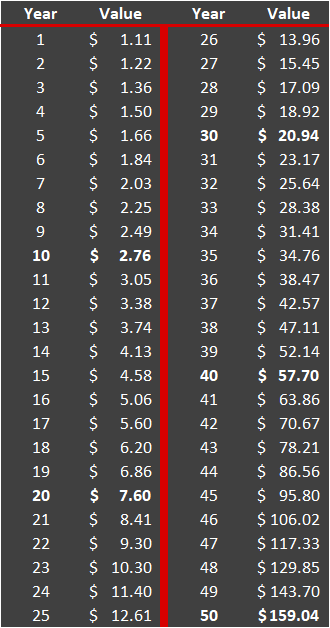

How much would a dollar invested today be worth in 10 years?

A dollar invested today and allowed to compound for 10 years would be worth $2.76. After 20 years? $7.60. 30 years? $20.94. 40 years? $57.70. After 50 years? $159.04.

We recently put up a post that served as an overview tutorial about compounding interest.

If you haven’t read it or if you’re not familiar with how compounding works in your favor, I’d encourage you to go back and check it out.

As is our custom, we ran through a few scenarios that we hope illustrated just how powerful every dollar you can invest now can be in the future.

This actually got us thinking. What if we knew how much each dollar invested today could potentially be worth 10, 20, or even up to 50 years from now?

If we knew the future value we were trading away with each dollar spent it might make us more disciplined, or at least reflective, in how we use our money.

This concept we’re talking about is known as opportunity cost.

Formally defined, opportunity cost is “the loss of potential gain from other alternatives when one alternative is chosen”.

Put simply, opportunity cost is what we miss out on when we choose one option over another. Let’s look at a simple example.

Mocha Mike And The $100 Cup of Coffee

Mocha Mike, true to his name, loves to grab mocha latte coffees at the shop down the street from his apartment. He stops every morning on the way to work and happily pays $5 for his morning pick-me-up.

Mike is doing well in his career and a $5 cup of coffee isn’t really going to endanger his progress. But for the sake of our own edification, let’s see how much that $5 might be worth after 30 years when Mike plans to retire.

Assuming our standard interest rate of 10.67% (this is the S&P 500 average return since its inception in 1957), if Mike decided to forgo the cup of coffee one day and instead invest $5 it would be worth $104.68 in 30 years.

Now, I’m not trying to shame Mike. We all have preferences that we spend a few dollars on every now and then. Instead of talking you out of those things, we just want you to understand the long-term opportunity for making the other choice.

I think we’d all agree that we feel better about our decisions when we have adequate information to make them. On the other hand, ignorance leads to poor choices, a lack of decisiveness, anxiety, or some combination of all three.

So, How Much Is a Dollar Worth Anyway?

As is our custom, we’ve inserted a table below illustrating the value of a dollar invested today and every year for 50 years into the future.

As usual, we’re using the 10.67% interest rate which is the average rate of return for the S&P 500 since its inception in 1957.

So, let’s assume you’re 25 years old and want to retire at 55. Every dollar you spend instead of investing represents a cost of $20.94. At 75, that same dollar could have been worth $159.04!

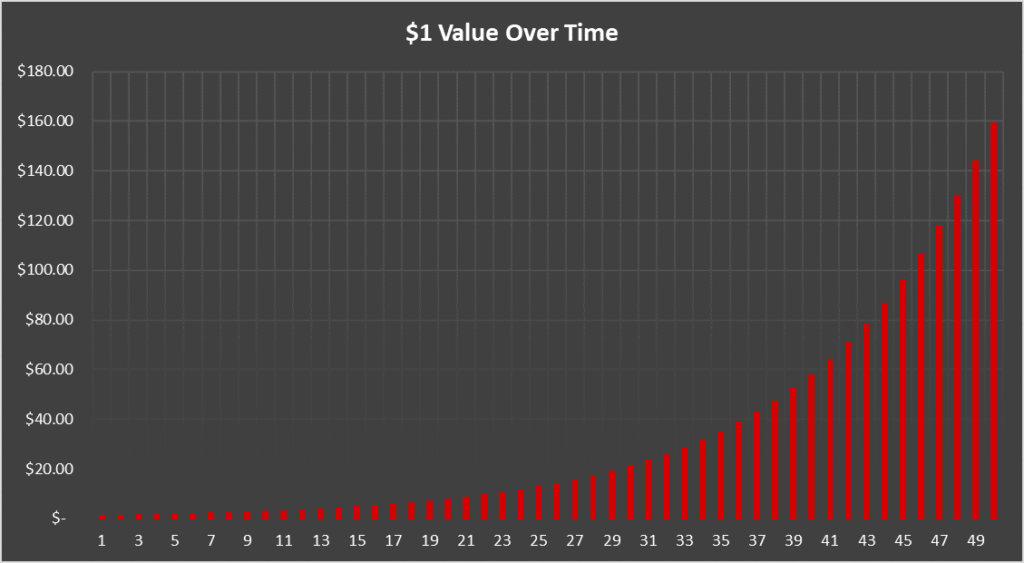

For the sake of better visualization, here is the table in graph form:

Note how much growth occurs later in the timeline. Half of the value comes in the last 7 years of the investment.

That’s 50% of the value in 14% of the time!

It’s important to see this because it helps us understand the all-important virtue of patience in investing.

Good things truly do come to those who wait. We just have to be disciplined enough to leave it alone and let it grow.

