Why is Compound Interest Important?

Bottom Line: Compound interest is important because it provides a boost to your investment growth that is difficult to substitute for similarly low risk.

Albert Einstein once said “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

At least, some people say he said that. Apparently, it cannot be substantiated.

In any event, it’s more or less true.

The fact that one can exponentially grow the value of their assets through the miracle of compound interest is not only astounding, but it’s also one of the most important principles to understand in all of personal finance.

If you think of the financial roadmap as a seafaring journey instead of a highway, compound interest is like using the wind and ocean currents to your advantage. It has the energy to do most of the work for you if you’ll let it.

Perhaps most importantly, compound interest is a tool available to all of us, especially those with more years to let it work in their favor.

When Compounding Interest Blew My Mind

To answer our initial question, “why is compound interest important?”, it may help if I share my personal experience.

For some reason, it hit me like a lightning bolt.

When Lisa and I were engaged we went to a live Dave Ramsey event. I had read part of his book and figured I was going to get the cliff notes in a live version.

At some point during the show, Dave provided an illustration highlighting the importance of saving early for your future.

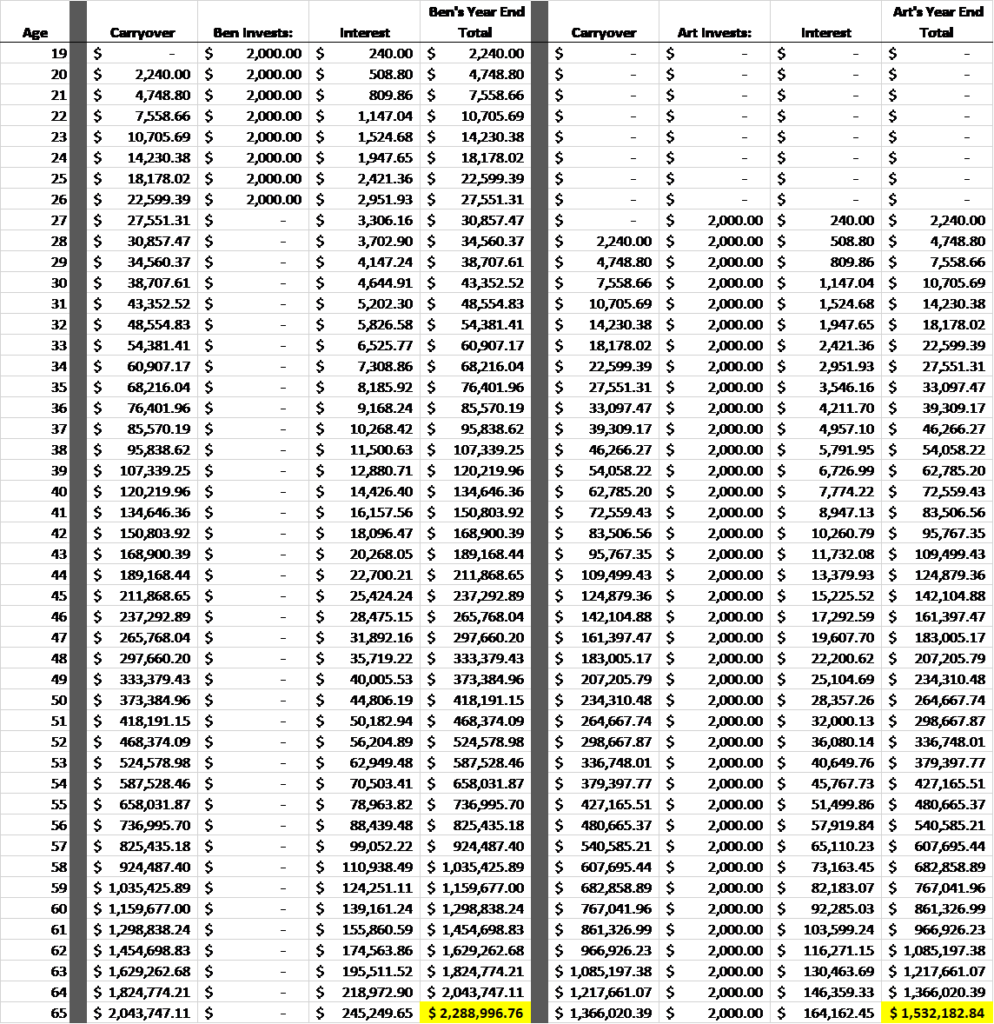

He introduced us to two hypothetical teenagers named Ben and Arthur. (Looks like they’re named Jack & Blake now. 🤷♂️)

Each one invested $2,000/year for a period of time. With two key differences:

- Ben starts when he’s 19 years old, saves for 8 years, then stops contributing principle, and allows the balance to grow for 47 total years until he’s 66.

