How to Use Charitable Remainder Trusts

Charitable Remainder Trusts (CRTs) are a great tool for taking advantage of significant tax deductions, making a generous donation to charity, and still benefiting from the donated assets for up to 20 years. There are also many types of CRTs meaning they can accommodate a variety of estate planning needs.

Picture in your mind for a minute an elderly couple with extensive wealth, but no heirs to leave it to once they pass.

You might guess that they would bequeath their estate to a charity of their choosing once they are gone, and that’s exactly what most people in such a circumstance would do.

But what if this couple wanted to benefit from the tax deduction of such a significant donation now while still receiving income or dividends from the assets they plan to donate?

This sounds like a “have your cake and eat it too” scenario, but there’s a legal way to do just that called a Charitable Remainder Trust (CRT).

CRTs allow their grantors (the person who creates and funds the trust) to donate assets from their estates while they’re still alive, while also receiving the tax deductions for the donation, and still receiving any dividends or earnings generated from the assets in the trust.

It’s a way to capture both the benefits of a tax-deductible donation and still receive an income from the assets, all while you’re still living.

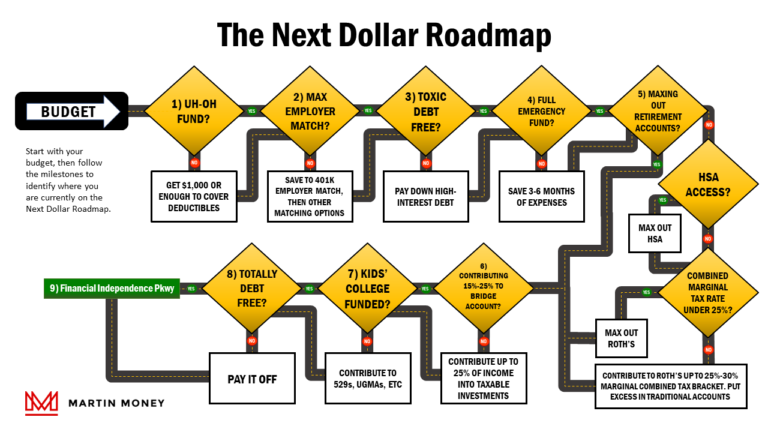

Before diving in, if you want a quick refresh on trusts and trust vocabulary, we briefly covered them in Milestone 9 of the Next Dollar Roadmap.

Mr. & Mrs. C.R. Taylor

Assume Mr. & Mrs. Taylor are 65 years old and have $500,000 of stock in ABC Company.

They currently receive about $25,000 annually from their stock in the form of dividends which they use to supplement their social security and cover living expenses.

They credit much of their success in life to their alma mater, Port Chester University, and want to leave all of their ABC stock to PCU once they pass away.

So, they call their attorney to revise the will accordingly.

While meeting with their attorney he suggests that they establish a Charitable Remainder Trust because:

1) they can receive a tax deduction for the amount they put into the trust;

2) they can continue to receive the dividend income generated by the assets in the trust;

3) PCU still receives a generous donation when they pass.

The Taylors are sold on this plan and ask their attorney to set up the paperwork.

Limitations & Considerations

The primary thing to remember about CRTs is that they are irrevocable trusts, meaning once they are funded there is no way to get the assets back out of the trust.

For all intents and purposes, the assets are no longer the property of the grantor.

The current deduction for assets placed into the trust is the actuarial present value of the remainder interest that will ultimately go to the charity; valued at the time the donor makes the gift to the trust.

In other words, basically what it’s worth today.

Income received by the noncharitable beneficiaries (usually the Grantor) from the CRT is not tax deductible. It is first deemed to be ordinary income, then capital gains, next as other income, and finally as a return of principal.

Each year, the IRS limits taxpayers to a deduction of 30% of their adjusted gross income (AGI) for non-cash donations (including assets like securities). This means any contribution of non-cash assets over that amount would have to be spread out over the course of multiple years.

There are also required minimum amounts that must pass to the charity (called Minimum Remainders). Basically, this insures no one will use a CRT for an elaborate tax deduction that doesn’t ever benefit the charity.

First, the present value of the charitable remainder interest must be at least 10% of the value of the asset(s) when originally contributed to the CRT.

Second, for CRATs (see below) there can’t be more than a 5% chance that the trust’s assets will be exhausted before the charity receives it.

If a CRT fails either test, it can be reformed to requalify under the law.

CRATs & CRUTs

A Charitable Remainder Annuity Trust (CRAT) distributes a fixed amount annually to the noncharitable beneficiary (again, usually the grantor) that must be at least 5% but no more than 50% of the value assets used to fund the trust.

A Charitable Remainder Unitrust (CRUT) distributes a variable amount annually to the noncharitable beneficiary based on a percentage of each year’s current value of the assets in the trust.

Like a CRAT, the value of the distribution must be at least 5% but no more than 50% of the value assets used to fund the trust for a period of either 20 years or the remainder of the beneficiary’s life, whichever is shorter.

One other feature of CRUTs is that they allow for ongoing contributions to the trust, whereas a CRAT does not.

