MartinMoney.com Turns One: The Year in Review

So, it’s been one year.

There are a lot of things I think about when I look back, but frankly, if I wrote all of that down I think my mom might be the only person kind enough to read it.

Hey mom!!

Instead, I think I’ll try to keep this simple and write as if I’m writing to someone who has an interest in setting up a blog.

When I was doing my own research, I felt like posts and videos that explained the best and worst decisions were the most useful so we’ll follow that formula here.

We’ll start with the negative stuff first.

What I Did Wrong

1) I Didn’t Niche Down Enough

If I had a nickel for every time I’ve heard a pro blogger say “niche down”, I’d have a whole lot of nickels.

And, it would amount to a small fortune.

The problem with hearing that was it rarely came with much of an explanation that I could align with personal finance.

When I heard “Niche Down”, I thought, “Great. I’ll just write about the investing side of personal finance for a while since that interests me the most.”

Investing is a massive, massive topic. I could write a thousand blog posts about it and not cover everything.

The bottom line? I didn’t know what “niche down” really meant.

If I were explaining it to someone who’s just starting a blog or YouTube channel or some similar media project, I’d tell them to think about the subject matter they want to focus on.

Then, I’d ask them what their favorite sub-category is within that subject.

Next, I’d ask them what their favorite aspect is within that sub-category.

Then, I’d ask them what their favorite topic is within that aspect of that sub-category of that subject.

Next, I’d ask them what their favorite theme is within that topic.

And I’d keep asking the same question recycled as many ways as I could until they just couldn’t come up with a more delineated answer.

So, in the context of my personal finance blog, I like investing. Within investing, I like tax-advantaged accounts.

Roth’s are my favorite tax-advantaged account.

The use of backdoor and mega-backdoor Roth IRAs is the most interesting way to use them.

When I determined that I needed to niche down more I began writing a series of posts about Roth accounts only. I wrote 13 posts about Roth’s in just a few weeks and began posting them one after another.

And that’s exactly when the site finally started showing up in search results on a meaningful basis.

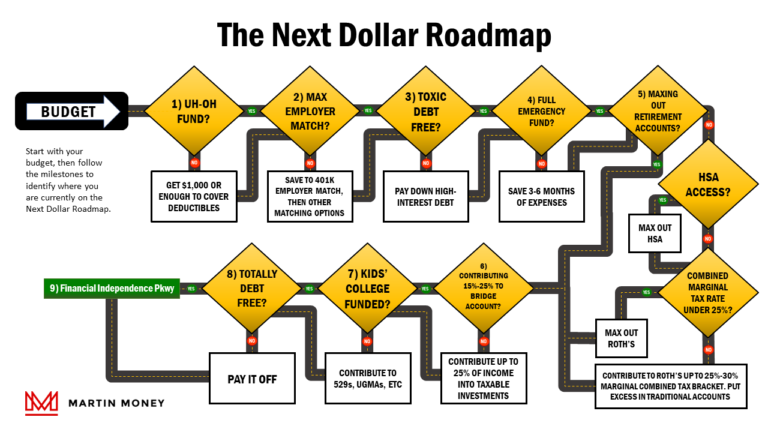

For months I thought I was niching down (except for the Next Dollar Roadmap) when in reality I was all over the place.

I’d like to add that I used Google to choose my Roth topics.

I’d literally go to the search bar and type “Roth”, click search, and Google would provide links along with a section titled “people also ask”.

I copied these questions word for word and answered them in posts.

I wish I had done that from day one.

2) Keyword Stuffing Ooops

When I was getting started I knew search engine optimization was critically important.

I also knew I didn’t want to pay for access to a site that would provide it to me.

It’s not that those sites are bad. It’s just that I’m cheap and didn’t want to be told what to write about.

Anyhow, in lieu of such useful tools, I downloaded some free apps to use on the blog that would help me with my SEO.

One of these is called RankMath.

I’m not going to hate on RankMath, here, but I paid far too much attention to how it scored each blog post for SEO.

