What Age Do People Reach Financial Independence?

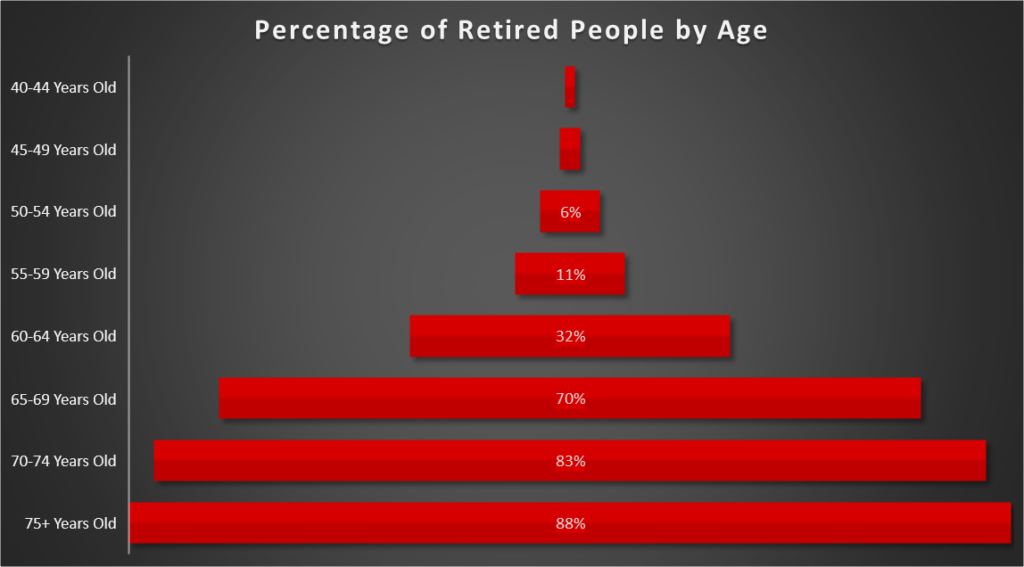

Over two-thirds of Americans retire at age 65 or later. Less than 3% of Americans retire by age 50.

This is yet another popular question in the world of personal finance.

As usual, I’ll have to make some assumptions about the intention of the question before providing an answer.

There are a couple of ways to view the term “financial independence”.

First, one could mean the age at which someone is no longer dependent on financial support from parents or guardians. Usually, this would be the age when your parents no longer provide for you financially.

In case you’re wondering, the average age for this milestone is 31.

I was a bit surprised by this, but I’m like 42 now. I’m old. What do I know?

In any event, it appears that financial “help” from parents is continuing later and later into the lives of their children.

Our Understanding of Financial Independence

The second interpretation of the question at hand is that “financial independence” means no longer dependent on any outside source for financial support.

And by “any outside source” we mean no need for parents, a job, assistance from Uncle Sam, nothing.

Totally on your own.

Like FIRE independent.

This is a little more difficult to define because there are about 10 different versions of FIRE now, and they involve various ranges of employment from zero to working full-time.

Instead of trying to pinpoint specific clusters of people from the overall pool of “FIRE-ees”, it makes more sense to just lump everyone into the same bunch.

Gallup released a study in 2022 that highlighted the shift in retirement ages over the last couple of decades, as well as when people expected to retire compared to when they actually did.

Part of that study sought to identify how many retirees existed by age.

No, “retired” and “financially independent” are not the same thing, but it is as close as the available data will get us.

For your reading pleasure, here is a table and a graph showing the percentage of retirees by age group.

| Percentage of People Retired by Age Range | |

|---|---|

| 40-44 Years Old | 1% |

| 45-49 Years Old | 2% |

| 50-54 Years Old | 6% |

| 55-59 Years Old | 11% |

| 60-64 Years Old | 32% |

| 65-69 Years Old | 70% |

| 70-74 Years Old | 83% |

| 75+ Years Old | 88% |

Great news! You won’t have much trouble finding someone your age to play pickleball with you when you reach age 65.