So, if a beneficiary desires a steady and predictable distribution of income from the CRT, a CRAT would be the more desirable approach.

If the beneficiary is willing to accept the risk of ups and downs of their distributions for the sake of capturing any appreciation in the trust assets, then a CRUT would be more suitable.

In either CRT type, if the income or earnings aren’t sufficient to make the required distribution to the beneficiary, then the trust assets are used or sold to make up the difference.

Options for the Taylor’s

Let’s revisit our friends Mr. & Mrs. C.R. Taylor.

As a reminder, Mr. & Mrs. Taylor are both 65 years old and have $500,000 of ABC stock they’d like to place into a CRT for their alma mater.

Furthermore, we will assume that Mrs. Taylor dies at the age of 80 and is predeceased by her husband, Mr. Taylor.

In this example, we’ll evaluate the outcomes of three scenarios.

First, we’ll consider a donation of stock directly to their alma mater after the Taylors pass away.

Second, we’ll run the numbers assuming the Taylors set up a CRAT to make their donation.

Finally, we’ll look at a CRUT which will follow the rise and fall in the asset value of the trust corpus and the Taylors’ annual distribution.

Direct Donation After Death

You might think of this example as a control for our case study. We are including it to illustrate what would happen if the Taylors continued with the status quo, and continued to hold their $500,000 in ABC stock for 15 years until Mrs. Taylor’s death.

As you can see below, ABC stock pays a consistent 5% dividend for the remainder of Mrs. Taylor’s lifespan. The change in stock price is subtle from year to year but reflected in the table.

By continuing to enjoy the dividends of ABC stock and leaving their shares to PCU after their death, the Taylors receive a benefit of $432,243.00 (total gains plus total dividends) before taxes of $64,836.45 (15% on dividends), resulting in a net gain of $367,406.55.

In this case, since the Taylors are only taking out the dividend, PCU will receive $652,606 in ABC stock shares once Mrs. Taylor passes away.

Year | Value of Trust Assets | Dividend | Change in Stock Price | Capital Gain | Distribution to Beneficiary |

1 | $500,000 | $25,000 | 3.15% | $15,750 | $25,000 |

2 | $515,750 | $25,788 | 2.76% | $14,235 | $25,788 |

3 | $529,985 | $26,499 | 1.24% | $6,572 | $26,499 |

4 | $536,557 | $26,828 | -2.54% | ($13,629) | $26,828 |

5 | $522,928 | $26,146 | 3.23% | $16,891 | $26,146 |

6 | $539,819 | $26,991 | 1.20% | $6,478 | $26,991 |

7 | $546,296 | $27,315 | 0.80% | $4,370 | $27,315 |

8 | $550,667 | $27,533 | 4.20% | $23,128 | $27,533 |

9 | $573,795 | $28,690 | 6.00% | $34,428 | $28,690 |

10 | $608,222 | $30,411 | 3.20% | $19,463 | $30,411 |

11 | $627,686 | $31,384 | 2.54% | $15,943 | $31,384 |

12 | $643,629 | $32,181 | 1.84% | $11,843 | $32,181 |

13 | $655,472 | $32,774 | -2.14% | ($14,027) | $32,774 |

14 | $641,444 | $32,072 | 1.74% | $11,161 | $32,072 |

15 | $652,606 | $32,630 | 1.32% | $8,614 | $32,630 |

TOTAL |

|

|

|

| $432,243 |

The Taylor CRAT

In this scenario, the Taylors will establish a CRAT which will distribute $25,000 of the value of the trust’s assets annually until Mrs. Taylor’s death 15 years later. The same amount will be paid out regardless of the performance of ABC stock.

Using this approach, over the period of 15 years the Taylors will receive a total tax deduction in the amount of $120,000 (in the 24% bracket and spread out over the course of several years due to AGI limitations) and $375,000 paid out as annual distributions from the CRAT.

The Taylors will pay $56,250.00 in taxes on the dividend income they receive from the CRAT, resulting in a net gain of $438,750.00.

Again, since the Taylors are reinvesting their capital gains, PCU will receive $716,988 in ABC stock shares once Mrs. Taylor passes.

Year | Value of Trust Assets | Dividend | Change in Stock Price | Capital Gain | Distribution to Beneficiary |

1 | $500,000 | $25,000 | 3.15% | $15,750 | $25,000 |

2 | $515,750 | $25,788 | 2.76% | $14,235 | $25,000 |

3 | $530,772 | $26,539 | 1.24% | $6,582 | $25,000 |

4 | $538,892 | $26,945 | -2.54% | ($13,688) | $25,000 |

5 | $527,149 | $26,357 | 3.23% | $17,027 | $25,000 |

6 | $545,534 | $27,277 | 1.20% | $6,546 | $25,000 |

7 | $554,357 | $27,718 | 0.80% | $4,435 | $25,000 |

8 | $561,509 | $28,075 | 4.20% | $23,583 | $25,000 |

9 | $588,168 | $29,408 | 6.00% | $35,290 | $25,000 |

10 | $627,867 | $31,393 | 3.20% | $20,092 | $25,000 |

11 | $654,352 | $32,718 | 2.54% | $16,621 | $25,000 |

12 | $678,690 | $33,934 | 1.84% | $12,488 | $25,000 |

13 | $700,112 | $35,006 | -2.14% | ($14,982) | $25,000 |

14 | $695,135 | $34,757 | 1.74% | $12,095 | $25,000 |

15 | $716,988 | $35,849 | 1.32% | $9,464 | $25,000 |

TOTAL |

|

|

|

| $375,000 |

The Taylor CRUT

Finally, in this scenario, the Taylors will establish a CRUT which will distribute 5% of the value of the trust’s assets annually until Mrs. Taylor’s death 15 years later.