You see when you write a post, RankMath has this cool feature that scores how well it is written for SEO based on your keyword usage (primarily), your subject matter, the use of pictures or video, etc.

I literally adjusted my posts to push this score as high as possible.

One of the best ways to do that is to shorten your keyword phrase so that it appears many times within your content.

That was a stupid move.

Actually, it was a stupid, stupid move.

You see, the Google algorithm is somewhat mysterious. All of us writers are trying hard to make and keep it happy so we show up in search results.

You know what it doesn’t like?

People like me trying to game the algorithm by stuffing our content with keywords.

In fact, if you do that, Google is likely to ignore you.

And that’s what Google did to me. (Not that I can really blame Google for defending itself.)

I didn’t experiment with changing my keywords until March of 2023 at the earliest, but when I did my indexing troubles began to disappear (after a few weeks) and the site began to operate like a new one should.

In summary, I think I lost about 8 months because I angered the algorithm.

I don’t blog for a living. In fact, I’m still not making a dime. If you plan to do this and replace your day job with it, don’t try to game the Google-meister. There are no exceptions given for ignorance either.

3) My Expectations Were Too High

When I started this project I had read and viewed dozens of posts and videos about how awesome blogging is and how you can make tons of money while traveling the world and riding around in your Ferrari with the top down and a jacuzzi in the back seat.

That’s not exactly what I was out to do, but it sure made it sound like a productive way to spend my time.

The pros: low cost of entry, work at your own pace, highly lucrative if successful, you get to be the captain of the ship and do whatever you want with it.

The cons: time-consuming. Loss of some anonymity (if you so choose).

To me, the risk/reward ratio made it a no-brainer.

Besides, I visited some of the sites that successful finance bloggers had put together and, I’m not going to name any names but, if they could find success with the junk they were posting then I wasn’t going to have any trouble at all.

(To be perfectly honest, this still bugs me a bit. There are some ridiculously trashy and simple finance sites out there that produce a small fortune for their owners and I have no idea why.)

But I was also under the assumption that if you just put enough content out there, people would inevitably stumble upon it and read it.

I expected search engines to automatically grab my content and put it somewhere in their relevant search results, as long as it was somewhat related to the search inquiry.

I mean, there’s like 350 million Americans. I’d be content if only one million stopped by. Should be easy, right?

Yeah, it doesn’t really work that way. It’s much more complicated and difficult.

This is especially true in “your money, your life” categories like personal finance.

Rightfully so, search engines are more cautious about promoting sites related to money due to the potential for scamming and misinformation.

This has undoubtedly made it harder for us to succeed and is part of the reason I sat for and passed the Series 65 exam earlier this year.

Basically, it will take longer and perhaps a drastic step or two to build credibility and trust from the super-computers running the internet.

I was woefully underprepared for how high that hurdle has been to clear, but I do feel like we’re getting there.

What I Did Right

1) I Started

Don’t get me wrong. I didn’t have an epiphany and spit out a website in a week. It took almost two months from the time I had my first idea (which was actually to write a book) and the day I launched the site.

Nevertheless, once I decided to do something I kept the wheels in motion.

I think the most important thing I accepted from the start was that I would fail at a lot of things.

The good news was none of this was critical to my livelihood, so there wasn’t much at risk except maybe my pride.

I once put together a simple web page with some HTML code when I was in college. It was about as lame a thing as you can imagine. I never really dabbled in web design again until I started working on this.

Technology has made building a website so much easier than I thought. I haven’t had to learn one iota of code and I’m pretty proud of the site we’ve got.

It was a constant grind of trial and error, but I made up my mind that I was going to look at it as a challenge and a learning experience and trudge forward no matter how long it took me to learn how to overcome whatever roadblocks I ran into.

There was also an underlying fear of not trying it and wondering what would or could have happened.

I agree that we tend to regret the things we don’t do more than the things we do. I don’t have any regrets about this so far. (Except for the three things I did wrong above. I regret doing those.)

2) Playing With Video

From the outset, I felt like it would be important to incorporate YouTube into the blog.

If I was already going to be spending time and effort researching and writing about topics, why not provide them through multiple means of use?

