Student Loans: Financial Friend or Foe?

Student loans can be a useful tool for financing education, but can also become an unyielding burden if not approached with care. We recommend not borrowing more than the amount of your expected first year’s salary for your chosen field of study.

There’s a lot of attention being given to student loans at the moment.

President Biden recently proposed his approach to student loan forgiveness that will lighten the burden many face after accumulating mountains of debt in exchange for an education.

I’m not really writing this to discuss the merits of that or the lack thereof.

What I would like to dive into a bit though, is how student loans present a very complex decision to people at a stage in life when they aren’t most equipped to evaluate such a decision and the consequences it may create.

On the one hand, student loans provide an avenue for people who want to learn a skill set that they can then turn into a life-improving wage. Who wouldn’t want that?

On the other hand, more and more, student loans are leaving people at an enormous financial disadvantage right out of the gate as they begin their working and wealth-building journey.

The goal of this post is to provide a healthy dose of fear to young people who are looking into ways to finance college, while also proposing some ways to quantify what an appropriate amount of debt is for the sake of post-secondary education.

My Financial Jumpstart

I was traveling with a friend recently when we began to discuss the outrageous cost of college and how on earth we would afford to help our kids through it all.

Naturally, we talked about ways to save and griped about how expensive it had become. We may have indulged ourselves in rants like, “Can you believe how fancy the dorms are nowadays?” or “How much do professors make anyway?” more than once.

Eventually, we shared some of our own experiences with student debt. My friend confessed that he had carried a balance that took over two decades to pay off.

I don’t think of myself as naïve, but I was a bit surprised.

This guy is a lot smarter than me. I assumed he had scholarships or at least most of his college paid for by his parents.

Not so much.

I don’t fault him, I just didn’t expect that result. I was an average student and received little to no financial assistance from my parents, but managed to graduate with around $13,000 in debt which I paid off in less than two years after I graduated.

Yep…four years at a state school…maybe $4,000 total in scholarships…$13,000 in debt. I’m actually really proud of that all things considered.

I was also fortunate that I had a healthy fear of debt and a flexible job to help defer costs in college. It gave me an opportunity to reflect.

Ultimately, the more I thought about it, the more I realized that accumulating minimal student loan debt is one of the three most important financial decisions I’ve ever made (the others being marrying my wife and avoiding all other debt as much as possible).

I started out only slightly in the hole, which is a lot better off than many find themselves after four years of college.

Additionally, my wife was an awesome student. She earned scholarships that left her with no debt after college.

As a result, though we didn’t know it at the time, we were at Milestone 4 the day we got married in 2006. Based on what my friend shared, I think he reached it in 2020.

When I said this guy is smarter than me, I meant it. I had always correlated intelligence with the amount of debt someone was likely to have coming out of college.

What dawned on me from that conversation was just how much this problem isn’t a matter of smarts, but the fact that many people are unaware of the impact accumulating loads of student debt will have on their lives for years, even decades, to come.

I didn’t know at the time how much being a college cheapskate would pay off later, but I see now that it has. I feel fortunate that it played out for me as it did.

Naturally, I want other people to understand the student loan decision further so they’re not starting their lives with a major financial burden.

The Good (of Student Loans)

We’re not fans of debt.

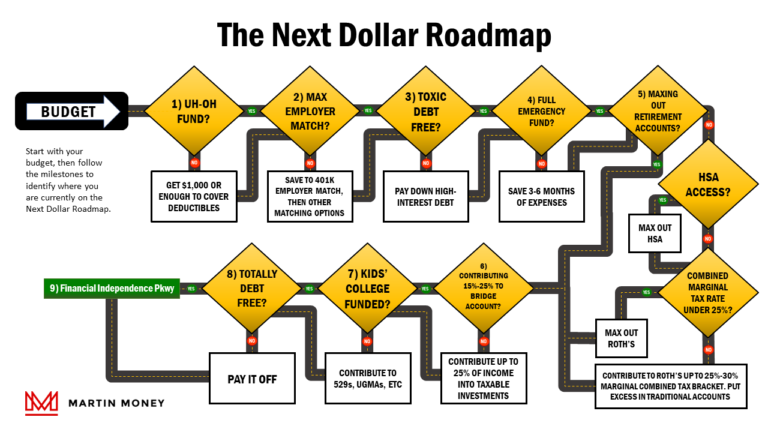

If you look back at Milestone 3 on the Next Dollar Roadmap, you’ll note there are not many times that we feel assuming debt is a wise financial choice.