From the CRUT, the Taylors will receive a variable income due to changes in the overall value of ABC stock. Over the course of 15 years, the Taylors take $432,243.00 in distributions which is all dividend income taxed at 15%.

The net taxes paid over the 15-year period is $64,836.40, but the Taylor’s also receive the same $120,000 they would have received from establishing the CRAT in the scenario above.

So, all told, the Taylors’ CRUT produces a net gain of $487,406.60.

Again, since the capital gains were left in the CRUT, PCU will receive a donation of $652,606.00 in ABC stock.

Year | Value of Trust Assets | Dividend | Change in Stock Price | Capital Gain | Distribution to Beneficiary |

1 | $500,000 | $25,000 | 3.15% | $15,750 | $25,000 |

2 | $515,750 | $25,788 | 2.76% | $14,235 | $25,788 |

3 | $529,985 | $26,499 | 1.24% | $6,572 | $26,499 |

4 | $536,557 | $26,828 | -2.54% | ($13,629) | $26,828 |

5 | $522,928 | $26,146 | 3.23% | $16,891 | $26,146 |

6 | $539,819 | $26,991 | 1.20% | $6,478 | $26,991 |

7 | $546,296 | $27,315 | 0.80% | $4,370 | $27,315 |

8 | $550,667 | $27,533 | 4.20% | $23,128 | $27,533 |

9 | $573,795 | $28,690 | 6.00% | $34,428 | $28,690 |

10 | $608,222 | $30,411 | 3.20% | $19,463 | $30,411 |

11 | $627,686 | $31,384 | 2.54% | $15,943 | $31,384 |

12 | $643,629 | $32,181 | 1.84% | $11,843 | $32,181 |

13 | $655,472 | $32,774 | -2.14% | ($14,027) | $32,774 |

14 | $641,444 | $32,072 | 1.74% | $11,161 | $32,072 |

15 | $652,606 | $32,630 | 1.32% | $8,614 | $32,630 |

TOTAL |

|

|

|

| $432,243 |

Summary of the Taylor’s Options

So, here is a summary of how the three options we looked at played out.

| No Trust | CRAT | CRUT |

Taylor’s Gain | $367,406.29 | $438,750.00 | $487,406.29 |

PCU | $652,605.57 | $716,988.00 | $652,606.00 |

Overall, the CRAT produced the greatest total return because less of the corpus was exposed to taxation due to the fixed amount paid out of the CRAT annually.

However, the CRUT provided more income to the Taylors over the remaining 15 years of their lives.

By looking at our “control”, (i.e. if the Taylors just keep the stock in a taxable space and accept the dividend income it throws off each year) we can clearly see the advantages of CRTs.

The tax deduction produced by funding the CRT puts the control scenario at a severe disadvantage.

Other CRT Info…

- You do not have to be without heirs to use a CRT or even make it a viable estate planning strategy. However, if you are not charitably inclined, there is no incentive for using a CRT because the tax benefit is only a fraction of the value of the trust corpus.

- You can donate real estate (like your primary home) this way but you don’t need a CRT to do so. Accounting for donating your house can be a challenge because you’ll have to account for depreciation and discern between improvements and repairs. It can become a pain.

- The examples I’ve provided are meant to be extraordinarily simple. Real life is more complex. If this is a strategy you want to look into further, you’ll need to see a real pro. It is worth the investment to get this right.

- Finally, there are other, more complex CRTs that we didn’t get into. They are all variations of CRATs and CRUTs, but you should look into these further if they sound useful to you.

- Net Income with Makeup Charitable Remainder Unitrust (NIMCRUT) – This setup allows the beneficiaries to delay much of the distribution of the trust’s earnings until a later date they define when the CRT is established. In other words, it allows the beneficiary to take a deduction now and defer income until they are fully retired.

- Net Income Charitable Remainder Unitrust – Pays the stated unitrust amount or the annual income value for a given year, whichever is less. Like the NIMCRUT but without a makeup provision.

- Flip Unitrust – This allows the grantor to fund a NIMCRUT with an illiquid asset (like a business) and then “flip” the trust type to a standard CRUT after selling the asset within the trust. This is useful for delaying income from the trust. There are limitations on flip trusts.

Please go to our contact page and shoot me a note if you understood why I used a whooping crane for the primary photo and its connection to a reference in the post. It would make me feel less old for just a while.

Frankly, there aren’t a lot of clever pictures for CRTs so I went the funny route.