How Much Money Should I Have Saved by Age 30? 40? 50?

There are several ways to estimate how much you need to have saved by age 30 to be on track for your goals, but many agree that about 1x of your income is a good start.

Milestones are a great way of measuring progress.

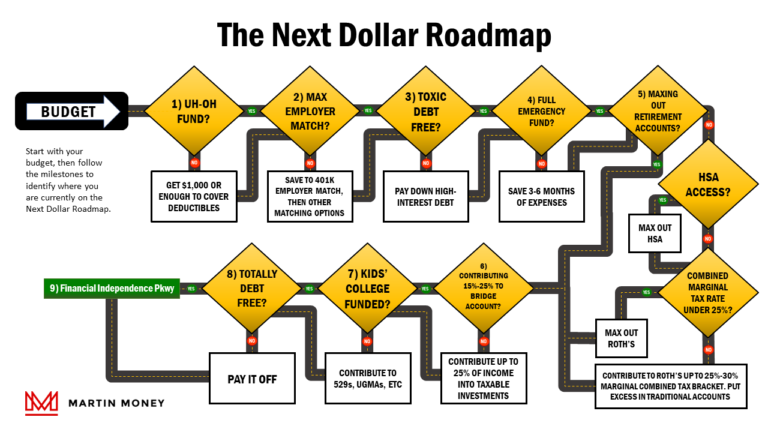

This is an easy segway to talk about our Next Dollar Roadmap and its 10 milestones (9 plus the starting point of budgeting), but we’re just talking about saving today.

Specifically, we want to discuss good savings targets for you as you reach any given age in life.

To be clear, by saving, we don’t purely mean net worth.

Sure, net worth is an important metric for evaluating financial health, but if you own a home this massive asset can skew the picture a bit.

It’s not that your home doesn’t count, but you’ve got to live somewhere.

For most people, selling their home in order to provide income isn’t an option they want to consider.

So, we’ll leave your home equity out of this saving discussion.

Instead, we’ll focus on retirement assets like 401(k)s and IRAs as well as any investments one might have in a taxable brokerage account.

We’ll also include any cash savings you may have in a bank or invested in treasury investments.

In fact, it may be easier to just say we’re going to count everything that isn’t a home or a depreciating asset like a car or boat.

Finally, none of this is inflation adjusted, so just assume you’ll need to adjust expectations for that as you go.

Our Method

If you want to just skip down to the tables, just click this link down to the tables. If you care about how we came up with this information, read on.

Before we dig in, we need to acknowledge something very important.

Everyone…has…unique…goals.

A post like this is a bit of a blunt instrument in that it has to make some pretty broad assumptions about the lifestyle everyone is shooting for.

You may be content to work until your dying day or you may want to leave work ASAP. Of course, you could be somewhere in between or even prefer to work part-time even in “retirement”.

You may want to travel a lot, a little, or none at all.

You may want a gigantic home the kids and grandkids can come to visit you in or you may want a tiny condo to limit the headaches of maintaining your living space.

For each of these scenarios and the endless variety of combinations they could produce, there are varying levels of financial need required to provide for them.

As a result, we’ll be providing three levels of saving for each age in our evaluation. The basis for these levels comes from the famous book The Millionaire Next Door by Thomas Stanley and William Danko.

UAWs, AAWs, and PAWs

In the book, Stanly and Danko propose a formula for calculating how much one should have saved in order to be considered an average accumulator of wealth (AAW).

Their basis was the product of years of research, but you’ll need to read the book to get all the details. I highly recommend it but won’t get a commission if you decide to grab a copy.

Anyhow, the formula for being an average accumulator of wealth (AAW) is [10% x AGE x Annual Income].

So, for a 40-year-old making $100,000 annually, AAW status would be $400,000 (10% x 40 x $100k).

In the book, Stanley and Danko also characterize those who lag behind this formula as being either Under Accumulators of Wealth (UAWs) or those who have reached beyond AAW as Prodigious Accumulators of Wealth (PAWs).