Using debt to obtain a value-generating education is one case where we see some merit.

Truthfully, one of the best things about the United States is the availability of education. There are so many paths to learning here and I think that’s something worth celebrating.

Even if you come from a background that isn’t blessed with affluence, there are organizations whose sole purpose is to help people like you get an education.

Since elementary and secondary education are basically free, we’ll turn the financial focus to post-secondary education.

And even though we’ll refer to “college” a lot in this post (because it’s the most popular option), please understand that nearly every concept is also interchangeable with technical, trade, or specialized educational routes as well.

The primary reason we think student loans may be a wise decision is the return on investment for the debt.

If you go take a look at our post about generating more income from your current job, you’ll see that those with Bachelor’s degrees make 67.1% more than those who stop their education with a high school diploma. They’re also much less likely to find themselves unemployed.

It’s also true that incomes for college graduates grow much faster than for those who only complete high school.

These benefits have a dramatic financial impact when stretched out over a lifetime of earning.

So, just like we think mortgages can be “good” debt because they are taken out against an appreciating asset, we think of education as an investment that grows in value over time. In fact, we’ve seen that play out in our own careers.

I will confess that I have my doubts that we would have been able to achieve any level of success financially without our education. It was invaluable to us.

Are there other ways to generate solid income? Yes, but even in those cases obtaining an extensive education doesn’t hurt.

Even if you start your own successful business, you’re unlikely to have any regrets about learning as much as you can.

The Bad

So, does this mean any borrowing for post-secondary education is worthwhile? Nope. Not even close.

The primary reason is how expensive it has become.

According to educationdata.org, the cost of college tuition has outpaced inflation by 171.5%!

Over the last 20 years, averages for tuition and fees has risen an average of 6.2% per year. That’s a pretty remarkable climb.

Years ago, it wasn’t uncommon for students to be able to pay for college out of pocket while working in jobs with near minimum wage compensation.

Since the average annual tuition alone was almost $10,000 in 2020, such a feat would be nearly impossible assuming the students also need to eat or have a place to sleep!

It’s actually pretty shameful, but this post isn’t really meant to steer off into the gross mismanagement of college costs. Just know that I may or may not be annoyed by the tendency of governments and colleges to treat the symptoms instead of the root issue; the cost.

Without some form of grant or scholarship assistance, students without means are left with no other option but to borrow.

The 2022 average cost to attend college in the United States including room and board is $35,551 per year. This means over the course of four years; our friend Average J will need $142,204 to complete a degree program.

Ironically, the average mortgage balance in 2022 in the United States is $231,464.

Why is that ironic? Because if you’ve ever tried to borrow for a house, you know one of the most important questions lenders have is about your income. They don’t give loans to people that don’t have a way to pay them back.

Now I’m not tossing stones at Uncle Sam for loaning money to borrowers of questionable credit. What I do want to point out is how there is a much lower level of underwriting and accountability for a similarly large debt burden.

It doesn’t require a huge imagination to see how some people end up in a very deep hole for the sake of a degree.

Thankfully, the average student loan balance in 2022 is only $37,787. So, not everyone has six-figure student debt, but there are some that do and I want them to know how dangerous that is.

Beware, students. Approach the financing for your education with great trepidation. There will be a price to pay eventually.

The Ugly

And just how big is the problem?

42.8 million people have student loan debt in the United States amounting to $1.745 trillion.

It’s a massive problem.

Many people are graduating from college and finding that there’s not much money left for anything else after they service their student loan debt.

So, because of student loan debt, they’re waiting longer and longer to take other significant wealth-building steps like buying homes or starting retirement savings.