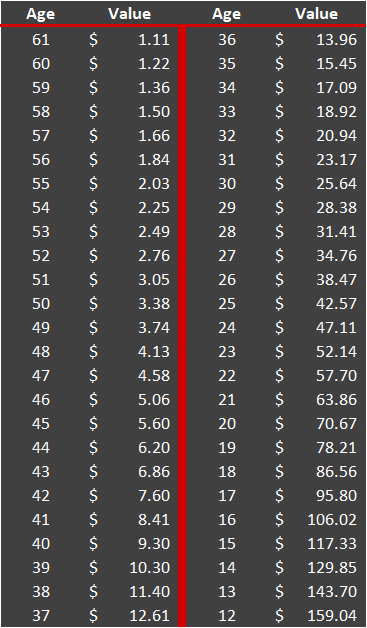

Now, let’s revise the graph a bit and list this according to age based on the average American retirement age of 61.

In this example, our 25-year-old friend would have 36 years for his or her dollar to grow.

Hopefully, this will be of some use to you as you make your own financial goals and plans. Just pick a year out into the future that you are aiming for, subtract the current year, and you have your cost per dollar.

What if I Stuff My Roth IRA?

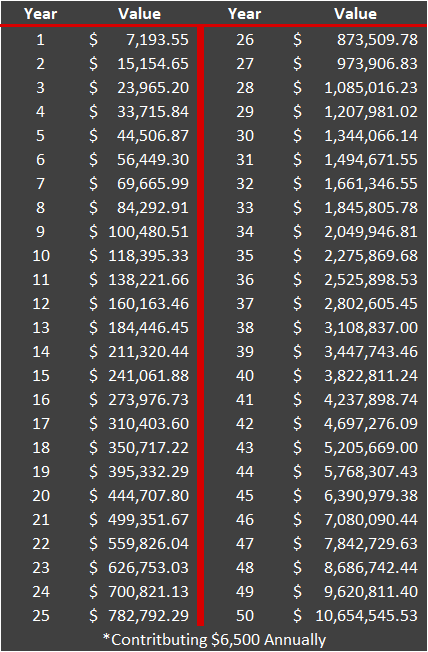

We’ve squeezed the dollar to death in this post, but perhaps you’re wondering what would happen to a larger sum.

For example, what if you fully funded a Roth IRA each year? How much would that be worth down the road?

Here you go…

The table above assumes the same 10.67% interest rate, but it also assumes you put $6,500 into your IRA every year for 50 years.

The balance is the end-of-year balance for each period.

The table also assumes that the maximum amount you’ll ever be able to contribute to a Roth IRA is $6,500. That’s unlikely because the cap follows inflation data from the Bureau of Labor Statistics. In most years it will go up.

In all likelihood, you’re not going to contribute to an IRA for 50 years, but even if you only did so for 40 you’d have $3.8MM. Not bad.

Furthermore, $6,500 is 15% of an annual salary of $43,333.33. This is lower than the median individual income which means most of us should be able to make this happen.

But I Gotta Live

There are some people who look at a tool like this and it is a huge motivator. For others, it is a soul-sapping burden.

Our intent is not to turn you into a miser who pinches pennies and only relinquishes your white-knuckle grip on a dollar when you have no other choice.

After all, what would be the point in saving every possible dollar for decades, trading away your life in the meantime, only to be able to enjoy your monetary success when you’re old?

Nah. Life’s too short to live that way.

Almost every path to wealth requires a certain level of discipline. You can’t have the future you want without making arrangements for it today.

But that doesn’t mean you should trade away all of today. Smell the roses, seize the day, live in the moment, and save something for tomorrow too.

Over the years I’ve heard a lot of very wealthy people opine about not stopping to smell the roses often enough. Sure, they’ve been ultra-successful, but they still have regrets about the costs to get there.

Striking the right balance here is one of life’s biggest challenges, but giving yourself tools like this one should be useful for making the best choices you can.

What Is Worth Spending Money On?

Having spoken with or heard from many millionaires over the years, we’ve been shocked to hear how similar the opinions are regarding the worthwhile use of money.

Here’s a short list for your own consideration as you make these choices each day.

Experiences

This can be things like vacations or expeditions of some sort. Most people find that visiting a new place or culture is a very enriching experience.

Lisa and I have to agree with this. Travel is one of our favorite ways to spend money.

Experiences could also be a fine restaurant if you’re a foodie or live performances if you are into a particular genre of music, dance, or other live-performing art.

Education

Primarily noted due to its potential return on investment, education tends to rank highly for the utility of each dollar spent.

I’m sure most who find value in education are referring to some sort of professional skill, but other learning experiences can bring a high degree of satisfaction as well.

My wife and I have an older home and needed a custom window in our kid’s bathroom to replace an existing one. A friend gave us the name of a gentleman that made leaded glass and stained-glass windows.

As it turns out, this was a sort of “encore career” for him. He wanted to learn how to make his own stained-glass windows, so he took a class once.

It eventually turned into a lucrative business for him; one he seemed to greatly enjoy.

Time (or things that save time)

When you’re younger and less wealthy, you tend to trade time in want of money. As you grow financially, you will likely find yourself looking for ways to trade money for time.

Hiring out housework or yard work is a common way you see this, but it could also mean the purchase of a tool or lessons that make you more efficient with your time.

Giving

Finally, many people find a great sense of satisfaction in giving their money to other people or charities.

I’ll give an example by asking a question. How many grandparents do you know that don’t enjoy giving things to their grandkids?

Studies even show that people (and even kids) around the world derive greater happiness from giving money or gifts to others as opposed to buying something for themselves.