Before that, it may be more of a challenge.

There are a few folks that attempt to reach financial independence by the time they turn 30.

I say go for it if that’s what you really want to do and you have something worthwhile to fill your time, but it looks like you will be in very select company.

Heck, even if you retire before age 50 only 2% of your peers will also be retired.

Please don’t take this as criticism. I think you should pursue financial independence as quickly as you can reach it.

But I also think you should have your eyes wide open about what you hope to do in retirement and what you’ll be able to do in retirement. There is a difference.

In any event, this could be useful information if you have a goal to retire before most, or at least be ahead of the curve in reaching your personal savings goals.

My guess is the percentage of early retirees will increase over time, at least in this generation.

Supposedly, over 40% of millennials are aiming to retire early. Again, “retire early” is a subjective term, but this nevertheless shows a high degree of intent for that age group.

Even if only 15% reach their goal it will be far more than in previous generations.

Why Do People Ultimately Retire?

Often when I’m researching a particular topic, I will stumble across other information I find fascinating.

That happened again when assembling this post.

Perhaps I’m naïve, but I’ve always assumed most people retire because they were financially able to.

It turns out only 20% of people identified being “financially able” as their primary reason for retirement and only 29% identified it as a contributing factor at all.

Sadly, negative working conditions, being laid off, or personal health problems were the primary driver 45% of the time.

Another 11% retired because they became a caregiver for someone, their employer closed its doors, or their spouse retired.

In other words, at least 56% of the time the primary motivator for retirement was a circumstance beyond the retiree’s ability to control.

The Gallup study we noted earlier found that on average people retire 4 to 6 years earlier than they expected to.

All of that to say, it’s not a bad idea to accumulate enough to be financially independent many years before you think you will retire, because things happen.

Retirement Age by Gender

Gender also seems to play a role in retirement age, though not a huge one.

At age 62 vs age 65 respectively, women are more likely to retire before men.

There are a lot of reasons this could be the case. My own theory is that the wife is typically the younger spouse in a marriage.

So, if couples retire together this will make the average age for women lower.

Retirement Age by Education

On average, those who obtained a college degree retire 2.9 years later than those who have a high school diploma.

This is largely driven by a higher degree of health issues for those with a high school education compared to those with a college degree.

Retirement Age by Race

| Ethnicity | % Retiring at Age 61 or Younger | % Retiring at Age 62 to 64 | % Retiring at Age 65 and Above |

|---|---|---|---|

| White | 48% | 24% | 27% |

| Black | 56% | 23% | 17% |

| Hispanic | 65% | 19% | 15% |

This data comes from the Federal Reserve and I found it interesting too.

Since the majority of wealth in the United States is held by white people, I had assumed that they would typically retire earlier.

Obviously, that’s not the case.

Common reasons cited were retiring in order to care for loved ones or because of personal health issues.

Now, if you’re paying attention, you’ll notice that these percentages likely conflict with the table above that shows the percentage of retirees by age.

I mean, how can roughly half of the white, black, and Hispanic populations be retired at 61 or younger, while only 32% of all retirees are under 65?

Granted, we do not have some other ethnicities accounted for in the data, but how much could they possibly skew the data?

Let me attempt to offer two explanations…

1) The definition of “retirement” was possibly different for each study”

Perhaps there are more people working part-time and one study ignored that while the other did not?

Perhaps the Federal Reserve data is based on the number of people who have begun filing for Social Security? Though, 62 is as early as you can file except in the case of a disability.

2) Mark Twain said there are three types of liars: “liars, damn liars, and statisticians.”

I think there’s a little bit of both at play here.

I don’t know how Gallup does their polling, but I tend to trust the fed data a little more.

My assumption is Gallup is asking their respondents to recall from memory certain aspects about their retirement while the Fed is using actual, you know…data.

Maybe you will have someone to play pickleball with after all.

