Why Should I Give?

Many people assume giving is solely about helping others, but there’s more to it than that. When we give, it makes us better people spiritually, fosters compassion, and provides us with a deeper sense of purpose.

Over the years, I’ve listened to hundreds of financial podcasts and read a multitude more blog posts and books.

There’s an endless field of financial weeds to get lost in if you so choose. By far, the most popular topic is some form of the question, “Do I have enough to retire?”

This then leads to an explanation of IRAs or 401(k)s or retirement income and tax planning. Clever strategies for conversions and backdoor contributions are thrown out with a wink and a nod as if it was a concept only the financial Illuminati had heard of.

Then there’s tax stuff. No shortage of complexity there. After all, accounting services is a $133 billion industry annually. Thanks again for keeping it simple, Uncle Sam.

One topic that I regularly hope will be covered in depth, but doesn’t seem to get much attention is giving.

This has always seemed a bit odd to me since even the most seasoned financial pros know it’s one of the three primary things you do with money (spending and saving being the other two).

My theory is the topic is so personal and driven by such deep individual beliefs, that the big shows and authors have more to lose than gain by spending much time there.

Lucky for you, we’re small potatoes.

What follows is based more on opinion than fact, but it’s an important idea to cover considering a little better than half of Americans give to charity annually.

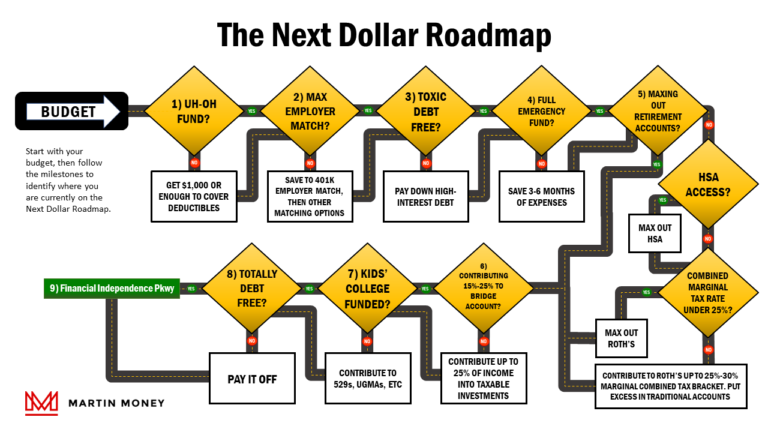

There are certainly financially strategic ways to give which we cover at Milestone 9 of the Next Dollar Roadmap. However, for this discussion, we’ll talk more about the motive and benefits of giving which we hope will provide a helpful reminder to you of why it is so important.

It’s Personal

If there’s one irrefutable law of giving, it’s this: Giving is personal.

If I had to boil it all down to one principle, that would be it. And I mean it in a couple of different ways.

First, it’s personal because of the motives that drive us to help others. No two of us have identical motives, passions, or even ideas about how much giving is appropriate.

It’s also personal because of how it affects us. A dollar to one charity may mean as much as one hundred to another depending on how you see it used or what the charity is doing.

You may even experience regret, God forbid, about making a donation to certain individuals or groups.

No one can tell you how you’re supposed to make a gift, nor can they tell you how you should feel after you give it. All of that is up to you.

And, I think, that’s a really lovely thing about giving too. It’s an individual experience that you only get if you are willing to give.

So, we’re starting this post with the adoption of the basic ethic that no one should give out of compulsion or guilt.

To really be a “gift” it must be given willingly because the giver wanted to give; because they wanted to experience the joy of helping or serving someone else who received a great benefit from their generosity.

This also means nothing in this post is meant to make you feel guilty or good, proud or humble, happy or sad, noble or shameful.

Instead, we hope it makes you think. Our desire is for you to understand yourself a little better and, yes, to encourage you to experience the benefit of giving too if you’re not already doing so.

Spiritual Growth

Lisa and I are Christians. There really isn’t any greater influence on our giving than that.

In fact, I’m not really sure we’d give anything if it wasn’t for our faith. I’m mentioning this on the front end, because I’m sure there will be many who read this that do not share our faith or do not consider themselves religious.

