Roth vs Traditional IRA or 401(k)

The decision to use a Roth or Traditional IRA depends on your tax situation now compared to your tax situation when you make withdrawals. Generally, the lower your income at the time of contribution, the more likely you are to benefit from a Roth IRA.

Many a debate has been triggered by the subject question of this post: For one’s retirement savings, is it better to use a Traditional savings vehicle or to use a Roth?

And it’s not a question one can just answer on a whim. It takes some thought and the consequences could be significant.

You need information about whose savings we’re investing. What tax bracket are they in? How much income will they have in retirement? How will changes to tax law impact their decision down the road?

We’ll try to address all of these questions and more, but first I want to clarify one point.

Traditional and Roth accounts are not retirement savings vehicles like IRAs, 401(k)s, 457s, or 403(b)s.

However, IRAs, 401(k)s, 457s, or 403(b)s can all be held in either Traditional or Roth type accounts.

When we refer to an account type as being Traditional or Roth, we’re making a reference to the tax treatment of contributions and earnings within the account.

Specifically, we’re asking if taxes will be withheld from money contributed to the account but not from withdrawals (Roth) or if taxes will be waived on contributions but withheld when withdrawn.

Finally, we probably won’t be able to help you answer the Roth vs Traditional question with absolute certainty (unless you’re currently in a very, very low tax bracket).

The primary reason is we do not know what our marginal income tax rates will be when we make withdrawals from these accounts.

Both your level of income and tax laws will probably change between now and the time you make withdrawals which makes calculating the optimal outcome impossible.

Truthfully, we don’t even know for sure what tax brackets will look like after 2025 (though it looks like they’ll be going up).

But, we will run through some scenarios and try to paint as clear a picture as we can so you can make a more educated decision for yourself.

What is a Traditional Account?

To begin, let’s explain what a Traditional retirement account is.

Technically, IRAs (1974) preceded 401(k)s by four or five years, but the genesis of their creation was generated by the same retirement problem.

For decades, corporations had provided employees with defined-benefit retirement plans which are more commonly known as traditional pensions.

Over the years a couple of things happened. First, workers started living beyond the life expectancies pension managers had accounted for when creating forecasts to model payouts to beneficiaries.

Second, interest rates began climbing in the mid-1960s and got downright scary in the 1970s through 1985.

Many of the conservative, fixed-income investments pension managers were using (like treasuries) were growing more difficult to predict or even costly to own (in the case of bonds).

Suffice it to say, the appetite for traditional pensions was fading and more companies were looking to shift this risk to their employees.

To assist with this migration from defined benefit plans to defined contribution plans, congress began passing legislation to support and incentivize workers to begin taking responsibility for their own retirement outcomes.

Initially, the tax code did this by allowing workers and employers to make contributions (with certain limitations) on a tax-deferred basis to IRAs and 400-level (401(k)s, 457s, 403s) retirement accounts.

Put simply, this meant any income directed into these accounts would be free from taxes until the time of withdrawal when funds could then be removed at regular income tax rates.

The benefit is years of growth within the accounts, unhindered by the anchor of taxation.

If you do the math, it’s easy to see the advantage.

Here’s a brief example using a $2,000 annual contribution in the 12% tax bracket with an expected annual rate of return of ten percent:

Traditional (Tax-Deferred) | Regular (Taxable) | |

Year 10 | $35,062.33 | $30,854.85 |

Year 20 | $126,005.00 | $110,884.40 |

Year 30 | $361,886.85 | $318,460.43 |

Because a Traditional account enjoys earnings growth without the drag of taxes, the account balance is able to grow larger over time.

The amounts listed only account for taxes on contributions, so the traditional account hasn’t had any taxes applied to it yet and only the contributions to the taxable account have been taxed.

Bear in mind also, any withdrawals from regular, taxable investments will be subject to applicable capital gains and dividend taxes which have not yet been calculated in the table above.

What is a Roth?

The Taxpayer Relief Act of 1997 included legislation by Senators Bob Packwood of Oregon and William Roth of Delaware which they originally called “IRA Plus”.

Under this new plan, account owners would be taxed on contributions made to these special IRA accounts, but not on any qualified withdrawals.

Eventually, the name “IRA Plus” was dropped in favor of the much more distinct “Roth” and I’m sure Bob Packwood feels a little ripped off.

Putting aside the apparent lack of fairness in history, let’s run the same scenario we did for Traditional plans as an example and see what difference a Roth makes.

As a reminder, we’re basing this on a $2,000 annual contribution in the 12% tax bracket with an expected annual rate of return of ten percent.