For our purposes, we’ll consider UAWs as ½ of the amount saved as AAWs and we’ll characterize PAWs as those having twice the amount saved of AAWs.

The Formula’s Blind Spot

Finally, there’s one more small issue we should address.

Let’s assume you’re 23 years old and while you’ve just found a job with a solid $50k annual salary, your accumulated savings are basically at zero because you’re just getting started.

It would be unfair to assume you should already have $115,000 saved (10% x 23 x $50k).

Well, there’s a solution to this problem. And while it isn’t completely perfect, it provides a dose of reality to an otherwise unfair formula.

If you’ve read many of our posts, you know I’m a big fan of the Money Guy Show.

They came up with a formula adjustment for those of you 40 and under that provides a more realistic measurement for UAWs, AAWs, and PAWs.

In their formula, if you’re under 40 years old you still multiply your age by your income, but instead of multiplying this amount by 10%, we’ll divide it by the number of years until you’ll turn 40, plus ten.

In mathematical terms, [ (Age x Income) / (Years until 40 + 10) ].

So, for our 23-year-old friend who is making $50k annually, the AAW number would be $42,592.59 (23 x 50k / 17+10).

For a 35-year-old making $75k? $175,000.

When you hit 40, it’s back to the regular formula.

How Much Should I Have Saved by Age

Please help me welcome back our friend, Average J, to help us illustrate just how much we need to have saved for the future of our dreams.

The latest data we have from our friends at worldpopulationreview.com indicates that the median individual income in the United States in 2023 is $44,225.

As I’ve explained before, we use median income for these illustrations because high net worth individuals skew the average income a little too much to be a fair representation of a normal person’s income.

We’ll look at household income in the next table for those of you who are not single.

And here’s the UAW, AAW, and PAW for an annual income of $44,225 from ages 18 through 65…

Age | Under Accumulator of Wealth (UAW) | Average Accumulator of Wealth (AAW) | Prodigious Accumulator of Wealth (PAW) |

