What is Deferred Compensation?

Deferred compensation is exactly what it sounds like; a portion of an employee’s income that is set aside to be paid at a later date.

Under this broad definition, employee retirement plans like pensions, 401(k)s, 403(b)s, and 457s are all forms of deferred compensation.

And like these plans, the primary benefit of deferred compensation plans is the deferral of taxes to a later date.

With that out of the way, I’d like to quickly clarify that the focus of this post is not Qualified Deferred Compensation like the retirement plan examples we just listed.

Instead, we will focus on Non-Qualified Deferred Compensation plans (NQDC), which is what is more commonly meant when people reference a “Deferred Comp plan”, “DC”, or “Golden Handcuffs”.

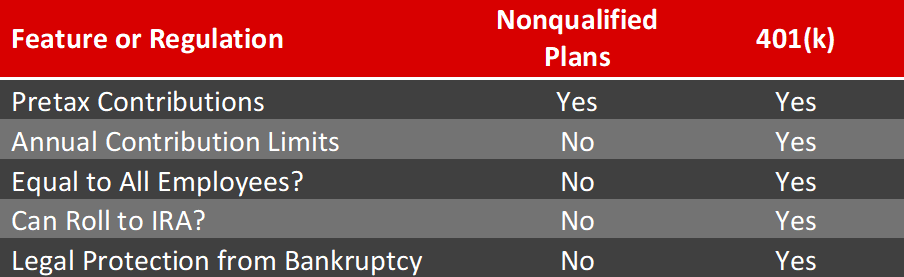

There are many differences between Non-Qualified and Qualified Deferred Compensation plans.

Instead of just listing them out in paragraph form, I decided to build a handy table:

Pretax Contributions – Both plan types can receive pretax contributions. Like Qualified plans, NQDCs are only taxable once they are “constructively received” by the employee.

Contribution Limits – While qualified plans have maximum contribution limits, NQDCs do not.

Equal to All – Qualified Plans must be shared with all full-time employees who are eligible to participate, but NQDCs can be limited to one or a few select individuals.

Roll to IRA – Rolling a qualified plan to an IRA is a common practice in retirement, but this is not an option for NQDCs because the balance is taxable when the employee takes control over it.

Legal Protection – ERISA provides protection of your qualified plan assets from creditors in the event that your employer runs into financial difficulty. There is no such protection in a NQDC.

Benefits for Employers

From the employer’s point of view, the primary purpose of deferred compensation plans is to enhance the retention of certain employees.

In many cases, there are no immediate tax benefits for the employer for money that is set aside for the future benefit of an employee participating in an NQDC plan, but there is a much higher degree of flexibility when setting the terms of a deferred comp agreement.

Since non-qualified deferred compensation plans are effectively a future compensation contract between the employer and employee, various incentives can be negotiated within the plan to entice valuable employees to stay with their current employer longer.

For example, an employer and employee may agree that if the subject employee is still with the company on a certain future date, he or she will receive a portion or all of their deferred compensation. If the employee elects to change employees or quit, they may have to forfeit their deferred compensation.

In many cases, once an employee is invited to participate in a deferred comp plan, they are allowed to continue doing so annually until they sever employment.

In the case of an unplanned life event, most deferred compensation plans are set to immediately vest and pay to the employee or their estate in the case of the employee’s death or permanent disability.

Benefits for Employees

Since most NQDC plans are reserved for well-paid, senior leaders in an organization who often also enjoy high levels of income, deferred compensation can provide a significant income tax benefit for employees.

For example, let’s assume you’re an executive at a company with an income of $550,000 annually. You are married and file jointly with your spouse which means you’re in the 35% marginal income tax bracket in 2024.

Well, if you and your employer entered an arrangement that would allow you to defer $170,000 of annual income to a later date, your marginal taxes would fall 11% to the 24% bracket.

If you manage to stay at or below that marginal tax rate when you receive your deferred income, you’d save eleven cents or more on every dollar that you were able to defer. That’s a tax savings of $18,700 in this case.

Not only that, deferring income could allow you to qualify for other useful tax benefits that you wouldn’t be able to take advantage of otherwise.

Again, there aren’t any caps on the amount of deferred compensation you can earn, so you and your employer are free to negotiate a non-qualified deferred compensation agreement that works for each of you.

Truthfully though, many deferred comp plans are a “take or leave it” arrangement since they primarily benefit the employee.

Risks of Deferred Compensation

There are a few potential downsides to NQDC plans.

First, NQDC plans do not receive any of the legal protections afforded by the Employee Retirement Income Security Act (ERISA).

