Qualified vs Non-Qualified Dividends

As I write for martinmoney.com, I frequently cite income, capital gains, and dividend tax rates.

Since the amount paid in taxes for these different sources of money varies so widely, it’s very important to understand how and why they are taxed the way they are.

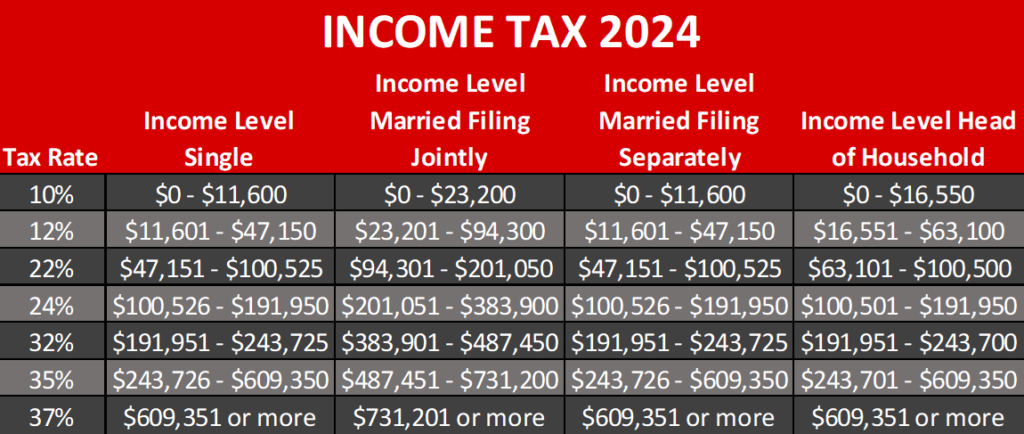

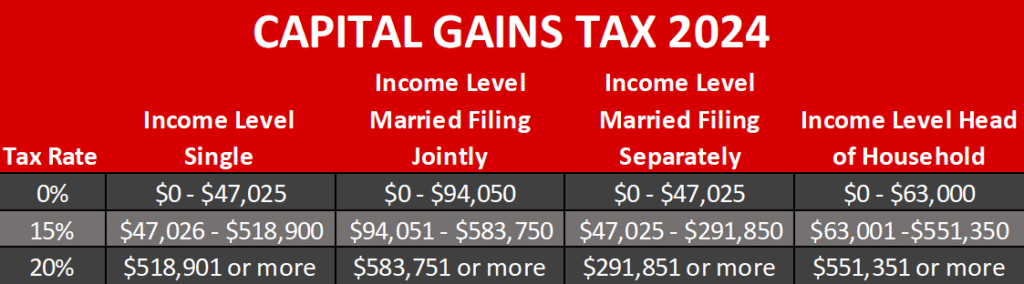

As a reminder here are the income tax, long-term capital gains tax, and qualified dividend tax rates for 2024:

Income will always be taxed according to the progressive income tax rates in the table above.

Capital gains that are realized after a security or asset has been held for over one year are known as long-term capital gains and are taxed at a lower rate than the same amount would be as income.

Short-term capital gains are gains that are realized from the purchase and sale of a security that was held for less than one year. These short-term gains are taxed at regular income tax rates.

Similarly, qualified dividends, like long-term gains, are taxed at a much lower rate than non-qualified dividends which are taxed as regular income.

Seems simple enough, but defining a dividend as “qualified” or “non-qualified” is more complicated than delineating between short and long-term capital gains.

Hereinafter, we’ll discuss what makes a dividend qualified or non-qualified so you can optimize your decision to buy or sell dividend-producing assets based on how they’ll be taxed.

What’s a Dividend

A dividend is simply a stockholder’s share of the profits from the operations of a corporation.

For example, let’s assume ACME Company announces a dividend of $0.50 per share next quarter and you hold 100 shares of ACME stock.

On the date the next dividend is scheduled to be paid (cleverly known as the payment date), you’ll receive $0.50 for each share or $50.00 in a dividend payment from ACME.

If the dividend is qualified, you’ll pay the lower dividend tax rate for the income you’ve received. If the dividend is non-qualified, you’ll be taxed at your marginal income tax rate.

Historically, a dividend was the whole point of owning a stock. I mean, what else would be the purpose of buying part ownership in a corporation if you’re not going to get a share of the profits?

Well, in recent years more and more companies have elected to re-invest profits back into the organization to fuel growth and development. This is especially true for young companies that are seeking to grow rapidly.

The benefit for investors in lieu of dividends is appreciation in the value of the stock.

For example, if ACME was trading at $100 per share and decided to reinvest its profits instead of paying a dividend to its shareholders, ACME may use the funds to expand operations leading to a higher market capitalization.

And some shareholders would prefer this over a dividend because a dividend paid is a taxable event while appreciation in the price of shares is only taxable when one sells the stock.

In other words, by not being paid a dividend, owners of the stock maintain control over when they pay taxes on their investments.

Another way to avoid taxes for dividends is to hold dividend-paying stocks and mutual funds in tax-deferred or tax-free (Roth) retirement accounts.

Generally speaking, one will find the stocks of more mature companies with saturated or captive markets tend to pay dividends instead of heavy re-investment into the company.

Companies like Coca-Cola, AT&T, & Utilities are well-known as “dividend stocks”.

For extra credit, you can research the “dividend aristocrats” list to learn about companies that have reliably paid steadily increasing dividends for decades.

Qualified Dividends

According to the IRS, qualified dividends are ordinary dividends that meet the following criteria:

- The dividend must be paid after December 31, 2002.

- The dividend must either be paid by a U.S. corporation, a foreign corporation located in a country that is eligible for benefits according to a U.S. tax treaty, or a foreign corporation that is available for trade on a U.S. exchange.

- The dividend must be from a stock that is held for at least 60 days during the 121-day period that begins 60 days before the ex-dividend date of the stock*. (The ex-dividend date is the first day a new owner of a stock is not entitled to get the next dividend paid to shareholders.)

- The dividend must not be non-qualified.

Like I already said, it gets a bit complicated but if you buy and hold a stock purchased on an American exchange, odds are the dividends will be qualified.

Unless you want a regular, taxable income from owning a stock, you should probably hold high dividend-paying shares in a tax-advantaged space so you’re not getting dinged on dividend taxes every quarter.

(*the holding period for preferred shares is usually 90 days instead of 60.)

Non-Qualified Dividends

Non-qualified dividends are dividends that meet one or more of the following criteria:

- The dividend isn’t qualified.

- Dividends from stocks where you hold a derivative position.

- Capital gains distributions.

- Dividends paid as part of an ESOP (Employee Stock Ownership Plan).

- Dividends paid on bank deposits.

- Dividends paid from REITs.

- Dividends paid from Master Limited Partnerships (MLPs).

- Dividends paid from farmers co-ops.

- Dividends paid from tax-exempt corporations.

- Payments made that aren’t from earnings or profits.

Like we said, the majority of folks will have qualified dividends from the stocks they own. If any of these apply to you, then I’m afraid you get to pay more tax.

Of course, the easiest way to know is to have a look at form 1099-DIV which you should receive from your investment account custodian at the end of each tax year.

Conclusion

It pays to know how your investments are taxed so you can strategically locate your assets to minimize tax exposure.

Hopefully, this information about dividends will help you do just that.

For more, check out our post about how income taxes work.