Here are the results:

Traditional (Tax-Deferred) | Regular (Taxable) | Roth (After-Tax) | |

Year 10 | $35,062.33 | $30,854.85 | $30,854.85 |

Year 20 | $126,005.00 | $110,884.40 | $110,884.40 |

Year 30 | $361,886.85 | $318,460.43 | $318,460.43 |

On the surface, it appears that the Roth isn’t any better than investing in a standard taxable brokerage account, but remember the Roth has no further tax obligations while capital gains and dividend taxes still must be withheld from the taxable account.

You may also think these values indicate that the Traditional route is superior to Roth, but you have to also remember that taxes have not been withheld from any of the Traditional funds.

Here is what the balances look like after taxes are withheld from the Traditional account and capital gains and dividend taxes have been withheld from the taxable account.

Traditional* (Tax-Deferred) | Regular (Taxable) | Roth (After-Tax) | |

Year 10 | $30,854.85 | $28,866.63 | $30,854.85 |

Year 20 | $110,884.40 | $99,531.74 | $110,884.40 |

Year 30 | $318,460.43 | $278,611.36 | $318,460.43 |

Okay, so the after-tax account is the loser here because the contributions are hit with taxes before they go into the account and the earnings are taxed coming out. (We assumed a 15% capital gains rate for this example.)

You will undoubtedly also note that the Traditional and Roth amounts are all equal.* It’s very important that you understand why.

In the example, we used the same earnings rate of 10%, but we also used the same income tax rate for money going in AND withdrawals coming out.

This illustrates an important mathematical principle.

If your income tax rate is the same when you make contributions and when you make withdrawals, and your rate of return is equal, the final balance will be the same regardless of which account you choose.*

Let me rephrase and repeat for emphasis…

All things being equal, neither Traditional nor Roth accounts hold any particular monetary superiority over the other.*

(*Actually, this isn’t entirely true. We’ll talk about why in the section about progressive taxes below.)

The All-Important Tax Question

Having brought attention to the fact that if all taxes are equal, neither the Traditional nor the Roth is mathematically superior to the other, let’s talk through some scenarios where each is superior to the other.

1) You are in the 0% tax bracket.

In 2023, your first $11,000 of income is taxed in the 10% tax bracket (for single filers, double it for MFJ). Effectively, once you take the standard deduction of $13,850, this means you’ll have no tax liability for your income.

It would make no sense to contribute to a traditional account so you can pass up zero taxes now and instead, pay taxes later if you have income when you withdraw.

That would just be dumb.

On the other hand, if you use a Roth and let your contributions grow completely tax free, you’ll never have to pay taxes on those dollars, period.

This is a no-brainer.

If you have enough money to make a contribution to a Roth while you are in the lowest brackets, you should do it.

Many will say, “But how are you supposed to have enough money to contribute to a Roth if you’re only making $11,000 per year?”

That’s a great question; frankly, I don’t have an answer.

What I do know is there’s a difference between having a low income and having a low taxable income.

If you are a tax technician and can tap dance through the rules to get your income low enough by using some clever planning, I say more power to you.

I would do the same and I would be sure to load as much as I could in Roth accounts in years like those.

At this point, I should probably remind you that you must realize earned income (not capital gains or dividend income) in order to contribute to a Roth or Traditional retirement account.

There probably aren’t many people who can make contributions in this super-low income range, but for those who can, you should go for it.

2) You are in a low tax bracket now but expect to be in a higher tax bracket when you make withdrawals.

This scenario is similar to the first one.

Why would you want to pay more in taxes later when you make withdrawals than you can pay now when you make contributions?

Let’s assume you are in the 12% tax bracket now, but plan to live on an income in the 22% or 24% marginal bracket when you begin making withdrawals.

By paying taxes on your contributions, you shelter 10% to 12% from taxes just by choosing Roth today.

The Roth is most popular for those of you who are living in low income tax years because you’ve had a job transition or maybe you’re just young and getting going in your career.

You may also be persuaded to lean toward Roth if you expect tax rates to increase in the future.

Considering income taxes are about as low as they’ve been in a long, long time, I personally think tax policy will move overall taxes up in the future but there are no guarantees.

3) You are in a high tax bracket now but expect to be in a lower tax bracket when you make withdrawals.

Traditionally, this is where most people expect to fall in the Roth vs Traditional debate.

As far back as I can remember, financial advisers give a rule of thumb that one should plan on replacing 80% of their working income in retirement.