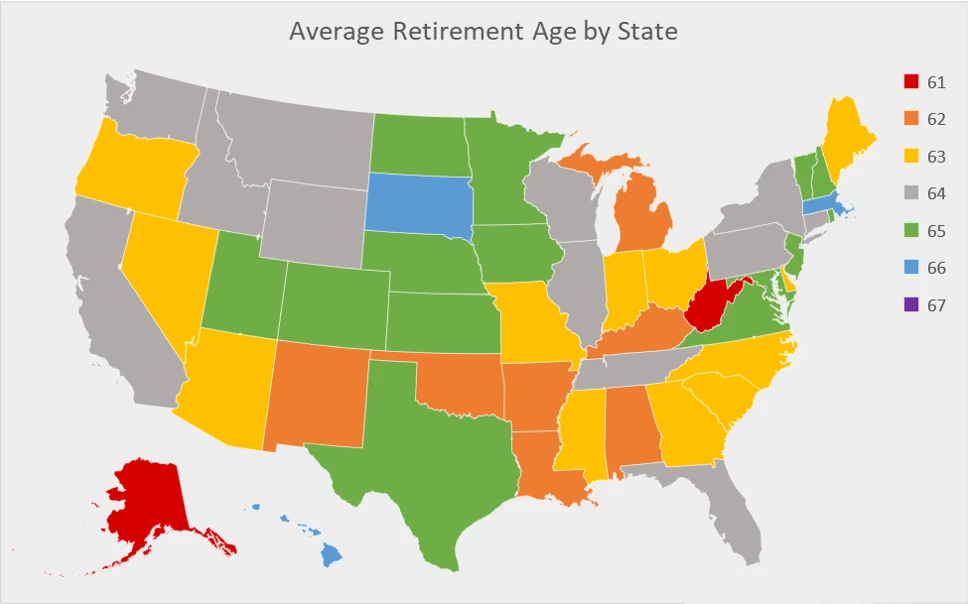

Retirement Age by State

And here’s the average retirement age by each state, including our friends in D.C.

| State | Average Retirement Age |

|---|---|

| Alaska | 61 |

| West Virginia | 61 |

| Alabama | 62 |

| Arkansas | 62 |

| Kentucky | 62 |

| Louisiana | 62 |

| Michigan | 62 |

| New Mexico | 62 |

| Oklahoma | 62 |

| Arizona | 63 |

| Delaware | 63 |

| Georgia | 63 |

| Indiana | 63 |

| Maine | 63 |

| Mississippi | 63 |

| Missouri | 63 |

| Nevada | 63 |

| North Carolina | 63 |

| Ohio | 63 |

| Oregon | 63 |

| South Carolina | 63 |

| California | 64 |

| Connecticut | 64 |

| Florida | 64 |

| Idaho | 64 |

| Illinois | 64 |

| Montana | 64 |

| New York | 64 |

| Pennsylvania | 64 |

| Tennessee | 64 |

| Washington | 64 |

| Wisconsin | 64 |

| Wyoming | 64 |

| Colorado | 65 |

| Iowa | 65 |

| Kansas | 65 |

| Maryland | 65 |

| Minnesota | 65 |

| Nebraska | 65 |

| New Hampshire | 65 |

| New Jersey | 65 |

| North Dakota | 65 |

| Rhode Island | 65 |

| Texas | 65 |

| Utah | 65 |

| Vermont | 65 |

| Virginia | 65 |

| Hawaii | 66 |

| Massachusetts | 66 |

| South Dakota | 66 |

| District of Columbia | 67 |

I honestly have no explanation for this map, but it does appear that there are clusters of retirees of the same age and geography.

Unless of course, you live in Kentucky, Tennessee, North Carolina, West Virginia, or Virginia.

That’s a mixed bag if I’ve ever seen one.

Conclusion

This was kind of fun, but it’s all a bit academic.

There actually isn’t much about your age, race, gender, or geography that will ultimately determine your retirement age.

Your savings rate will have more of an impact than anything.

We also invite you to check out our Next Dollar Roadmap to help you get oriented on your path to financial independence.