What is a Good Expense Ratio? Their Stunning Impact

Expense Ratios may seem like an insignificant factor when evaluating the suitability of a mutual fund or ETF, but over extended periods of time, even differences of less than 1% can lead to hundreds of thousands of dollars saved (or more).

Want to save hundreds of thousands of dollars?

What if I told you that you may be able to do just that without having to make any significant adjustments to your investment asset allocation and may even be able to reduce the overall level of risk in your portfolio at the same time?

It may sound too good to be true, but it’s possible due to the inefficiency of many mutual funds and ETFs.

What is an Expense Ratio?

For years, mutual funds have been created and managed by investment companies in order to serve as a significant source of revenue while providing targeted diversification for their clients.

In order to combine diversification with strategic, asset focused investing, mutual funds are managed by a team of investment specialists with one fund manager leading the effort.

As you might guess, this team of people does not work for free.

In order to pay this team of specialists, mutual funds collect an administrative cost from their investors in the form of an expense ratio.

The expense ratio is a percentage of the fund’s overall net asset value (the NAV) and it actually covers much more than salaries.

An expense ratio could be withheld to cover management fees, taxes, legal fees, transaction costs, marketing fees, accounting, and auditing fees, among others.

ETFs also have expense ratios, but they are typically lower than their mutual fund peers.

How is an Expense Ratio Calculated?

The expense ratio is calculated by dividing the total fees charged to you annually by your total investment.

So, for a $10,000 investment with an expense ratio of 1%, $100 would be withheld annually by the fund to cover expenses.

Most domestic actively managed mutual funds charge expense ratios between 0.5% and 1%.

This rate has declined steadily in recent years thanks to the advent of low-cost index funds which we’ll discuss in further detail later.

Funds that focus on international assets will typically have higher expense ratios than domestic funds.

How Much of a Difference Could It Make?

Since expense ratios are a relatively small portion of a fund’s overall value, it can be tempting to assume the amount doesn’t matter that much.

If the expense ratio is already less than 1%, how much of a difference will fractions of a percentage make?

Believe it or not, it can mean thousands, hundreds of thousands, or even millions of dollars over your lifetime.

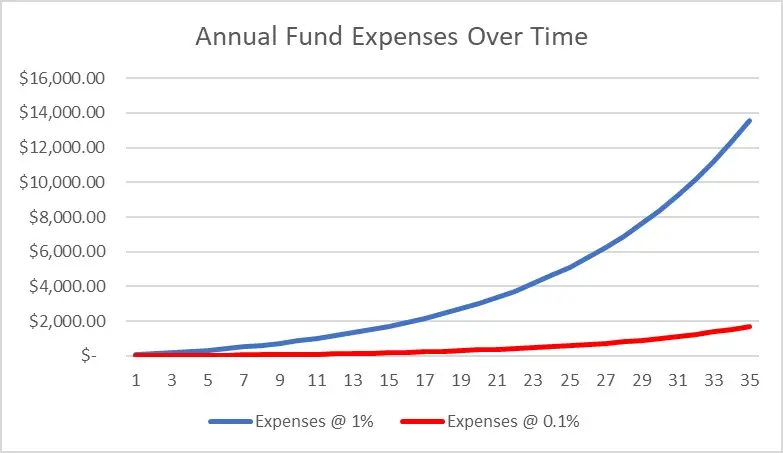

To illustrate, I ran a quick comparison between two investments that were equal in every way, with the exception of the expense ratios. For the example, I assumed the following:

- An investment of $5,000 per year for 35 years;

- An annual rate of return of 10.67% which was the average annual return for the S&P 500 when we kicked off this site;

- One investment has an expense ratio of 1% and the other 0.1%.

The good news is the balance of each investment reaches well above $1,000,000 over the course of 35 years. Yet another feather in the cap of compounding interest.

The bad news? The investment with the higher expense ratio of 1% cost its owner an additional $119,167.10 over 35 years☹.

Over this 35-year period, $135,198.85 was cannibalized by the more expensive investment while the less expensive investment lost a cumulative total of $16,031.75.

The balance of each at the end of the period was $1,343,290.56 and $1,704,633.20 respectively.

As you can see from the graph, the gap starts small but the difference increases exponentially over time.

Clearly, even the smallest delta in cost can have an enormous impact over time.

And what happens if the expense ratio goes up to 2%?

