Helpful Budgeting Tools

Budgeting is an important discipline for managing your finances. Thankfully, there are several ways to approach budgeting using a variety of tools.

Budgets are like scales.

You may have a love/hate relationship with yours, but at least it gives an honest reflection of how much you weigh.

Or…well…how much you spend.

Personally, we aren’t big fans of the budgeting process, and it appears most Americans agree. According to thepennyhoarder.com, only 45% of Americans keep a regular budget.

We admit, budgeting is not very entertaining and it can require a significant investment of time, but that doesn’t mean it isn’t worthwhile.

In the same thepennyhoarder.com survey, results showed that those who didn’t keep a regular budget were more likely to have high levels of credit card debt and lower income than those who do budget.

We’re not suggesting your monthly budget is going to lead directly to higher income, but it does appear to be a practice that we should imitate.

The popular book, The Millionaire Next Door, revealed that 62% of millionaires knew how much they spent on pillars like food, clothing, and housing.

I don’t know about you, but I see some value in trying to imitate behaviors that lead to millionaire-level success.

We strongly believe in the importance of budgeting

The reason is we don’t have a very good idea of what we need to adjust in order to produce a more favorable financial outcome without a budget. You won’t either.

We use the analogy frequently on this site, but you can’t make efficient progress on a journey if you don’t know your starting point. A budget gives you a clear picture of where you stand now, so you know which way to move forward.

So, how do we mitigate the monotony of budget-keeping as much as possible without reducing the benefits? One way we’ve seen to do that is through technology.

What follows is a summary of two tools we’ve used through the years for budgeting and some other suggestions to make the process a little less painful.

Excel

Pros:

- Easy to understand and use

- Cheap

- Saves time by using preset equations to perform calculations for you

- It can be emailed, so it’s relatively portable

- It’s private

Cons:

- There could be a learning curve for you if you’ve never used Excel

- Manually entering transaction data is a pain

- There’s not a good way to update a spreadsheet on a phone

In full confession, I love Excel.

It’s such a capable tool and makes life so much easier for collecting, organizing, and summarizing information.

So, naturally, when we were first married and trying to maintain a monthly budget, Excel was our instrument of choice. In fact, we still keep a copy of our monthly budget in excel, though we update it through mint.com.

Here’s an old version of our monthly budget.

Current Budget | |||

Item | Budgeted | Actual | Over/Under |

Tithe | $650.00 | $0.00 | $650.00 |

Mortgage | $1,100.00 | $0.00 | $1,100.00 |

Groceries | $900.00 | $0.00 | $900.00 |

Electricity | $135.00 | $0.00 | $135.00 |

Water/Sewer | $55.00 | $0.00 | $55.00 |

Natural Gas | $50.00 | $0.00 | $50.00 |

Cell Phones | $85.00 | $0.00 | $85.00 |

Life Insurance | $65.00 | $0.00 | $65.00 |

Car Insurance | $90.00 | $0.00 | $90.00 |

Cable/TV | $125.00 | $0.00 | $125.00 |

Pest Control | $30.00 | $0.00 | $30.00 |

Fuel | $350.00 | $0.00 | $350.00 |

Clothes | $300.00 | $0.00 | $300.00 |

Eating Out | $300.00 | $0.00 | $300.00 |

House/Cars | $350.00 | $0.00 | $350.00 |

Gift | $100.00 | $0.00 | $100.00 |

Hair | $100.00 | $0.00 | $100.00 |

Entertainment | $50.00 | $0.00 | $50.00 |

Child Care | $0.00 | $0.00 | $0.00 |

Gym Membership | $95.00 | $0.00 | $95.00 |

Kids Activities | $100.00 | $0.00 | $100.00 |

Kids 529 Savings | $200.00 | $0.00 | $200.00 |

Vacation | $500.00 | $0.00 | $500.00 |

Misc. | $100.00 | $0.00 | $100.00 |

Kid’s Allowance | $70.00 | $0.00 | $70.00 |

Transfer to Savings | $500.00 | $0.00 | $500.00 |

Totals | $6,400.00 | $0.00 | $6,400.00 |

| |||

Income | $6,500.00 | $0.00 | $6,500.00 |

In full disclosure, our income is higher than this. I’ve revised some numbers to loosely base this off of our income and spending from about 8-10 years ago.