I could try to write about giving without bringing up religion but as we already pointed out, giving is personal.

Attempting to write a post about giving without also mentioning my faith would be akin to picking the cilantro, onions, peppers, and lime out of a bowl of salsa because someone else didn’t favor the taste of them.

All you’d have left is a bowl of salt and tomatoes.

I completely respect your choice, but it isn’t practical for me to separate the two.

Introducing Stewardship

With that said, among the many principles of Christianity, one defines how we handle money above all others.

That concept is known as stewardship.

Under this idea, no one really considers their money as “their money”, but rather as God’s. We just act as his agents or stewards of the resources given to us.

Even if you’re not a Christian, you’d hopefully agree that you can’t take any of it with you when you die.

In that sense, we’re all just managing resources on a temporary basis at best. It’s only natural to think beyond yourself when you think about managing wealth.

So, stewardship informs how we spend, how we save, how we invest, and how we give. And, at the forefront of all of these is giving.

Historically, as God’s people made offerings to the Lord, God required that they bring the first and best of their crops or livestock even before they took any for themselves.

In a modern sense, this means Christians are called to give out of their income before spending it on themselves as opposed to spending it first and giving God whatever happens to be left over.

This is why we were so conflicted about covering giving at Milestone 9 (the last stop) on the Next Dollar Roadmap.

On the one hand, without a spiritual motive, giving is something you shouldn’t worry too much about early in your financial journey.

The basis is similar to the premise of putting on your own oxygen mask before helping others.

On the other hand, spiritually speaking, a lack of generosity is incompatible with faith in Christ.

Giving is done out of obedience and as an expression of faith that God will provide while using your generosity to provide for others.

So what does all this mean?

If you feel like giving is important to you from a Christian point of view, you should do so in some portion from every dollar you earn as income.

So, how much to give?

The standard baseline is a tithe or one-tenth of your income. This is based on several references in the Old Testament (Leviticus 27:30, Genesis 14:19-20, Numbers 18:26, Deuteronomy 12:5-6, Malachi 3:8-9 to cite a few).

I’m not looking to turn this into a theological deliberation, but for most Christians, a tithe is a minimum expectation.

Anything beyond that is considered an offering, which is above and beyond the standard of ten percent.

But again, I think it’s personal. If you don’t think a tithe is what you should give, that’s between you and God.

If you think you should give more, again, that’s between you and God. I believe he is capable of letting you know if you should be doing more or less.

Personally, we use the tithe as a minimum standard for giving. We have given more, but we never give less.

We also don’t just give to our church, but we do tend to focus our giving to 2 or 3 charities at a maximum.

In the end, if Christians agree with Psalm 24:1 (“The earth is the Lord’s and the fullness thereof…”) then we should also agree that there’s more to giving than just checking a box with God.

After all, if it’s already his, what need does God have for us to share it with others?

Instead, giving is about what God can teach you through the process of faithful generosity. It’s an opportunity for you to experience the joy of helping others while also leaning into him (God) to provide when you yourself are in need and, as a result, further build your faith.

Giving is for your good, not because God needs your financial assistance.

Fostering Compassion

A second benefit of giving is the way it fosters compassion within us.

I’m writing this as we approach the holiday season in 2022, and Charles Dickens’s A Christmas Carol is fresh on my mind. After all, there’s only been about 3 dozen film adaptations.

I’m sure you’re familiar with the story, so I’ll skip the plot, but who can forget Ebenezer Scrooge’s sudden penitent change in philanthropic philosophy?

He goes from being a filthy rich, penny-hoarding hermit to a filthy rich, generous guy that everyone likes at the end of the story.

Throughout the plot, Scrooge’s past is laid out before us all in plain sight. The loss, rejection, the pain and suffering; all clear for us to see as Dickens paints a portrait of how this bitter old man came to be.

Yes, it’s a fable, but the moral of the story is just as applicable to us.

If the goal is simply to add coins to the stack, we’ll wind up feeling rather empty and curmudgeonly as we find there isn’t really much purpose to be had in that pursuit.