- Arthur waits to contribute until he’s 27, but invests $2,000/year for each and every year for 39 years until he also turns 66.

The results are displayed below:

Some important points about this data:

- It assumes a 12% interest rate, which is pretty awesome if you can actually find it. It’s certainly an above-average rate to average over a long period.

- If the average rate dips below 8.8%, the outcome begins to favor Arthur and continues to do so the lower you go.

Disclaimers aside, it isn’t really the race to age 66 that impressed me about the data. What blew my mind was the fact that Ben was able to turn $16,000 invested over 8 years into nearly $2.3M by the time he retired.

Even at a more reasonable 10% average rate of return, Ben ends up with a little over $1,000,000.

At the time, I was 23 years old and had a negative net worth due to some student loan debt. It would be a bit of an understatement to say this provided me with motivation.

This was the first time it dawned on me that being a millionaire was something that was obtainable with reasonable certainty, even for a less-than-broke 23-year-old.

The most staggering thing to me was the way it succinctly illustrated how cash/money/principle was only one of the key components to fueling compound interest and building some real wealth.

The other key is time.

Perhaps you’re reading this as a young person without a ton of income. Hopefully, it’s reassuring to you to know that you at least have a very valuable asset in your youth.

Even modest contributions at this point will pay off big time later. Let’s go through another, more “average” example to illustrate.

Compounding Interest for the Average Jane or Joe

“That’s great Curt, but why is compound interest important for an average guy like me?”

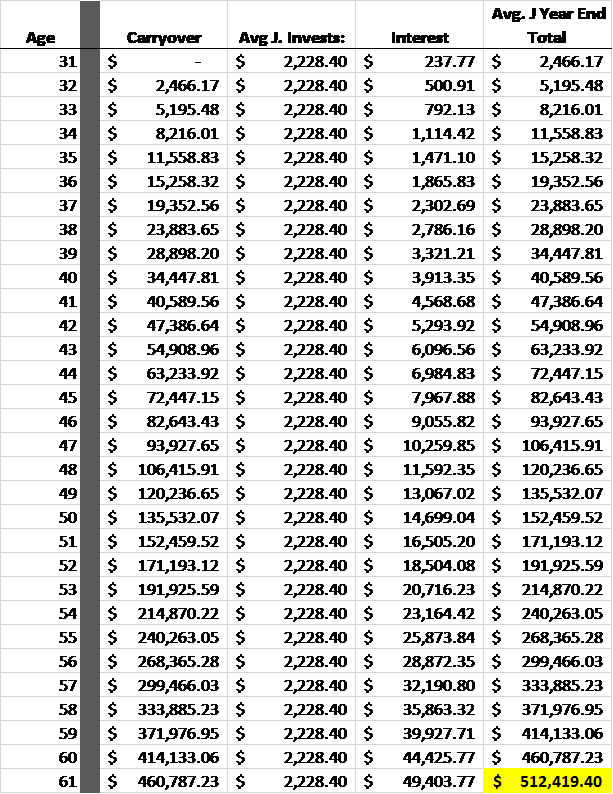

I did some quick googling and found the following very average facts in 2022…

- The average American begins saving at age 31.

- The average American retires at age 61.

- The average American saves about 5% of their income each month.

- The median monthly income for an individual American is $3,714. (I prefer median numbers for income because guys like Jeff Bezos, Warren Buffet, Bill Gates, and that Tesla dude skew the averages a bit.)

- The average rate of return for the S&P 500 over its entire existence is about 10.67%. We’ll use that rate for now.

Here is the table for a very average American:

The first thing I want to point out is that Average J was able to turn a total of $69,080.40 in invested principal into $512,419.40.

That’s nearly a 7.5-fold increase in value. That’s the power of compound interest.

Now, $512,419.40 is nothing to sneeze at, but it’s also probably not enough to fund a lengthy and/or luxurious retirement.

Using the 4% withdrawal rule, Average J will be able to use $20,496.77 per year from his or her savings to cover living expenses.

If Average J enjoys an annual income of $44,468.00 ($3,714/month x 12 months) and expects retirement expenses of around 80% of his or her current income, Average J will need $35,654.40 each year to cover the cost of living.

This leaves a shortfall of $15,157.63 which may be obtainable with social security, assuming congress shores it up before Average J reaches retirement age.