18 | $12,438 | $24,877 | $49,753 |

19 | $13,553 | $27,106 | $54,211 |

20 | $14,742 | $29,483 | $58,967 |

21 | $16,013 | $32,025 | $64,050 |

22 | $17,374 | $34,748 | $69,496 |

23 | $18,837 | $37,673 | $75,346 |

24 | $20,412 | $40,823 | $81,646 |

25 | $22,113 | $44,225 | $88,450 |

26 | $23,955 | $47,910 | $95,821 |

27 | $25,958 | $51,916 | $103,833 |

28 | $28,143 | $56,286 | $112,573 |

29 | $30,536 | $61,073 | $122,145 |

30 | $33,169 | $66,338 | $132,675 |

31 | $36,078 | $72,157 | $144,313 |

32 | $39,311 | $78,622 | $157,244 |

33 | $42,924 | $85,849 | $171,697 |

34 | $46,989 | $93,978 | $187,956 |

35 | $51,596 | $103,192 | $206,383 |

36 | $56,861 | $113,721 | $227,443 |

37 | $62,936 | $125,871 | $251,742 |

38 | $70,023 | $140,046 | $280,092 |

39 | $78,399 | $156,798 | $313,595 |

40 | $88,450 | $176,900 | $353,800 |

41 | $90,661 | $181,323 | $362,645 |

42 | $92,873 | $185,745 | $371,490 |

43 | $95,084 | $190,168 | $380,335 |

44 | $97,295 | $194,590 | $389,180 |

45 | $99,506 | $199,013 | $398,025 |

46 | $101,718 | $203,435 | $406,870 |

47 | $103,929 | $207,858 | $415,715 |

48 | $106,140 | $212,280 | $424,560 |

49 | $108,351 | $216,703 | $433,405 |

50 | $110,563 | $221,125 | $442,250 |

51 | $112,774 | $225,548 | $451,095 |

52 | $114,985 | $229,970 | $459,940 |

53 | $117,196 | $234,393 | $468,785 |

54 | $119,408 | $238,815 | $477,630 |

55 | $121,619 | $243,238 | $486,475 |

56 | $123,830 | $247,660 | $495,320 |

57 | $126,041 | $252,083 | $504,165 |

58 | $128,253 | $256,505 | $513,010 |

59 | $130,464 | $260,928 | $521,855 |

60 | $132,675 | $265,350 | $530,700 |

61 | $134,886 | $269,773 | $539,545 |

62 | $137,098 | $274,195 | $548,390 |

63 | $139,309 | $278,618 | $557,235 |

64 | $141,520 | $283,040 | $566,080 |

65 | $143,731 | $287,463 | $574,925 |

I had never run this calculation beyond 40 because I’m only 41 as I write this.

I’m pretty surprised at how low the numbers seem for folks in their 50s and 60s. I have two thoughts about that.

First, Average J could do a lot worse than having $143,731. Sure, median net worth at that age is somewhere around $225k, so it’s a little behind but not impossible.

Second, I’m aiming for much more than that and you probably should too.

Using the 4% rule, which we’ll discuss more in a bit, $143,731 would only provide $5,749.24 of annual income in order to last through retirement.

I hope Average J wasn’t looking forward to a long trip to Europe one day.

How Much Should I Have Saved by Household Income

Again, according to our friends at World Population Review, median household income in the United States in 2023 is $67,521.

This is actually down a bit from 2020.

Anyhow, here’s the same table for that level of income.

Age | Under Accumulator of Wealth (UAW) | Average Accumulator of Wealth (AAW) | Prodigious Accumulator of Wealth (PAW) |

18 | $18,990 | $37,981 | $75,961 |

19 | $20,692 | $41,384 | $82,768 |

20 | $22,507 | $45,014 | $90,028 |

21 | $24,447 | $48,895 | $97,789 |

22 | $26,526 | $53,052 | $106,104 |

23 | $28,759 | $57,518 | $115,036 |

24 | $31,164 | $62,327 | $124,654 |

25 | $33,761 | $67,521 | $135,042 |

26 | $36,574 | $73,148 | $146,296 |

27 | $39,632 | $79,264 | $158,528 |

28 | $42,968 | $85,936 | $171,872 |

29 | $46,622 | $93,243 | $186,487 |

30 | $50,641 | $101,282 | $202,563 |

31 | $55,083 | $110,166 | $220,332 |

32 | $60,019 | $120,037 | $240,075 |

33 | $65,535 | $131,070 | $262,140 |

34 | $71,741 | $143,482 | $286,964 |

35 | $78,775 | $157,549 | $315,098 |

36 | $86,813 | $173,625 | $347,251 |

37 | $96,088 | $192,175 | $384,350 |

38 | $106,908 | $213,817 | $427,633 |

39 | $119,696 | $239,393 | $478,785 |

40 | $135,042 | $270,084 | $540,168 |

41 | $138,418 | $276,836 | $553,672 |

42 | $141,794 | $283,588 | $567,176 |

43 | $145,170 | $290,340 | $580,681 |

44 | $148,546 | $297,092 | $594,185 |

45 | $151,922 | $303,845 | $607,689 |

46 | $155,298 | $310,597 | $621,193 |

47 | $158,674 | $317,349 | $634,697 |

48 | $162,050 | $324,101 | $648,202 |

49 | $165,426 | $330,853 | $661,706 |

50 | $168,803 | $337,605 | $675,210 |

51 | $172,179 | $344,357 | $688,714 |

52 | $175,555 | $351,109 | $702,218 |

53 | $178,931 | $357,861 | $715,723 |

54 | $182,307 | $364,613 | $729,227 |

55 | $185,683 | $371,366 | $742,731 |

56 | $189,059 | $378,118 | $756,235 |

57 | $192,435 | $384,870 | $769,739 |

58 | $195,811 | $391,622 | $783,244 |

59 | $199,187 | $398,374 | $796,748 |

60 | $202,563 | $405,126 | $810,252 |

61 | $205,939 | $411,878 | $823,756 |

62 | $209,315 | $418,630 | $837,260 |

63 | $212,691 | $425,382 | $850,765 |

64 | $216,067 | $432,134 | $864,269 |

65 | $219,443 | $438,887 | $877,773 |

This makes a little more sense to me, but I’m married so I tend to think of income in household terms.