In summary, we set up formulas in the spreadsheet to subtract the amounts in the ‘Actual’ Column from those in the ‘Budgeted’ column.

The product appears in the ‘Over/Under’ column which is formatted so the numbers turn red if we spent too much in a category. For example…

Item | Budgeted | Actual | Over/Under |

Groceries | $900.00 | $1,000.00 | ($100.00) |

To enter amounts into the ‘Actual’ column, we just set up a simple “=SUM()” formula and manually entered transaction amounts into the formula in those cells.

The income number at the bottom was also variable from month to month for us when I formerly worked in sales.

At the end of the month, once all the totals have been entered, Excel does the calculating for you and provides a picture of how you did.

Here’s a hypothetical example from a hypothetical summer month:

Current Budget | |||

Item | Budgeted | Actual | Over/Under |

Tithe | $650.00 | $650.00 | $0.00 |

Mortgage | $1,100.00 | $1,100.00 | $0.00 |

Groceries | $900.00 | $1,000.00 | ($100.00) |

Electricity | $135.00 | $210.00 | ($75.00) |

Water/Sewer | $55.00 | $61.00 | ($6.00) |

Natural Gas | $50.00 | $10.00 | $40.00 |

Cell Phones | $85.00 | $85.00 | $0.00 |

Life Insurance | $65.00 | $65.00 | $0.00 |

Car Insurance | $90.00 | $90.00 | $0.00 |

Cable/TV | $125.00 | $125.00 | $0.00 |

Pest Control | $30.00 | $30.00 | $0.00 |

Fuel | $350.00 | $291.00 | $59.00 |

Clothes | $300.00 | $351.00 | ($51.00) |

Eating Out | $300.00 | $345.00 | ($45.00) |

House/Cars | $350.00 | $210.00 | $140.00 |

Gift | $100.00 | $80.00 | $20.00 |

Hair | $100.00 | $120.00 | ($20.00) |

Entertainment | $50.00 | $60.00 | ($10.00) |

Child Care | $0.00 | $0.00 | $0.00 |

Gym Membership | $95.00 | $95.00 | $0.00 |

Kids Activities | $100.00 | $120.00 | ($20.00) |

Kids 529 Savings | $200.00 | $200.00 | $0.00 |

Vacation | $500.00 | $0.00 | $500.00 |

Misc. | $100.00 | $134.00 | ($34.00) |

Kid’s Allowance | $70.00 | $70.00 | $0.00 |

Transfer to Savings | $500.00 | $500.00 | $0.00 |

Totals | $6,400.00 | $6,002.00 | $398.00 |

| |||

Income | $6,500.00 | $0.00 | $6,500.00 |

Some items of note:

- About half of the expenses are the same every month, like the gym membership or insurance payments. It’s helpful to know these expenses won’t vary from month to month.

- We were under the total spend for the month, but we didn’t go on a vacation, so that spared us $500.

- We’ve got some work to do on our dining expenses. Groceries and eating out were both over. Time to visit Aldi more frequently or eat less.

- The income on our budget is net after taxes and deductions for 401(k) and HSA at work. Thus, the transfer to savings is actually money we throw into our full-sized emergency fund or invest in IRAs or taxable brokerage accounts.

As you can see, Excel provides a clean simple way to keep your budget and this is just an example. You can adjust/add/delete as needed and even use Excel to build other visual tools like charts and graphs of your budgets over time if you like.

We actually use Excel for storing a lot of other financial information.

My money workbook has 13 spreadsheets in total; ranging in topics from a net worth summary, income history, current cash flow, tax projections for about 10 years ahead, retirement income projections, 529 history, mortgage amortization table, and asset allocations, among other experimental spreadsheets.

Finally, if you don’t have Excel, look into Google Sheets. It is very similar to Excel and it’s free.

Mint.com

Pros:

- Automatic updating

- It’s free

- Great visuals on the dashboard and in each category

- Quick information about cash flow, net worth, budgets, etc.

