How Does Compounding Interest Work?

Personally, I don’t think there is a more important force for building wealth than compounding interest.

Ignoring compounding interest would be like trying to sail around the world without any wind. Technically, the ocean currents will move you around, but you’ll get much better results if you toss up a sail.

We’re going walk through an example to see how compounding interest works, but first you should know the reason compounding interest is capable of greatness is because of his best friend, the time value of money.

These two are thick as thieves and without the other, one wouldn’t be quite so significant.

Back to compounding interest…

Send That Dollar to Work

Imagine a dollar in your possession.

There are several things you can do with this dollar. You can spend it, give it away, or you could save and invest it.

The great thing is you have complete control over where your dollar goes. You can think of it as your servant.

If you want it to turn into a candy bar, it will do that.

If you want to give it to a charity that helps homeless dogs and cats, it will do that.

If you want to invest it so that it brings home more dollars, you can do that too.

Year One

To start out, let’s assume you put it in a savings account for one year, returning an annual interest rate of 10%.

(Yes, that’s an insanely generous rate for a savings account, but we’re trying to keep the math simple for this example, so please bear with me.)

That means you’ll be sending your dollar to the bank for one year, but at the end of the year your dollar is going to come back home and bring a dime with him.

Now you have $1.10.

You’re glad to have your dollar home, along with his friend dime, but truthfully, you didn’t miss him that much and decide that he would be much more useful if he’d just go find more dimes to bring home.

So, you send him right back to the bank.

Year Two

A year passes, and when your dollar comes home, he brings back his friend dime again, along with another dime (as expected), but this time they have a new friend called penny.

Normally, you’d be a little unnerved about unexpected guests showing up, but this is money. The more the merrier, right?

After all, money never eats your snacks, spills drinks on the sofa, or clogs the toilet.

You now have $1.21.

Again, you didn’t miss dollar and his friend dime. And even though you were expecting the second dime, you decided to send them all back to the bank to see what happens next year.

Maybe next year they’ll bring a quarter back?

Year Three

Another year passes and dollar returns with the dime twins and their friend penny. This time they bring home another dime as expected, but now there are two additional pennies.

You now have $1.33

What the heck is going on here?

You’re happy to see them all, but how come more and more of them are showing up?

After a few questions you find out that your original dollar works all year to recruit a dime, but you also learn that the dimes he brought home in year’s past work all year to bring home a penny.

So, the dollar has now brought back 3 dimes.

The first dime to come home has recruited two pennies.

And the 2nd dime has brought back a penny of its own.

After digging out the calculator, you realize that if you send all these guys back to the bank for another year, you’ll have $1.46 coming back to you.

Not only that, you look ahead even further and realize that if you keep this up for 10 years, you’ll have $2.59! Over 2.5 times the dollar you started with.

You haven’t stumbled upon a glitch in the Matrix. It’s just compounding interest and like I said, it’s an incredible force to have in your corner.

Maximizing the Impact of Compounding Interest

The only regret now is that you didn’t send more dollars to the bank three years ago.

Now that you understand what can happen over time, you send all your available dollars back to bring home as many friends as they can.

Pretty soon, you have an army of dollar bills getting up and going to work each day, bringing home friends, and never asking for anything in return.

This is how most wealthy people become rich.

It’s not the lottery. It’s not inheritance. It’s just money, discipline, and time.

And the more dollars you can send out to work each day, the more you’ll get back.

Every dollar you put in would be worth $63 in 20 years, $180 dollars in 30 years, and almost $300 in 35 years at a 10% rate of return.

We recommend that you save and invest at least 15% of your income each year.

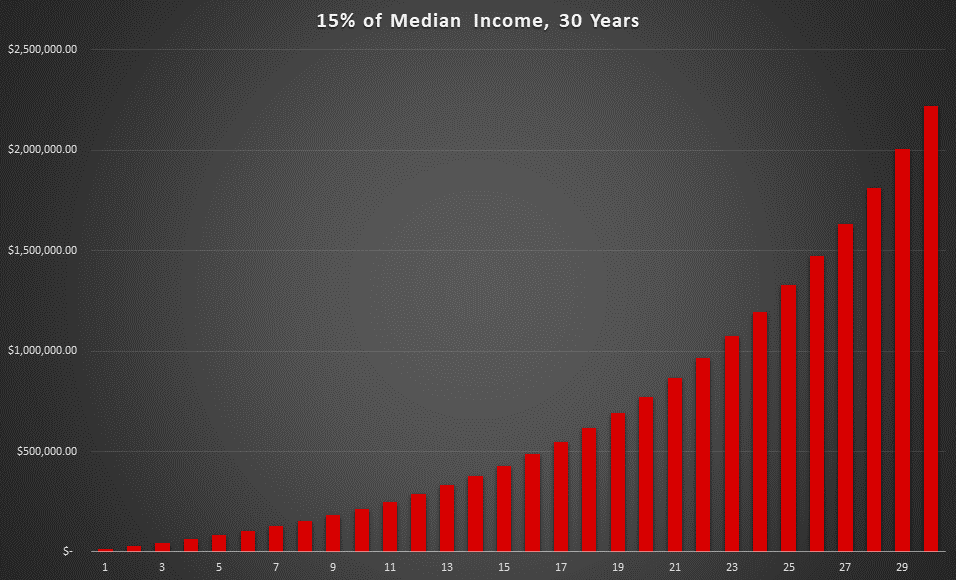

If you made the median household income of $81,843 in 2023 and saved 15% ($12,276.45) for 30 years, you’d have over $2.2 Million.

All from a total of $368,293.50 saved (16.7% of $2.2MM).

Notice how aggressively the money builds the longer it sits. It’s just like a snowball gathering mass as it rolls down a hill.

In the last year, the earnings would be almost $215,000!

Wrap Up

Compounding interest can work for anyone, but it does take time. Get whatever dollars you have working for you ASAP and scale up those contributions as you can.