What Happens if I Contribute Too Much to My Roth IRA?

Step 1: Don’t Panic

Step 2: Pat yourself on the back for doing too much of a good thing.

Step 3: Keep reading.

Roth IRAs are great, but they do have rules. The three primary guidelines are:

- You must have earned income to contribute to a Roth IRA;

- Your income must not exceed the annual maximum income limits for contributing to a Roth IRA;

- You must not contribute more than the annual maximum allowed.

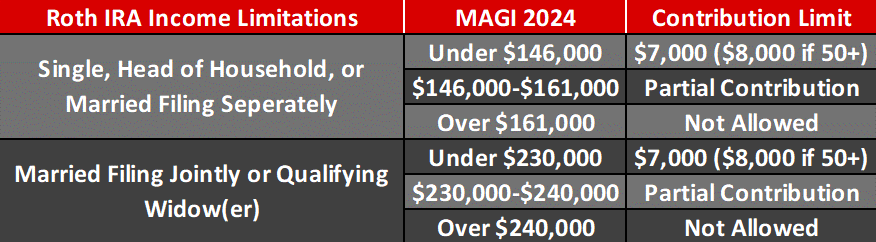

In case you’re wondering, here are the annual maximum income limitations and contribution limits for Roth IRAs in 2024.

The Penalty

Let’s start with the bad news first.

If you contribute more to a Roth IRA than you are allowed to, then the IRS will penalize you 6% per year for each year the excess contribution remains in the account beginning with the year you filed taxes for the year the error occurred.

For example, if you over contribute in 2024, you won’t be penalized until the money remains in the account through 2025.

That would be your first 6%.

They do cap this at 6 years, but a 36% penalty would still be a painful thing to go through.

So much so, in fact, it would kind of defeat the purpose of making an after-tax contribution in the first place.

On the other hand, 6% is a bit merciful. Most penalties for misuse of retirement accounts are 10% and the penalty for non-qualified HSA contributions is 20%.

You also have until the following tax year to fix things before the 6% penalty hits, so there’s plenty of time to get it fixed.

Unfortunately, you’ll owe income tax on any earnings you realized while your excess contribution was in the Roth account.

And, if you aren’t eligible to make qualified distributions from your IRA (like if you’re not 59.5 or older), you’ll owe a 10% penalty on those earnings from your excess contribution.

Common Situations

There are two ways to over-contribute to a Roth IRA.

The most common is to contribute in a year where your income exceeds the annual maximum.

Since we can’t exactly know what our modified adjusted gross income will be until we calculate our taxes, many times the accounts are funded only to have a raise or bonus bump the account holder’s income above the allowable threshold.

The other common way is that you simply contribute beyond the annual limit ($6,500 in 2023). This is easier to do than you might think, especially if your contributions are made irregularly.

How to Fix It

Ideally, you’ll catch your excess contribution before you file your taxes.

In this case, it’s as simple as contacting your account custodian and having the contributions removed in one of several ways:

- Liquidate the excess contribution and have the custodian send you the money

- Transfer the assets in kind to a taxable brokerage account

- Liquidate the assets and transfer the money from the excess contribution to a taxable account

- Recharacterize the Roth contribution to a Traditional contribution

If you’ve already filed your taxes then you have a couple of more complicated options:

- You can remove the excess and file an amended return by October 15th

- You can offset your excess contribution by reducing your contribution by that amount the following year. (Note: Researching the steps on this was confusing to me because, well…IRS. You should reach out to a tax pro for help on this one.)

Again, if you correct the issue before the end of the following tax year, you can avoid the 6% penalty.

Another interesting tidbit is that if you contributed to both a Roth and Traditional IRA, but went over the cumulative maximum then the Roth assets must be removed first.

Conclusion

If you’ve made an excess contribution, don’t panic. It really isn’t a huge problem, but it is a bit of a hassle to correct it and report it on your next tax return.

Several years ago my wife and I made this mistake, but we caught it way before we filed taxes so getting it cleaned up wasn’t that awful.

Your account custodian will probably have a process in place to make the correction relatively easy.