In qualified plans, ERISA prevents claimants from having access to your employer-sponsored 401(k) if your employer falls on difficult times financially.

You won’t have any of these protections in a non-qualified plan, so you need to be confident in your employer’s financial stability before deferring much of your income for very long.

Second, while non-qualified deferred compensation can be invested for your future benefit, the options are typically somewhat limited. In the past, this was a larger problem than it is today, but it is something to bear in mind as you decide whether or not to participate.

Finally, once you receive your NQDC dollars, it is a fully taxable event. There aren’t any options to roll the money into an IRA or some other tax-advantaged space to limit your tax liability.

In many cases, the year(s) deferred comp plans are distributed is simply a high tax year, but there are strategies that can be used to limit the tax bite.

Deferred Comp Strategies

If you ever have the opportunity to participate in a deferred compensation plan, there are a few planning things you should consider before jumping in with both feet.

1) Spread the Love

One key strategy is to negotiate installments of the deferred comp over a period of several years to spread out the impact and potentially keep yourself in a lower tax bracket.

It can be extremely difficult to forecast your income needs in retirement and it gets harder the further you are from stepping out of the workforce.

Frankly, if you have enough income to be enrolled in a deferred compensation plan, then you probably have enough to hire a financial planner to run some forecasts for you on how your income will play out in retirement.

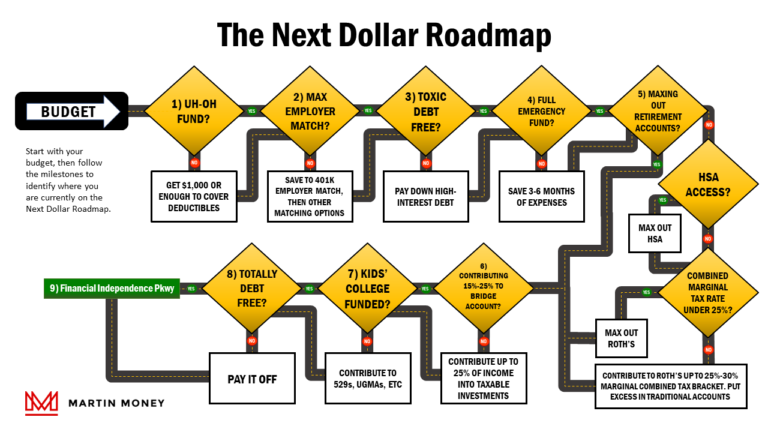

2) Did You Max Out Other Options First?

You can defer compensation and contribute to your qualified employer-sponsored retirement plan in the same tax year.

However, you should max out your employer-sponsored options first for several reasons.

- Qualified plans have greater withdrawal flexibility in retirement. With a 401(k), 403(b), or 457, you’re free to take money out of your account at your desired pace until you reach required minimum distribution age.

- Vested balances in a qualified plan are yours. You don’t have to worry about your employer’s financial health potentially submarining your balance like you do in a non-qualified deferred comp plan.

- You will typically find that you have more investment options in a qualified plan.

- You will likely have access to an employer contribution in a qualified plan, which is free money. No reason to pass that up.

If you are enrolled in a high-deductible health plan (HDHP), then you should also max out your contributions to a health savings account (HSA) before turning to non-qualified deferred compensation.

HSAs also receive many of the benefits we listed for qualified plans above, but come with the added bonus of being completely tax-free when the funds are used for a qualified medical expense.

3) How Far Into the Future Can You See?

When you do retire and begin receiving deferred compensation, will you also be receiving income from other sources like pensions and/or social security?

All of these income sources only serve to drive your income and your tax liability higher.

You should try to forecast these to the best of your ability when you sign up or adjust your deferred comp during annual enrollment.

4) Where Will You Live?

If you move between the time you defer compensation and the time you receive it, you’ll owe income tax on it in the state where you earned the income.

Potentially, you could avoid this if you spread the distributions out over the course of ten or more years. This could be especially helpful if you move to a no or low-income tax state.

5) What to Invest In

If you have significant control over the investment options in your deferred comp plan, be sure the asset allocation aligns with when you will receive the money.

Naturally, the further away you are from receiving your deferred compensation, the more risk you are likely able to take.

However, the sooner you’re set to receive your deferred comp, the more conservative you should be so you can avoid having to liquidate the assets in your account when there is a market swoon.

Wrap Up

Deferred compensation plans are a helpful tool for high earners to postpone and optimize income taxes.

If you have access to a deferred comp plan, be sure you understand the terms so you can avoid any planning mistakes that will leave you with a higher tax bill.

We have more on our website and YouTube channel about qualified retirement plans. Please feel free to check those out when you have time.