Instead, giving allows us to receive an experience of joy by helping others improve their own circumstance due to our benevolence.

I suppose in a way giving provides an opportunity for our money to reach a very high level of utility.

I can’t speak for everyone, but I’d imagine for most of us $20 spent providing a meal to someone who was truly hungry would be more meaningful and useful than going to watch the latest Top Gun in 3D.

These are unique experiences we can have using money that have a lasting impact on us and others. The momentary endorphin splash from frivolous spending just doesn’t do that.

Giving is a refreshing reminder to us that there are people who have needs and that, in many cases, a dollar sent their way will have so much more meaning than it will in your personal treasury.

Remember there are others outside your bubble

I don’t know about you, but a challenge we face is a general lack of awareness regarding people in need.

I live about 2 miles from my place of work. My kids’ school is about 1.5 miles from my house. I spend about 95% of my life in this small area which also happens to be where a lot of other educated, middle-class people live.

We don’t really get a lot of people begging at street corners. Public transportation isn’t something we ever use in Birmingham because we all drive everywhere.

In our area, everyone’s got their financial house in order. We don’t really see “needy” people.

That doesn’t mean they don’t exist.

I’m not trying to lay down a heavy guilt trip if you live in a similarly affluent area, but you can see how we might forget that there are a lot of people who don’t live life this way.

There are a lot of people who struggle to put food on the table, clothes on their backs, and a roof over their heads.

And that’s just in the United States.

One of my favorite websites is How Rich am I? They have a fun form you can fill out to compare your income or net worth against the rest of the world.

A word of caution, it will provide some perspective. Odds are you’re richer than you realize, but go check it out if you’re at all curious.

One of my favorite milestones to check is how the poverty line in the United States compares with incomes in the rest of the world.

For 2022, the two-person household poverty line was $18,310. That annual income would put you in the 80th percentile of worldwide wealth.

In other words, you’d be in the top 20% of worldwide earners if you only made $18,310 between two people.

We’re not exactly hurting in the United States, but it can be difficult to remember that unless you travel to third-world countries very often.

By engaging in regular giving, we’re forced to consider others who aren’t in our bubble; those who really do have significant needs and could use our help.

Ignorance just isn’t the friend of generosity. They are rarely seen together. Giving serves as a cure.

Greater Purpose for Wealth

Our final virtue-building argument for generosity in this post is how it can provide purpose and meaning for your journey of wealth accumulation.

I was listening to a podcast recently called “Millionaires Unveiled.” It is a sort of audio/reality version of the famous book, The Millionaire Next Door.

You should check it out if you listen to podcasts.

Anyhow, there was a guy on the show with a net worth of over $7M. He had a high income, but a lot of anxiety and stress that came with his career too. Eventually, he decided he needed to exit and retire early.

His turning point?

He came to the realization that once you have enough money, multiplying it any amount of times over doesn’t really make much of a difference.

If you can live happily for the rest of your life with $2M, why break your neck for another $2M? The exchange of time, anxiety, and stress is not worth the accumulation of dollars that won’t bring you any greater level of satisfaction in life.

He had a good point.

If you will, try to imagine a graph with a curve that measures our willingness to trade time for money. As we have more money, our willingness to trade time for it decreases. As we have less money, our willingness to trade time for money goes up.

In this way, our pursuit of money is like a supply and demand curve from basic economics.

Eventually, we all have a point where another dollar just wouldn’t benefit us much more than the last one. Granted, it’s hard for me to imagine at the moment, but it does make sense.

Imagine a life that one builds for the sake of accumulating more and more money, only to find that accumulation incredibly empty and unfulfilling in their later years.

Instead, giving provides an option for us to accumulate wealth with a purpose in mind. It takes the cold, dungy coffers of your personal safe and humanizes it by meeting the needs actual people have.

We’d encourage you to think about causes that deeply move you and how you might help them in the future, even if you’re quite young.

If you have a beneficiary or target in mind for the wealth you accumulate over the course of your life, you’re more likely to enjoy the journey and the finish.

For more about motives for building wealth, check out our starting with why post.