Why is Compound Interest Important? Some What If’s…

Digesting all these numbers, I couldn’t help but wonder what would happen if Average J saved a little longer or maybe a little more.

How much does the interest rate matter? And how much does it take to get to a $1M balance in 10, 15, 20, 30, or even 40 years?

Let’s get all nerdy and see. I think I’ll shrink the tables a bit from here on out.

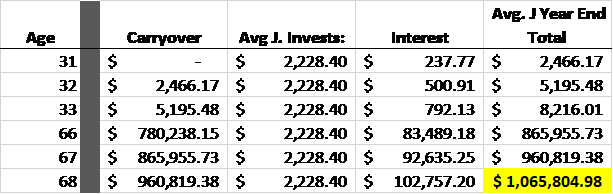

1) Average J saves for 7 more years.

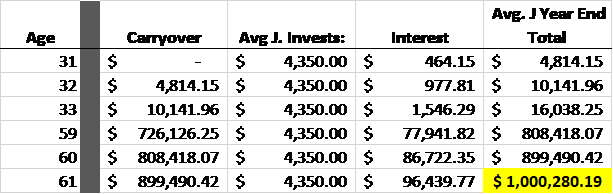

Here’s the chart if our friend saves for 7 more years. The result is the same if Average J starts 7 years earlier or retires 7 years later.

So just 7 more years and an additional $15,598.80 invested to a cool million. Nice job.

2) Average J saves more each year.

If Average J wants to hit the million-dollar mark by the time he or she hits 61, that savings rate will have to jump to about $4,350 annually.

That’s 9.78% of Average J’s income. Well below the 15%-25% range we propose in Milestone 5.

The total principal invested at this higher rate is still only $134,850.00. That’s the same 7.5-fold increase we saw in our earlier example.

3) How much does the interest rate matter?

Well, Average J would have to see a rate of return of 13.84% annually to reach $1M for the original savings rate and time period we evaluated. This is unlikely.

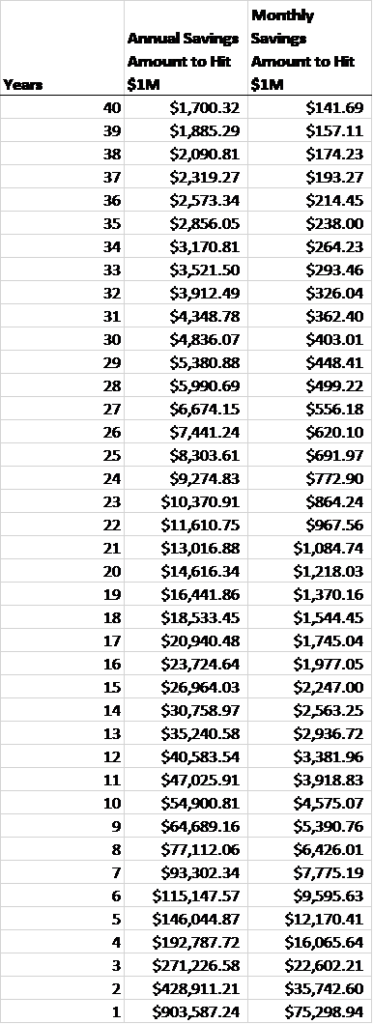

4) How much do I need to save each year to hit $1MM in 10, 15, 20, 25, and 30 years?

All of this academic stuff may be interesting, but perhaps it’s missing the mark for you.

To give you an idea of how much you need to save annually to hit the million-dollar mark through compound interest, here is a table of how much you need to save each year to hit $1MM for the specified period.

Again, the assumed interest rate is 10.67% which is the annualized rate of return for the S&P 500 going back to its origin in 1957.

This table assumes that you make your contribution in one lump sum on your birthday each year, which is unlikely unless you have some very generous gift-giving friends.

However, it was just easier to build this way and still preserves the ultimate point. Which is?

Clearly, it pays to start early, but even if you’re not as young as you like today is the best day to get started.

So, again, why is compound interest so important?

Every dollar you can invest is like sending a little worker out into the marketplace to go recruit friends. Most days, they’ll bring back more friends.

Then those dollars will bring back friends, and all those dollars can bring back friends, and so on.

The best part is these workers never go to HR with personal issues. They don’t fight or engage in office gossip. They don’t even ask for meals or a place to sleep at night.

Eventually, you may realize one day that your little army of dollar recruiters is outworking you and your day job. That is a satisfying day for sure. But you can’t get there until you start with your first dollar and the Next Dollar of course.