- Available on a computer or personal device app, so you can check it nearly anywhere you can get data

- Mint provides some helpful information about where you stand relative to other users

Cons:

- It’s a lot of work to set up

- Transactions still need to be reviewed regularly to ensure accuracy

- Your personal information may be private, but much of your data is used for marketing purposes.

- Communication between mint and other accounts requires maintenance from time to time

If you’ve used a spreadsheet to enter transactions for a budget, then you know that it can be tedious to type in the data manually.

At times, it can also be frustrating if you’ve entered a number wrong or somehow bungled a formula.

About 10 years ago, we had enough of manually entering the spend information for every transaction we conducted. A friend of ours recommended mint.com and we’ve been using it ever since.

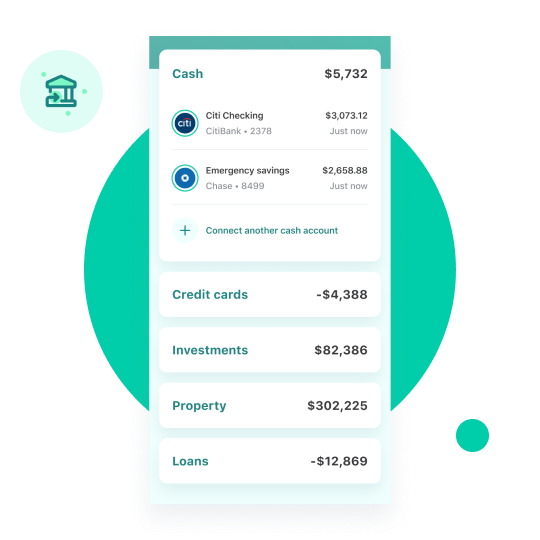

Mint is an online personal finance app that serves as a sort of dashboard for the collective financial accounts in your life like checking, savings, credit cards, investment accounts, insurance, mortgage, and so on.

In summary, it takes all your money stuff and records it in one place allowing you to quickly gain a broad perspective of your financial wellbeing.

The setup does take some time. You’ll have to establish the account, then enter account and password information for each associated financial institution you wish to connect to mint.

Mint then automatically updates your transaction information from each of these accounts, saving you the time and effort of entering the data manually.

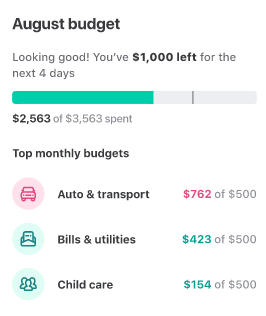

To set up your budget, you’ll also need to establish categories and spending limits for mint to follow.

Mint will automatically categorize the transactions it recognizes, but for those it doesn’t understand initially the program will learn as you correct them manually. In other words, it gets better and does more of the work for you the longer you use it.

The result of this heavier up-front lifting is a budget that is updated in real-time as you check on it.

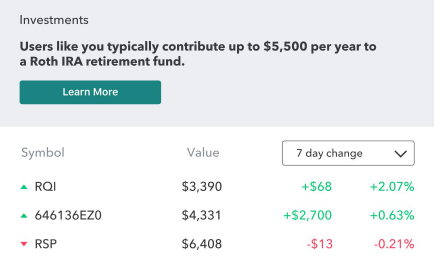

Mint can also track your investments and their performance if you elect to set those services up too.

We don’t typically track our investments in mint because it seems to have a hard time distinguishing between contributions and investment returns. We also frequently have trouble with mint communicating directly with Vanguard (I think this is Vanguard’s fault personally).

Other Apps:

Here are some other popular budgeting apps. We haven’t used any of them, so we’re not going to provide an in-depth summary but thought many would be interested in these as well.

- You Need A Budget (YNAB)

- Personal Capital (These guys will call you relentlessly to offer their investment services if you reveal that you have a significant net worth)

- EveryDollar

Conclusion

Regardless of how which process you use to track your spending, it’s a discipline we all have to develop for financial success.

Hopefully, this look into a couple of tools can take some of the pain out of your personal budgeting.