I’ll put aside my opinion of that benchmark for now and just assume it applies to you. After all, most people do experience a reduction in income in their retirement years and both Roth and Traditional type accounts are for retirement.

In this scenario, you are likely to be in a lower marginal tax bracket in retirement and will therefore pay less in income tax during your withdrawal years.

As a result, it would be more beneficial to use a Traditional account to take the tax deduction now and pay taxes at your lower rates in retirement.

If you are in a high income tax bracket, Traditional accounts probably just make good sense.

4) You think your tax bracket will be the same now and when you make withdrawals.

Most people would tell you that it doesn’t matter which way you go in this scenario.

They’re wrong.

If your income tax bracket is the same now as it will be when you make withdrawals, you should choose a Traditional account.

Read on to see why.

The Impact of a Progressive Tax System

Earlier we made a couple of mysterious parenthetical references to the idea that even when all other things are equal, Roth or Traditional may be superior in terms of sheer returns.

In summary, when all else is equal, Traditional accounts probably come out better because of our progressive tax system.

I don’t want to write an entire post on this sidebar but, to summarize, in the United States we do not pay the actual amounts associated with each tax bracket just because our total taxable income falls in that range.

Rather, we pay the percentage associated with each bracket up to the maximum range of the bracket, then we pay the rate associated with the next one, and so on.

Ultimately, our average tax rate (the actual percentage of our income withheld for taxes) will always be lower than the marginal tax rate (the percentage of tax withheld from our top bracket).

So, if someone falls into the 22% tax bracket, this means their marginal tax rate is 22% (meaning all the dollars taxed in that bracket are taxed at 22%), but their overall tax liability is probably somewhere around 15% or lower as a percentage of their total taxable income.

Let’s go through a quick example.

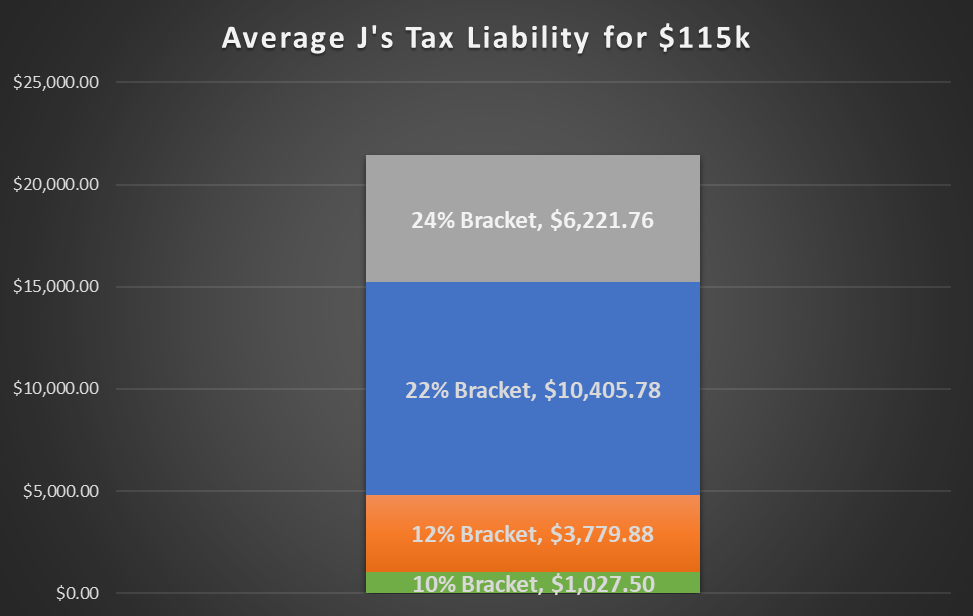

Assume Average J is single and had a taxable income of $115,000 in 2022 after all deductions and credits were accounted for.

This table summarizes Average J’s total federal income tax liability for the year:

Average J’s 2022 Tax Liability for $115k Income | |||

Income | Tax Bracket | Taxable Income in Bracket | Tax Liability |

$115,000 | 10% | $0 – $10,275 | $1,027.50 |

12% | $10,276 – $41,775 | $3,779.88 | |

22% | $41,776 – $89,075 | $10,405.78 | |

24% | $89,076 – $115,000 | $6,221.76 | |

Total Tax Liability |

|

| $21,434.92 |

Here’s what it looks like in a stacked bar chart:

Average J’s average or “effective” tax rate for this scenario is 18.6%.

So, why am I going through all this trouble to explain tax brackets?