It just made sense from an efficiency standpoint.

Again, I knew next to nothing about video editing, but if I could build a website surely, I could make a video, right?

So, while I was mostly focused on the website, I made short video summaries of my blog updates in order to force me to play with video and start learning about it.

I’m really glad I did that.

Even though I still see plenty of room for improvement I feel like it gave me a bit of a head start when I turned my attention to YouTube.

3) I Scoured The Web for Tools

There are many technology tools I’ve acquired and used over the last year. Many of them were free.

Here’s a list in case you are looking for some yourself.

- Elementor Pro – My web design software. I pay an annual fee and it was definitely worth it. There have been a few glitches, but their support has been pretty solid.

- NitroPak – is a great plugin for speeding up the speed of your website. It is free until your site reaches a certain level of traffic. I found it to be an easy way to improve the page loading speed on my site.

- GIMP – is a great freeware graphic design program. I found the learning curve to be pretty steep with GIMP and still only use a fraction of its potential. There are plenty of folks on YouTube with tutorials that can explain how to do just about anything in the software.

- Davinci Resolve 18 – is a top-notch video editing software. The pro version is $299, but they also have a free version that is quite remarkable. I currently use the free version, but will happily fork over the $299 for the full version once we start turning a dollar or two around here.

- OBS Studio – is freeware that allows you to record your computer screen and do some neat picture-in-picture stuff. I use it frequently and it has been very handy to have.

- Pixabay, Pexels, and Coverr are all websites with tons of graphics, photos, video clips, and even music that are available for free. I used Unsplash a lot in the past, but once I found these other sites I quit using it.

These are just a few tools that I’ve found very helpful.

I still can’t believe how much value you can get from the free versions of these programs. They have saved me hundreds of dollars.

4) I Picked a Topic I Enjoy

There’s no way I’d have the endurance to keep this going if I wasn’t writing and making videos about a topic I wasn’t very interested in.

I still consume financial books, blogs, and podcasts daily and don’t ever get tired of it.

If you decide to launch a blog of your own, be sure the subject matter is appealing to you. Otherwise, it would become quite a chore to keep it going.

Traffic

For those of you wondering about the amount of traffic we actually get on the site, prepare to be unimpressed.

In August, we’ll peak out at about 220 page views from a little more than 60 unique visitors.

This is woefully below my expectations initially.

When I launched the site, I expected to reach 1,000 page views by the end of the 4th month. At that point, I’d try to monetize through Adsense and watch the money slowly begin rolling in.

Currently, we have 122 posts, so our post-to-visitor ratio is not just low, it’s like 10th percentile or less for new blogs.

This is the reality of stepping into one of the most competitive categories on the internet.

Despite the disappointing growth, there is growth nevertheless.

I still believe there are better days ahead and plan to continue for at least another year in earnest.

If things don’t pick up quite a bit by then I will probably keep things going, but will only work on the site in my free time.

The Year Ahead

I don’t have any wild ambitions for the year ahead.

I plan to continue a heavy focus on video through September until I have a good rhythm going on recording, editing, and posting.

In the fall, I will definitely turn up the focus on marketing/promoting the blog by pursuing guest posts and podcast visits. I haven’t spent much time focusing on this and I’m sure site traffic has suffered as a result.

I’m also planning to begin looking into setting up my own Registered Investment Advisory (RIA) firm since I have passed the Series 65.

I don’t plan to necessarily begin taking on clients, but I want to have the license and the RIA is the only way to get that.

Finally, I’m looking into attending FinCon in New Orleans this October.

FinCon is an annual conference for financial content creators. It is a pretty big deal and probably a place I could learn a lot.

If I go, I’ll be sure to post about it in the blog section of the site.

Wrap Up

There’s so much more I could say, but I think this more or less covers the interesting technical information.

I’m really proud of everything I’ve learned and done over the last year. I’m also happy I’ve jumped into this head first because I’ve learned so much more than I would have ever thought possible.

Mostly, I want to thank you for your interest and encouragement. Even the smallest compliments are incredibly inspirational.

Here’s to year two.