed school you have a couple of options:

- You can pay the penalty and withdraw the balance (also owing income tax on the earnings);

- You can redesignate the account beneficiary to another qualified beneficiary (see our 529 post for more details); or

- Beginning in 2024, you can roll over the remaining funds into a Roth IRA for the beneficiary (subject to many exceptions and limitations).

Of course, the best option is to save exactly the right amount to pay for college, but that would be an incredibly difficult number to predict.

In many cases, parents save some percentage below what they expect they’ll need and make up any gaps through other means.

Others overfund the account intentionally to create a legacy education savings account. This is a neat strategy, but it exceeds the scope of this post.

For help estimating the financial needs for the students in your life, look up the total annual cost of attendance for schools you think he or she may attend.

This estimate is published each year by all colleges for establishing financial aid eligibility for attendees.

Coverdell Education Savings Account (Coverdell ESA)

Coverdell ESA’s have declined in popularity in recent years due to the ever-expanding flexibility of 529s.

They work very similarly to a 529 but come with greater limitations. In 2022, contributions are phased out beginning at a modified adjusted gross income (MAGI) of $95,000 for single filers and $190,000 for married filing jointly.

The maximum annual contribution is only $2,000, though the funds can be used for education expenses other than college. The named beneficiary must also be under the age of 18 at the time of contribution.

One advantage of ESAs is the ability to self-direct the investments in the account. In a 529 plan, you are limited to whatever investment options are made available by the plan’s managers.

Also, most K-12 education expenses, including many supplies, are eligible for funding through the ESA. 529s can only fund tuition at the grade school level.

You can have both a 529 and ESA for a single beneficiary, but any remaining funds in an ESA become taxable to the beneficiary at age 30 if not used for education expenses (subject to income tax and a 10% penalty).

You can potentially mitigate this risk by moving ESA funds to a 529. The withdrawal is tax-free if the contributions go into a 529 and are used for qualified education expenses.

I am not aware of any states that offer deductions for Coverdell ESAs as many do for 529s.

ESAs and 529s have the same FAFSA treatment, so look into that if it applies to you.

Prepaid College Tuition

Once very popular, prepaid college tuition plans allow participants to pay for future college costs at today’s rate. There are currently 18 states with plans, but only 10 are still accepting new applicants.

Prepaid college plans are actually a type of 529 (except for one in Massachusetts) that allows participants to purchase a number of semesters or fractional units of future education.

The prices in these plans are based on current average tuition rates at a select group of colleges. This means any earnings and withdrawals are tax-free as long as they are used for qualified education expenses.

Prepaid plans can be combined with standard 529s and Financial Aid treatment for prepaid plans is the same as standard 529 plans.

In most cases, participants will have to choose a private or public option when setting up the account, but this can be changed later. Changes may result in a shortfall or overage in savings, but there are processes for mitigating that too.

One drawback of prepaid plans is they normally only cover tuition and fees whereas standard 529s cover tuition, fees, computers, internet, supplies, fees, books, and some other expenses.

UTMA/UGMA Accounts

If you’re running out of places to efficiently transfer money to your kids, you may want to consider the Uniform Transfer to Minors Act (UTMA) or Uniform Gift to Minors Act (UGMA).

UGMAs and UTMAs are custodial accounts that allow participants to transfer money or assets to minor beneficiaries.

The accounts belong to the child but are controlled by the custodian until the child reaches the age of majority for your state (anywhere from 18-21 depending on your state).

Unfortunately, UGMA’s and UTMA’s are not as beneficial from a tax perspective as 529 plans. Contributions are made with after-tax dollars and can be made up to the annual gift tax exemption of $16,000 ($32,000 per couple).

The first $1,150 of earnings (that is, interest or dividends from investments) in the account is tax-free. The next $1,150 is taxed at the child’s income tax rate.

Anything beyond the first $2,300 of earnings is taxed at the parent’s income tax rate until the child reaches the age of majority for your state.

Any earnings received by the recipient after reaching the age of majority would be taxed at their income tax rate because they have complete control of the account at this point.

For example, let’s assume Susie-Q has $20,000 in an UGMA account. The account earns 10% ($2,000) in 2022 and Susie is in the 12% tax bracket. Susie will owe 12% income tax on $850 ($2,000-$1,150), which totals $102.

Let’s also assume Susie’s friend Jack has $50,000 in a UGMA account which also earns 10% in 2022. Like Susie, Jack is in the 12% bracket, but Jack’s parents are in the 32% bracket.

Jack receives $5,000 from the investments in his UGMA. As a result, $1,150 is tax-free, $1,150 is taxed at 12% (this is $138), and the remaining $2,700 is taxed at his parents’ rate of 32% ($864). All told, Jack pays $1,002 ($138 + $864) when income taxes are due next April.

Since UGMA/UTMA accounts are owned by the beneficiary, FAFSA reduces the student’s aid eligibility by 20% of the asset’s value. 529s are viewed as the parent’s asset which reduces aid by only 5.64% of the asset’s value.

There are no spending restrictions on UGMA/UTMA account dollars. When combined with the limited tax benefits, this feature of UGMA’s/UTMA’s makes them a useful strategic tool for your financial plan.

Just Give Your Kids Money

Another option, which may or may not cross your mind, is to simply begin giving sums of money to your children.

In 2023, you are allowed to give up to $17,000 to any other individual, completely tax-free and without any obligation to notify the IRS. This is known as the Annual Gift Tax Exclusion.

If married, you and your spouse can combine your Annual Gift Tax Exclusion and give up to $34,000 to any one person.

Any gifts over this amount in a calendar year are subject to reporting to the IRS and will count against your Lifetime Gift Tax Exclusion. In 2023, the Lifetime Gift Tax Exclusion is $12.92M per person.

It’s helpful for me to think of Gift Tax Exclusions as the IRS giving you two empty vessels in which to shelter gifts from taxes in your lifetime. The annual exclusion is a bucket that empties each calendar year, but the lifetime exclusion is a swimming pool.

Fill up the bucket in a year, and the excess spills into the pool. Fill up the pool and you’ll owe gift taxes (while you’re living) and estate taxes (after you die) on everything else that doesn’t fit.

Let’s walk through an example.

Suppose Jack and Sally grow up and get married. They eventually have two kids of their own and are doing so well financially that they decide to gift $50,000 to each child on their 21st birthday.

Jack Jr. is up first and receives his $50,000 from mom and dad on his birthday. The first $34,000 of the gift is excluded from Gift Tax reporting because Jack and Sally use their annual exclusion amounts.

The next $16,000 is counted against Jack and Sally’s Lifetime Exemption of $25,840,000 ($12.92M/each in 2023). As a result, when Jack and Sally die, only the first $24,824,000 will be exempt from estate taxes.

In summary, there is a gift tax, but you have to give away a lot of money before you trigger it. Givers pay the gift taxes; recipients do not.

With all of this said, we don’t think it’s a particularly good idea to give large sums of money to young people. Aside from the maturity risks, it can really sap their motivation to make something of themselves and earn their own way in life.

There are a lot of studies that illustrate how children who received little to no financial help coming of age were happier as adults than those who were given hefty financial assistance by their parents.

The side effects of large cash gifts can present themselves in a lot of unhealthy psychological ways as people age.

We’ll cover giving in further detail in Milestone 9.

Next stop, Milestone 8: Pay Off Any Remaining Debt