Because when one makes a contribution to a Roth or Traditional account, the taxes paid or deferred come out of one’s marginal or “top” tax bracket.

In Average J’s case, this means the dollars deducted for Traditional contributions or the taxes paid for Roth contributions would be applied at the 24% rate because those deductions or contributions come after (or “go on top of”) regular income.

However, because people tend to have very little or even no earned income in retirement, the first dollars withdrawn from a Traditional account will probably be taxed at the lowest tax bracket or “from the bottom” of one’s overall tax liability.

This means the first withdrawals in retirement are likely to be taxed at lower rates than Roth dollars contributed, even in the same tax brackets.

Let’s look at an example to unpack this further.

Progressive Pete

Pete is 30 years old and has an annual taxable income of $100,000, after all other deductions and credits. He is trying to determine whether he should contribute to a Roth or Traditional IRA to save for retirement.

Here are some assumptions we will make about Pete’s situation:

- Pete’s income in retirement will also be $100,000 and will be supplemented by $35,000 of Social Security income. The remainder will come from Traditional or Roth accounts depending on Pete’s tax strategy at the time.

- Pete is in the 24% bracket and expects to be in the same bracket in retirement.

- Pete’s annual rate of return is 10%.

- Pete plans to contribute $5,000 annually to the IRA before taxes for 30 years. If he elects to go with the Roth, he’ll deduct taxes from his contribution amount.

Here is a comparison of how Pete’s options could shake out. These are the balances after all tax obligations have been paid:

| Traditional (Tax-Deferred) | Regular (Taxable) | Roth (After-Tax) |

Year 10 | $74,282.71 | $62,325.67 | $66,618.43 |

Year 20 | $266,952.93 | $214,898.07 | $239,409.50 |

Year 30 | $766,689.86 | $601,547.26 | $687,585.01 |

Because Pete is forecasting that he will withdraw IRA funds at the bottom of his tax bracket ladder, his average tax rate on the IRA withdrawals would be 15.3%.

Meanwhile, Roth contributions would be taxed at the 24% rate going into his account.

Under this set of assumptions, the Traditional IRA is clearly the wisest course of action for Progressive Pete.

This example makes some hefty assumptions you should be aware of:

- Social security is the only other source of income for Pete. If you expect to receive a pension or other income when you begin making withdrawals, that could push up the lowest bracket where your Traditional withdrawals are made.

- This case assumes tax brackets remain constant. This is unlikely though they could move in any direction.

Other Considerations

- Inheritance – Roth accounts are easily the most convenient way to receive an inheritance. No tax issues and the remaining funds can grow tax-free for another decade.

- Paying for College – Roth IRA funds can be used to pay for qualified education expenses, penalty-free. However, we suggest using 529 plans.

- Access to principal – Because Roth contributions are made on an after-tax basis, the IRS allows you to withdraw contributions (not earnings) at any time, tax-free. This makes them a handy 2nd level emergency fund if things really get out of hand.

- Reducing AGI – Traditional contributions reduce one’s AGI and MAGI which can be a very useful way to not just reduce taxable income but also qualify for various other tax benefits.

- Your Age – The younger you are, the longer Roth dollars have to grow. Thus, the more you should consider using them.

What The Martins Do

In full confession, there probably isn’t another financial topic I have switched my point of view on more than the Roth vs Traditional dilemma.

One minute I’m anxious to swing everything to Roth because I’m sure the government is going to have to hike future taxes to the moon.

Other times I feel like I’m overthinking things a bit and should take the tax-reducing benefit now when the margin between my income and expenses is probably narrower than it will be in the future.

Ultimately, we have elected to hedge our bets and do a little bit of both.

If you took the full sum of our retirement savings into account, you would find that about 54% of it is in Roth accounts and 46% sits in Traditional style accounts.

In recent years our income has increased a bit which is pushing the needle more and more toward Traditional. We’ll just have to take it a day at a time.

If we were in the 12% or lower brackets, this would be a no-brainer to me. Roth all the way.

And if we were fortunate enough to have income in the 32% and up brackets, we would certainly go the Traditional route.

We’re in the more challenging 22% – 24% middle ground where things aren’t as clear. Furthermore, we live in a relatively middle-of-the-road state when it comes to income taxes.

At 5%, Alabama state income tax gives us a combined (federal and state) marginal tax rate of less than 30%.

Truthfully, I still favor the Roth a bit more than Traditional accounts. Mathematically, I think traditional usually makes more sense, but I like the idea of taking the tax risk off the table now since I know what it is.

You may be different.

Ultimately, the choice is yours. Best of luck.