The UAW number is pretty close to the average net worth for a 65-year-old which is better but also tells me that most people haven’t saved well enough to be considered “wealthy” by Dr. Stanley or Dr. Danko.

Remember also that we’re assuming income remains flat at $67,521 throughout Average J’s lifetime. In all likelihood, yours will increase over time.

And this is where most people ask me, “But what is considered wealthy anyway?”

I have to confess, much like beauty is in the eye of the beholder, wealth is in the viewpoint of the saver.

I know this sounds like a cop-out, but your goals are your goals.

If you want to take me out to lunch so I can tell you what your goals should be I can give it a shot, but you’re probably a better evaluator of that than I’ll ever be.

There are people who have died miserable with millions and those that have died pleased and poor.

How Much Should I Have Saved to be “Wealthy”

We’ve given our share of input on how to calculate “your number”, but what if we just provide the target and back into the amount you’d need to have at each age to hit it by the time you turn 65?

According to Charles Schwab’s 2022 Modern Wealth Survey, Americans feel like they need $2.2 Million saved to be considered “wealthy”.

Using the 4% rule, this would provide $88,000 of income in the first year.

Works for me.

But what would you need to have saved at each age to reach $2.2MM by the time you turn 65? Or what if you want to have it by 60? 55? 50? Or even 45?

We’ve got you covered.

The table below provides all of that assuming an annualized rate of return of 8%, just because I had to pick something.

(In case you’re wondering, the S&P500 has returned over 10.5% for its lifetime, so 8% is kind of conservative, IMHO.)

I’ve also assumed that you’ll be saving more throughout your life the earlier you want to meet the $2.2MM goal.