Not only that but the longer it takes to begin building wealth for oneself, the more likely we are to convince ourselves that it’s not worth it and that we’ll never get ahead.

Maybe we start viewing ourselves as victims and create imaginary villains that are keeping us down, justifying even more destructive financial behavior.

This is a bit of spitballing, but it’s not that farfetched. The financial decisions we make early on in life reverberate for decades. Student loans have a pivotal psychological impact on many.

Thoughtful Approaches to Student Loan Debt

So, how should one approach student loans to ensure they work for their good instead of becoming a financially destructive ball and chain?

You can be anything you want to be, but that doesn’t mean you should.

You’ve probably heard some version of this before when you were little.

The teacher asks the class, what do you want to be when you grow up?

She gets predictable responses about being firemen, policemen, racecar drivers, and presidents. Then, she reinforces these dreams by reminding her students that they can be anything they want to be.

She’s not wrong. We’ve already discussed how the ability to achieve is one of the United States’ most redeeming qualities.

But just because you can be anything you want, doesn’t mean you should.

For example, I really enjoy woodworking. I’ve built several things that we even use in our house on a day-to-day basis. Personally, I think I’m good enough to be a pro.

So why don’t I?

Because my company pays me a lot more to be a supply chain manager for them than I could make running my own cabinet shop.

They also have dental which is quite practical.

Dreams are wonderful, even when it comes to careers, but dreams don’t pay bills or put food on the table. Work does that.

We need to be reminded of this somewhere along the line as we move toward adulthood. The harsh truth is people pay for things that bring them value.

You may be one of the fortunate people who can generate income by solely following a passion of yours, but you are probably going to have to compromise on it a bit if you want to obtain a solid income.

Know Your Anticipated Income

Once you figure out how to combine your passion with the reality of commerce, you need to have an idea of what income to expect.

This is important because it will inform our next point about how much debt is acceptable.

There are several options for investigating anticipated income for a given field of study. Salary websites like payscale.com are helpful.

You can also look up professional societies associated with a given profession. In many cases, they collect and publish survey data about incomes for their related fields.

Finally, find someone who does the work you’re interested in and ask them what you should expect to make right out of school. This is probably the easiest and most accurate way to get data for a specific geography and/or type of work.

Don’t borrow more than your first year’s salary

Our rule of thumb for “how much student loan debt” is no more than the amount of income you anticipate making in your first year of work.

Going to be a doctor? Great. You’ll be able to pay off larger debts than your friends in Art History (I swear I’m not taking a swipe at any art history majors out there).

Plan to become a history teacher or coach? That’s great too, but you don’t get to borrow as much as the doctor because your shovel won’t be as big when you start digging yourself out of the debt hole.

I know your dreams are your dreams, but the math doesn’t change just because it means a lot to you. Two plus two is four whether you are happy or sad about it.

Be wise. Be prudent. Don’t sacrifice your future for an expensive education with a disappointing income.

Spend some more time thinking about our first point. There may be ways to merge your passions with other fields of study, even if you have to compromise a bit to do so.

What if it’s too late for me?

Maybe I’m a pessimist, but I always picture the naysayers when I write posts.

Somewhere out there, I’m predicting that someone is buried in student loan debt and is also low on hope in digging out of it.

Let me begin by expressing how sorry I am that you’ve found yourself in this spot. Debt is a soul-crushing evil which is exactly why we spend so much time talking about it on this site.

I’d love to wave a magic wand and undo your debt, but I’m afraid I can’t do that.

Just like math doesn’t care if we’re happy or sad, it also doesn’t care if our past decisions were made with a complete understanding of the long-term effects of our decisions.

If you’re in this boat, your path is to walk the Next Dollar Roadmap. Start reading to figure out where you are, then follow the steps in each post from there.

You can also warn those behind you. If there’s a student in your life, make sure they know how dangerous debt is. It may not help your situation much, but at least you’ll feel good about helping someone else.

Then, you can tell them about martinmoney.com and have them start reading the Roadmap too. Maybe one day we’ll all have our act together and student loans will be more of a tool than it is a trap.