The cumulative cost of expenses goes up to $225,055.18!

While 2% is a relatively high expense ratio, there are funds that have charged as much as 5%. It’s hard to imagine how anyone could achieve success in this scenario (other than the fund manager).

But Doesn’t Active Management Mean I’ll See Higher Returns?

Nope.

In fact, 80% of active fund managers underperform a passive market index approach to investing.

It’s understandable to assume that human direction over the investment would lead to higher investment returns.

After all, a human can respond to changes in economics, politics, technology, and a litany of other events.

Ironically enough, though, the human adjustments are the very thing that cause the expenses within the fund to increase.

And as the expenses increase, the actively managed fund’s ability to compete with passive index funds is undermined, bit by bit.

You see, each time a trade is made in an attempt to meet the objectives of the fund or to adjust course for the sake of improved returns, a cost is incurred.

That cost is spread out on a pro-rata basis to all of the fund’s investors and they add up significantly.

I suppose the fund managers could just sit back and not make trades in an attempt to reduce costs, but then what would you need a fund manager for?

They have to justify their existence somehow. So, they make trades and you pay for them.

But we’re not the first people to wonder why they’re necessary.

Enter Jack Bogle

Jack Bogle was an investing genius.

He created The Vanguard Group in 1974 after being relieved of his duties as the chairman of the Wellington Fund a few years prior.

After creating Vanguard, Bogle is credited with inventing the first-ever index fund in 1976.

It changed the investing world.

Paul Samuelson, who won the Nobel Prize for economics, ranked “this Bogle invention along with the invention of the wheel, the alphabet, Gutenberg printing.”

A bit of an exaggeration perhaps, but the point is clearly made that index funds are a game-changer.

Bogle hated wasteful management fees and was convinced that a large basket of investments consolidated into a single fund would create excellent diversification while also significantly reducing the cost of fund management.

He was right.

For decades now the popularity of index funds has soared as investors wise up to the fact that active management rarely outpaces passive management.

In my own experience, a shift in our portfolio back in 2010 from active management to passive index funds has resulted in a more than 2% increase in the annualized average rate of return (not that our result is indicative of what others might experience).

Where Can I Find Low Expense Investments?

Next, I’d like to acknowledge one unfortunate possibility.

You may not have access to any low-cost index funds in a 401(k) or other employer-sponsored retirement plans.

Investment companies know that they have a captive audience once they are selected to administer a retirement plan for a particular company.

Unless the HR people in your organization are diligent about keeping these costs low, you work for a very large company, or both, your fund choices may not include any low-cost options.

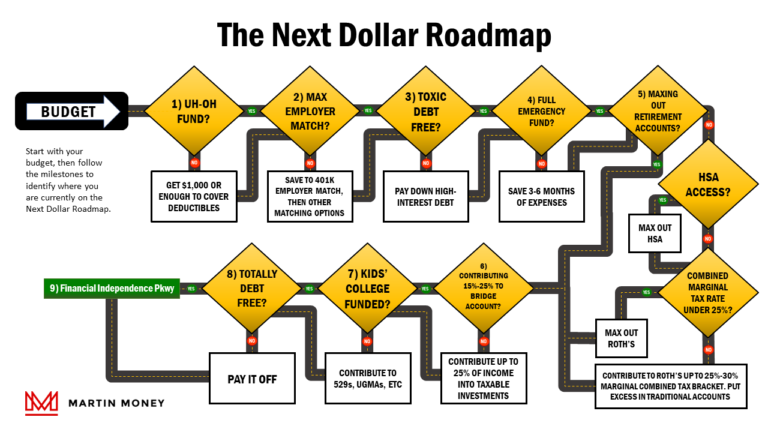

If you find yourself in such a situation, we suggest taking full advantage of your employer match before moving on to IRAs where you will have access to a broad selection of index funds.

For investment accounts where you have access to the full market of investment options, finding low-cost index funds should be a snap.

Nearly every investment house has a variety of their own index funds, and if they don’t you can probably still choose from the long list of funds offered by Vanguard, Fidelity, or another large brokerage.

You should be able to find mutual funds and ETFs following a variety of indices or strategies with expense ratios of 0.10% or less.

We have used Vanguard for years and enjoy expense ratios as low as 0.03% for some of our investments.

Personally, I believe this seemingly small detail has made a significant difference in our ability to generate and keep earnings from our investments over time.