So, what are you waiting for? Get started now! After all…

I know that’s right.

So, How Can I Get to This Level of Saving?

By following the Next Dollar Roadmap of course. Here are some points to help you get to Milestone 5, which is really where you start hitting retirement savings hard.

Counting in reverse so we can illustrate how each milestone builds upon the previous ones…

Milestone 4 is to fully fund your emergency savings.

You really shouldn’t start hitting your tax-advantaged savings until you have a fully stocked emergency fund.

The primary reason is for the most part the money you contribute to these plans, which are intended for retirement savings, isn’t able to be withdrawn without a penalty until you’re 59.5 years old (with some exceptions).

Sure, you can still get to it, but a 10% early withdrawal penalty is a steep price to pay. Better to avoid that and just have 3-6 months of expenses saved on the taxable side of the fence than to pay a penalty plus income tax.

It’s at this point someone from the back of the room will usually say, “Yeah, but my Roth contributions can be withdrawn at any time, penalty-free!”

Yes, that’s true and it’s also a nice fallback feature of Roth accounts, but that doesn’t mean using your Roth as your emergency fund is the best choice. The reason is once you withdraw those after-tax contributions, they can’t be put back…ever.

That means all the compounding interest those dollars would have earned tax-free is now forfeit. See the charts above for examples of why this is a costly choice to make.

Milestone 3 is to pay off toxic debt.

Back in our Next Dollar Roadmap, we talked briefly about how trying to make progress in building wealth while simultaneously taking on and paying for debts, is like trying to bail water with a bottomless bucket.

Put another way, while investing puts compounding interest at work in your favor, debt pits compounding interest against you.

You need to get the burden of debt out of your life so you can really sharpen your focus on growing your wealth.

With that said, some debts are what we’d classify as “toxic” and some are not. A home mortgage is an example of a debt you can sit with as you’re building wealth.

Truthfully, if you even had a 15-year mortgage and waited until after it was paid off to begin investing, you’d really miss out on the time component of compounding interest.

In this case, paying off the debt is probably more costly than just servicing it with minimum payments while you also invest.

Other low-interest debt like some student loans may also be something you learn to live with while investing, but only if it’s not realistic to pay them off quickly. See our post on Milestone 3 for more details.

Milestone 2 is to take advantage of your employer match.

Even though debt works against you, the resistance it applies to your forward progress is overcome easily by your employer’s matching dollars.

A dollar-for-dollar match from your employer is a one-time 100% rate of return.

Remember back up in this post when we showed that Average J would have to basically double his or her contribution to hit $1M in 30 years? Why wouldn’t Average J just let the boss do that?

Speaking of averages, in 2022 the average matching rate for 401(k) plans is 6%. In our example above, Average J was only saving 5%. Average J should boost that savings rate by 1% and thank the boss for making him or her a millionaire.

Milestone 1 is to fund your Uh-oh Fund ($1,000+ in emergency savings).

Even though it’s more exciting to invest than to simply put money into a savings account, at a minimum you need your Uh-Oh Fund to protect you from being derailed by surprise repairs or medical issues.

We recommend saving at least $1,000 but would challenge you to save all the way up to your highest insurance deductible.

It’s really going to depend on your circumstances, but the goal is to insure you can absorb the unexpected. And to do this without having to stop working on the milestones ahead or taking on debt to ride it out.

The Uh-Oh fund may seem like a lot of money, but if you’re really focusing all your financial efforts on this first milestone before moving to the others it should be obtainable pretty quickly.

If needed, you can work more hours, start a side gig, sell stuff on eBay or Facebook marketplace, take online surveys for money, cut the neighbors’ grass, get a weekend or holiday part-time job, etc.

There’s no reason to worry about the road ahead until you get this first milestone off your plate.

Let me respectfully encourage you to get after it and make this happen. No one is going to do this for you. It’s time to find your way. As we continue to develop the site we’ll post some helpful information.

And all this is after you sit down and draft your budget.

The budget is the first step to really understanding your financial well-being.

Think about those vital measurements your doctor takes every single time you go. They check your temperature, weight, and blood pressure, and ask you the same questions about your health history, medications, and allergies.

It gets a bit redundant, but they’re also important factors in a proper evaluation.

Without a budget, you can’t make well-informed decisions moving forward on your path to wealth because you won’t know how much you can realistically save or spend.

You can’t know how quickly you can pay down debts or contribute funds to take advantage of the compounding interest we’ve discussed in this post.

So, there you have it. The magic of compounding interest. It’s fundamental that you understand its power so you can use it to carry you to financial independence.