How much you should have saved at each age to reach $2.2 MM by… | |||||

Age | $2.2MM by 65 | $2.2MM by 60 | $2.2MM by 55 | $2.2MM by 50 | $2.2MM by 45 |

18 | $293 | $308 | $340 | $522 | $855 |

19 | $587 | $616 | $681 | $1,044 | $1,710 |

20 | $1,173 | $1,233 | $1,361 | $2,088 | $3,420 |

21 | $2,346 | $2,466 | $2,722 | $4,176 | $6,841 |

22 | $4,693 | $4,932 | $5,444 | $8,351 | $13,682 |

23 | $9,385 | $9,863 | $10,889 | $16,703 | $27,364 |

24 | $18,770 | $19,726 | $21,777 | $33,405 | $54,727 |

25 | $26,814 | $28,180 | $31,111 | $47,722 | $78,182 |

26 | $33,518 | $35,226 | $44,444 | $68,174 | $111,689 |

27 | $39,433 | $44,032 | $63,491 | $97,391 | $159,555 |

28 | $45,852 | $53,697 | $79,364 | $121,739 | $199,444 |

29 | $53,316 | $63,174 | $99,205 | $152,174 | $249,305 |

30 | $61,996 | $73,458 | $124,006 | $190,218 | $311,632 |

31 | $70,450 | $85,416 | $145,890 | $223,785 | $366,625 |

32 | $80,057 | $99,321 | $171,635 | $263,277 | $431,324 |

33 | $90,973 | $114,162 | $199,575 | $306,136 | $501,540 |

34 | $103,379 | $131,220 | $232,064 | $355,972 | $583,186 |

35 | $116,156 | $150,828 | $266,741 | $409,163 | $670,328 |

36 | $130,512 | $169,470 | $306,599 | $470,303 | $770,492 |

37 | $146,643 | $190,415 | $348,407 | $534,435 | $875,559 |

38 | $164,767 | $213,950 | $395,918 | $607,312 | $994,954 |

39 | $185,132 | $243,125 | $449,906 | $690,128 | $1,130,629 |

40 | $205,702 | $276,278 | $505,513 | $775,424 | $1,270,370 |

41 | $228,558 | $313,952 | $567,992 | $871,263 | $1,427,382 |

42 | $253,953 | $352,756 | $638,193 | $978,948 | $1,603,800 |

43 | $282,170 | $396,355 | $709,103 | $1,087,719 | $1,782,000 |

44 | $313,523 | $445,342 | $787,893 | $1,208,577 | $1,980,000 |

45 | $348,359 | $494,825 | $875,436 | $1,342,864 | $2,200,000 |

46 | $387,065 | $549,805 | $972,707 | $1,492,071 | |

47 | $430,072 | $610,895 | $1,080,786 | $1,657,856 | |

48 | $477,858 | $678,772 | $1,187,677 | $1,821,820 | |

49 | $530,953 | $754,191 | $1,305,139 | $2,002,000 | |

50 | $583,465 | $837,990 | $1,434,219 | $2,200,000 | |

51 | $641,171 | $931,100 | $1,576,065 | ||

52 | $704,583 | $1,034,556 | $1,713,114 | ||

53 | $774,267 | $1,136,874 | $1,862,080 | ||

54 | $850,843 | $1,249,312 | $2,024,000 | ||

55 | $934,992 | $1,372,871 | $2,200,000 | ||

56 | $1,027,464 | $1,508,649 | |||

57 | $1,129,082 | $1,657,856 | |||

58 | $1,227,263 | $1,821,820 | |||

59 | $1,333,981 | $2,002,000 | |||

60 | $1,449,979 | $2,200,000 | |||

61 | $1,576,065 | ||||

62 | $1,713,114 | ||||

63 | $1,862,080 | ||||

64 | $2,024,000 | ||||

65 | $2,200,000 | ||||

How Much Should I Have Saved as a Multiple of Income

Another popular way to evaluate how much you should have saved is to assume certain multiples of your income along the way.

Fidelity provides the most popular recommendation, which suggests the following multiples of your income by each corresponding age below.

Age | Multiplier |

30 | 1X |

35 | 2X |

40 | 3X |

45 | 4X |

50 | 6X |

55 | 7X |

60 | 8X |

67 | 10X |

Yeah, I’m not a fan.

I mean, 1x by 30 is great, but only 10x by 67?

The famous Trinity Study showed that we should have 25x our spending level by 65 in order to ensure we’d have enough to live the remainder of our lives without running out of cash.

This standard is widely accepted in the financial services industry though some think it’s safer to push up to around 30x since life expectancies are longer than when this study was first conducted.

10x looks a little tight to me.

Consider this instead…

Age | Multiplier |

30 | 1X |

35 | 2X |

40 | 3X |

45 | 5X |

50 | 8X |

55 | 13X |

60 | 20X |

67 | 25X |

This chart picks up steam as you get older because it assumes compound interest begins to do much of the heavy lifting for you.

Your peak earning years are also typically in your late 40s through your 50s, so the Average J should be able to make up some ground here.

It’s the whole reason we talk about saving early and often. There’s just no replacing time when it comes to investing.

Conclusion

There are an infinite number of ways for one to calculate their own savings goals.

If you ask me, trying a lot of them won’t hurt.

You’ll never get a number that’s 100% accurate anyhow, but multiple methods will provide a spectrum of results that together can provide some idea of where you’re headed and how the journey is going.

Personally, I started by making some assumptions about the spending I’d want to do as I grew older and even more assumptions about my income and investment returns over time.

Using conservative numbers, we started saving what we thought it would take.

After a while, compounding interest began working its magic and it became abundantly clear we’d reach our goal.

So, we kept saving and continue to do so in order to pull the date that we reach our goal closer and closer.

We may not “retire” at that point, but at least we’ll be working because we want to then and not because we have no other choice.

I’d encourage you to get into the numbers and nerd out a bit until you have a good idea where you stand.

There’s no better time to make adjustments than right now.